NZD/JPY Price Analysis: Bullish momentum resumes after sideways consolidation

- NZD/JPY has risen by 0.75% to 91.70 in Monday's session, signaling a bullish resumption.

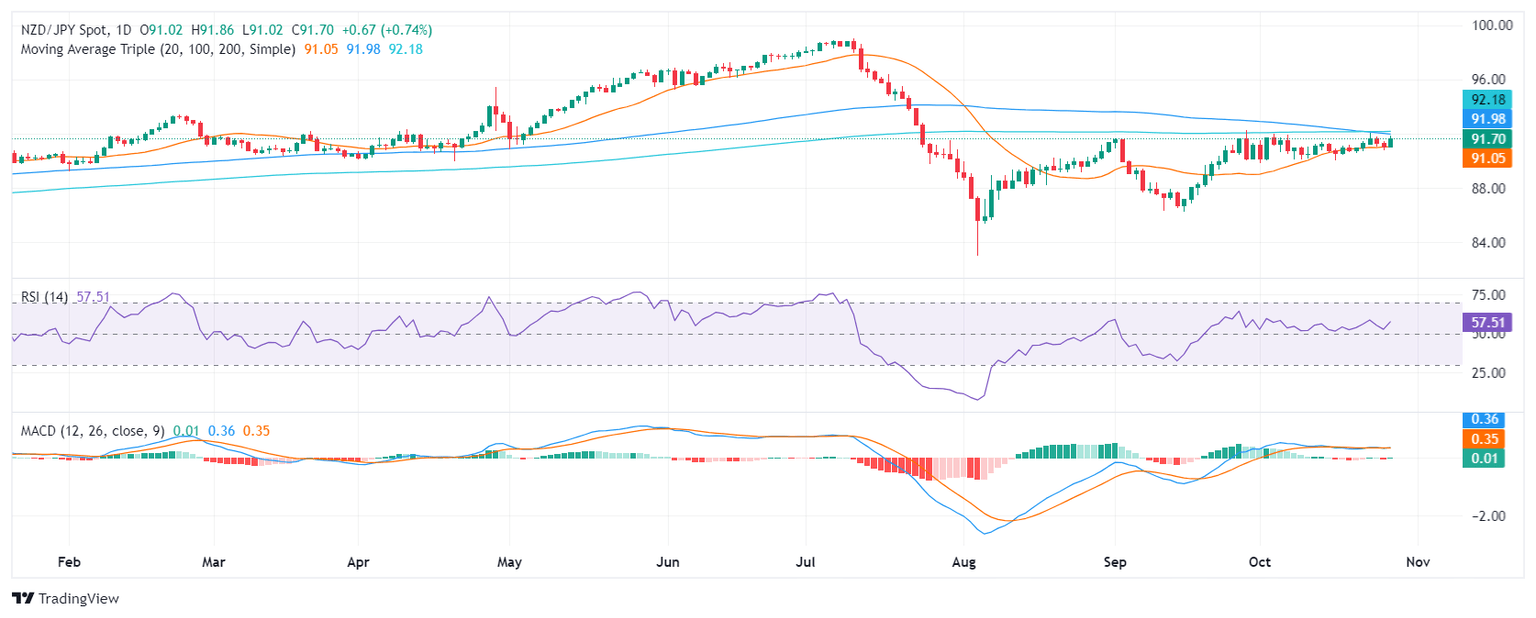

- Technical indicators show a neutral outlook, with the RSI at 58 and the MACD hovering around the zero line.

NZD/JPY has resumed its upward trajectory after a period of consolidation. In Monday's session, the pair surged to 91.70, suggesting a potential shift in market sentiment. This move could be the beginning of a new bullish phase for NZD/JPY.

While technical indicators currently portray a neutral outlook, they do not contradict the bullish momentum evident in the price action. The Relative Strength Index (RSI) has risen at 58, indicating that buying pressure has stabilized. Meanwhile, the Moving Average Convergence Divergence (MACD) histogram is hovering around the zero line, signaling a lack of clear direction. However, the MACD is beginning to show signs of a bullish crossover, which would align with the positive price action.

The pair has been trading sideways over the past sessions, within a narrow range defined by support at 91.00 and resistance at 92.00. The 20-day Simple Moving Average (SMA), around the mentioned lower boundary will hold as critical support in the event of a pullback as it was defended by the buyers in the last two weeks but if sellers breach it, it might flip the table.

NZD/JPY daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.