NIO Stock News: Nio Inc jumps higher as EV makers provide July delivery updates

- NYSE:NIO gained 2.28% during Monday’s trading session.

- Chinese EV makers report delivery figures for the month of July.

- Nio is rumored to be launching its first smartphone by next year.

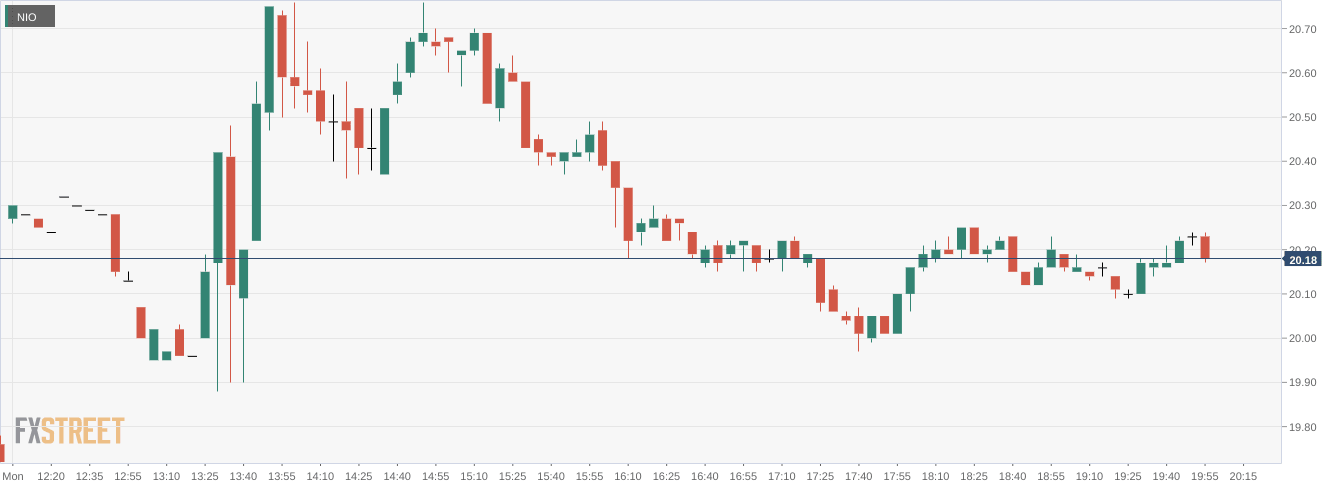

NYSE:NIO kicked the month of August off on the front foot as the Chinese EV maker saw its stock reclaim the key $20.00 price level. On Monday, shares of Nio gained 2.28% and closed the first trading session of the month at $20.18. Stocks pulled back late in the day after closing out their strongest month since 2020. All three major indices dipped into the red in what was a mostly flat start to the month. Overall, the Dow Jones fell by 46 basis points, the S&P 500 dropped by 0.28%, and the NASDAQ inched lower by 0.18% during the session.

Stay up to speed with hot stocks' news!

Chinese EV makers hosted their vehicle delivery reports for the month of July during the Asian trading session. Nio managed to post a 26.7% year over year increase with a total delivery number of 10,052. While this figure grew from 2021, it actually fell on a sequential basis from the June delivery number of nearly 13,000, representing a 22% sequential decline. Both Li Auto (NASDAQ:LI) and XPeng (NYSE:XPEV) had a similar performance, improving from 2021 but coming in lower than in June. XPeng delivered 11,524 vehicles, the most out of the three companies.

NIO stock forecast

It is widely believed in China that Nio’s first foray into the smartphone industry will come as soon as 2023. Nio CEO William Li has noted that Apple (NASDAQ:AAPL) getting into the EV business with iPhone integration was a major reason why Nio decided to start developing a smartphone for its own electric vehicles. No official date has yet been released by Nio for the launch of its phone.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet