NU Holdings (NU) should pullback before next rally

NU Holdings Ltd., (NU) provides digital banking platform in Brazil, Mexico, Colombia, Germany, Argentina, United States & Uruguay. It offers spending solutions comprising credit & prepaid cards, mobile payment solutions & integrated mall that enables customers to purchase goods & services from various ecommerce retailers. It is based in Brazil, comes under Financial services sector & trades as “NU” ticker at NYSE.

NU ended I sequence at $16.15 high as showing in the previous article. It ended ((5)) in diagonal structure started from August-2024 low. Below $16.15 high, it should pullback in II correction in 3, 7 or 11 swings against June-2022 low.

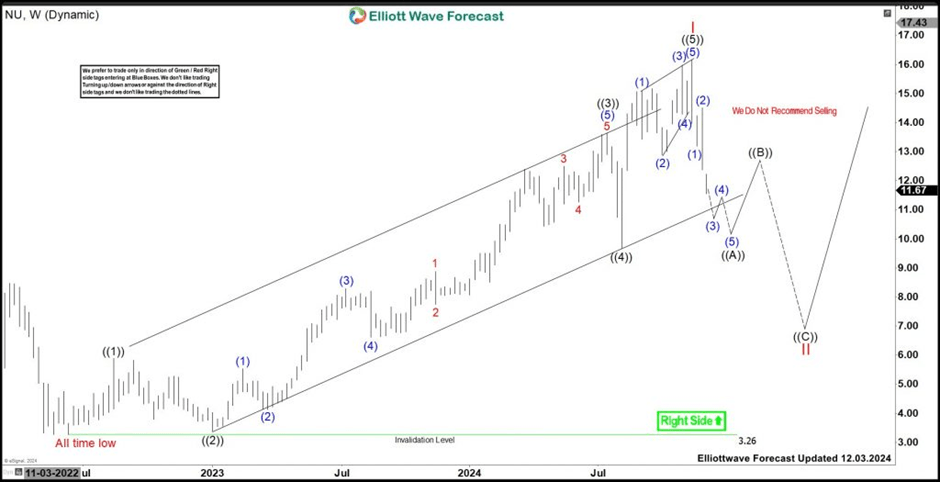

NU – Elliott Wave latest weekly view

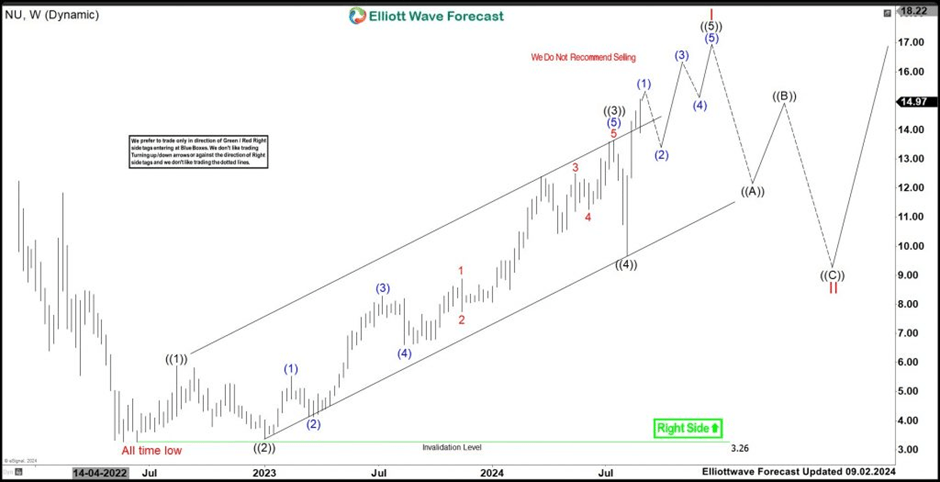

It ended impulse sequence I at $16.15 high from June-2022 low. Within I sequence, it placed ((1)) at $5.88 high & ((2)) at $3.39 low as dip pullback. It ended ((3)) as extended sequence at $13.64 high in July-2024 & ((4)) as sharp pullback at $9.67 low as 0.382 Fibonacci retracement of ((3)). Finally, it ended ((5)) as diagonal sequence from August-2024 low at $16.15 high as I expected from last update.

NU – Elliott Wave view from 9.02.2024

Within ((5)), it placed (1) at $15.11 high, which pop up with massive volume. It ended (2) at $12.89 low, (3) at $15.98 high, (4) at $14.29 low & (5) at $16.15 high on 12th November to finish I. Below I high, it favors lower in (3) of ((A)) as the part of II correction. Within ((A)), it placed (1) at $13.19 low & (2) at $12.37 high. Currently, it favors lower in (3), which can extend towards $11.54 – $9.71 area before bounce in (4). It expects 5 swing lower in ((A)) followed by 3 swing bounce in ((B)) connector. We like to buy it later in ((C)) at extreme areas when finishing II correction.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com