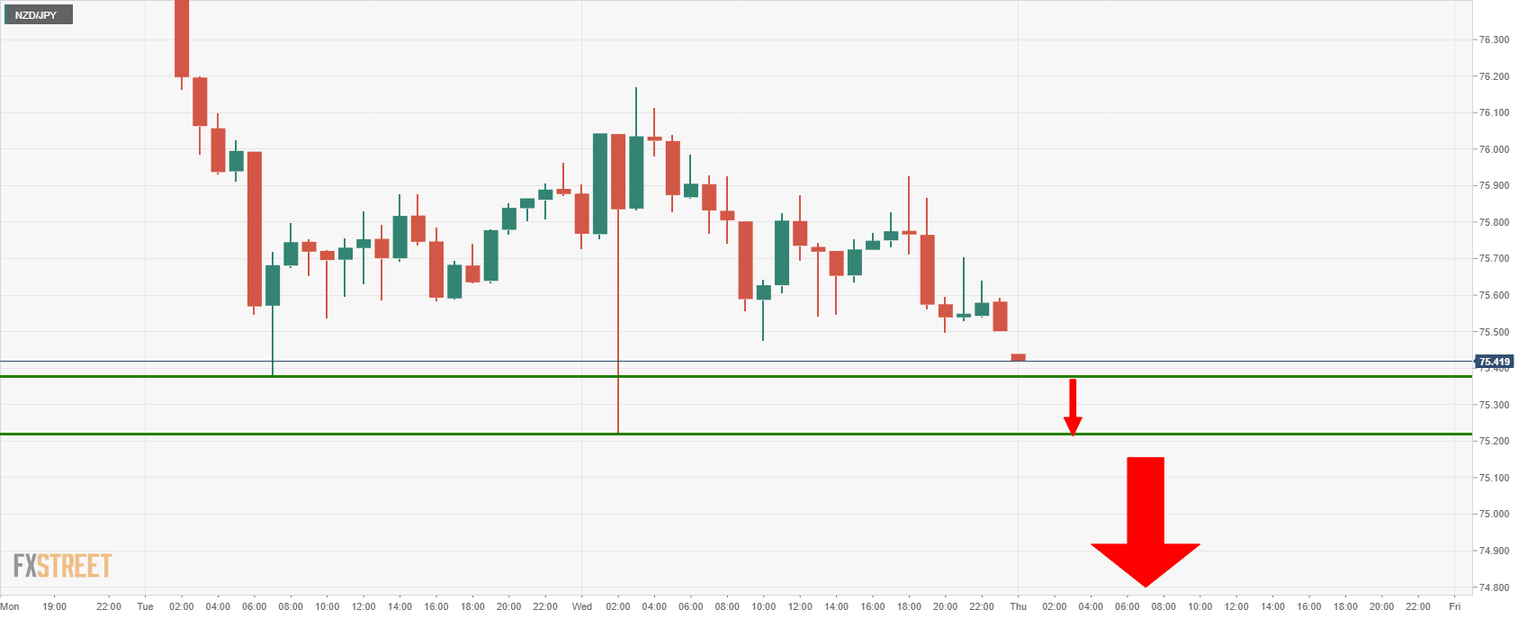

NZD/JPY Price Analysis: Bears taking charge below 75.50

- NZD/JPY bears are taking charge in the Asia session.

- Bears are targeting lower lows on the hourly and daily time frames.

As per the prior analysis, NZD/JPY Price Analysis: Bulls looking to daily 61.8% Fibo and bears looking to 200 SSMA, the price is lower following the Reserve Bank of New Zealand hawkish hold the prior day.

Prior analysis

''The RBNZ could hold today and that would be expected to see the kiwi a lot lower and that would expose daily downside structural targets of 74.50 (200 SSMA 74.40) and 73.90/00:''

Post-event, kiwi falls

In the above chart, the price is showing that it fell after the event into support territory.

In current trade, the price is moving on an hourly structure in a bearish environment as follows:

The prior lows are in focus near 75.40 and 75.20 which guard a deeper run towards the daily targets at 74.50 and lower to test 74.00 the figure.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637648436114862010.png&w=1536&q=95)