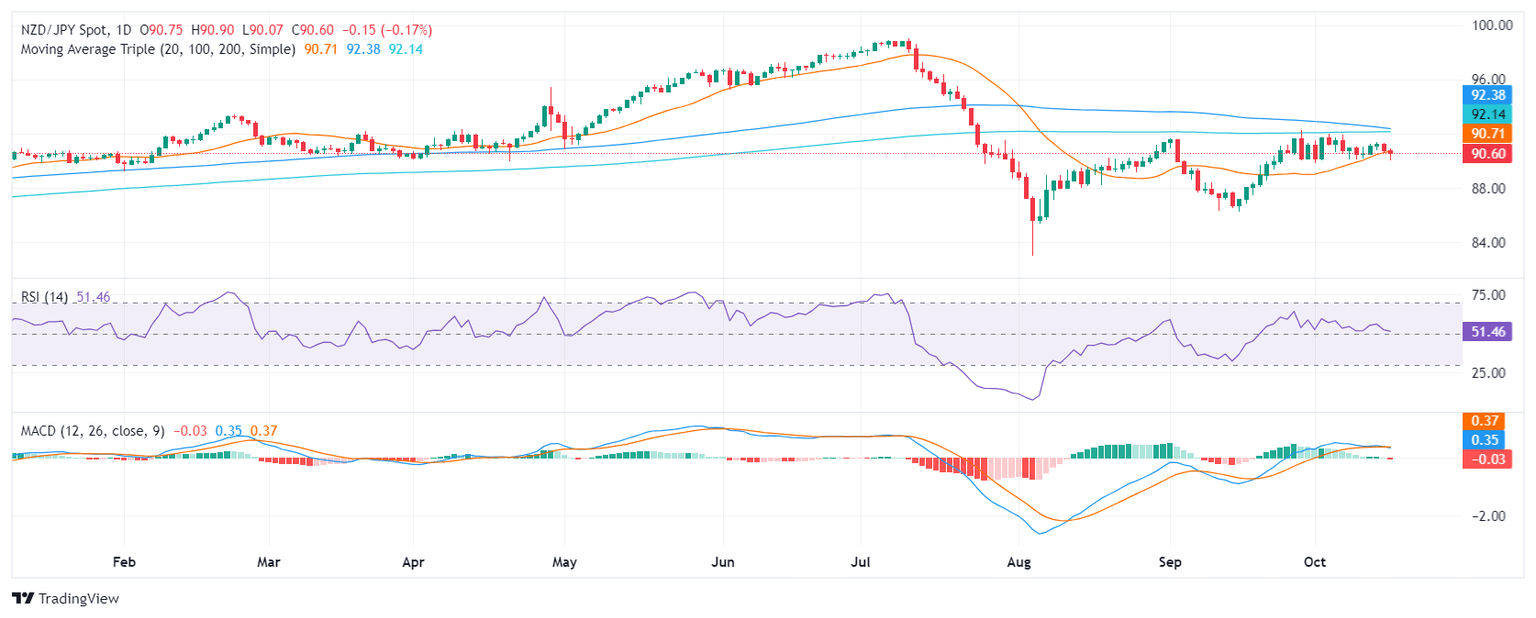

NZD/JPY Price Analysis: Bullish momentum flat, 20-day SMA proves to be a strong barrier

- The NZD/JPY continues trading side-ways using the 20-day SMA as a support.

- RSI and MACD indicate declining buying pressure.

- Buyers must defend th 20-day SMA to avoid losses.

In Wednesday's session, the NZD/JPY mildly fell to 90.60, continuing the sideways movement seen in the past few sessions.

The daily Relative Strength Index (RSI) is currently at 51, indicating that the pair is in the positive area. However, the RSI is declining, suggesting that buying pressure is declining. The Moving Average Convergence Divergence (MACD) histogram is green and decreasing, confirming the bearish momentum.

The 90.60 level remains crucial for the near-term outlook of the NZD/JPY pair. On Wednesday, the pair continued to struggle near this support level. A breakdown below 90.60 could pave the way for further losses, potentially targeting the next psychological support at 89.50. However, if the pair holds above 90.60 and buyers regain strength, a reversal could push the price towards the 91.00 resistance level and even up to 92.00, where the 20, 100, and 200-day Simple Moving Averages (SMA) converge.

Bears have been persistently testing the 20-day SMA, which has served as a notable support. A successful break below this level could solidify the bearish momentum, leading to increased downside pressure.

NZD/JPY Daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.