NIO Stock News and Forecast: Shares power up as Nio test drives new ET7 sedan

- NYSE:NIO rode higher on Thursday gaining 1.13% amidst a broader market rally.

- Nio is seen test driving its new Model S rival, the ET7 sedan.

- Wall Street remains bullish on Nio ahead of its second quarter earnings.

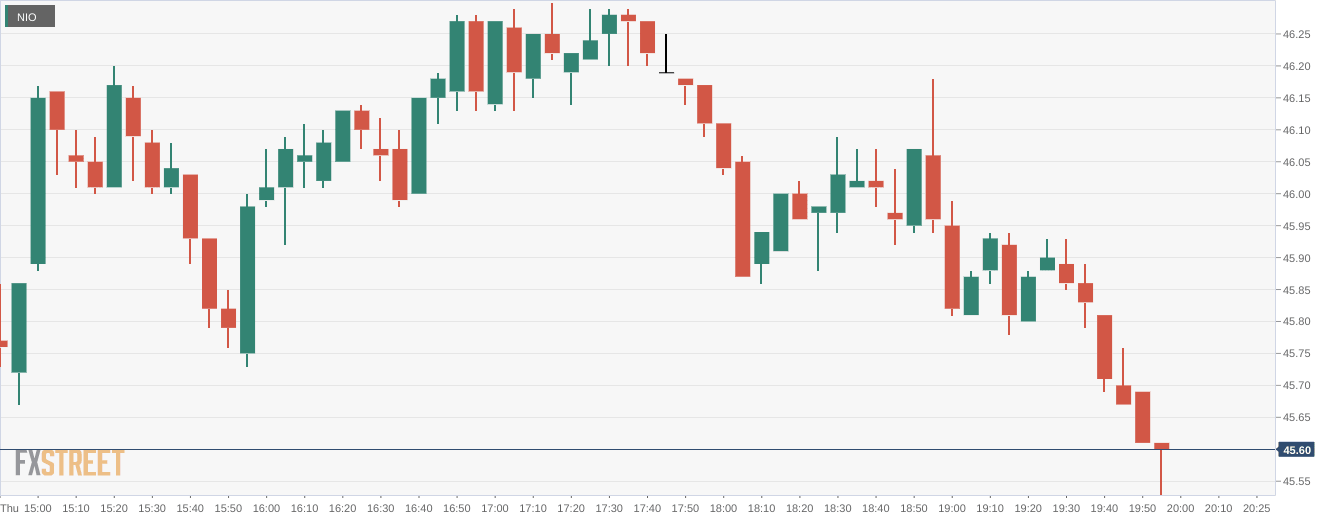

NYSE:NIO has shrugged off the recent Chinese government crackdown and continues to deliver in a sector that is thriving in China. Thursday saw shares of Nio add 1.13% to hit $45.60 by the closing bell. Overall it was a bullish day for the markets as the S&P 500 hit a new all-time high and the NASDAQ and DOW bounced back from recent sell offs. Much of the enthusiasm revolved around President Biden’s infrastructure bill which looks like it could go through as early as this weekend.

Stay up to speed with hot stocks' news!

We know Nio has several new vehicle models slated to hit production and consumers over the next few quarters. One of those was spotted on roads of China and the vehicle was covered in camouflage and without Nio logos. The model was quite clearly the new version of the ET7 sedan that is scheduled to hit showrooms in 2022. The ET7 is a luxury sedan that will rival the Model S from Tesla (NASDAQ:TSLA) in both the Chinese and European markets. Nio has several other models rumored to be released in 2022, including more family friendly vehicles like a minivan and a new compact SUV.

NIO price prediction

Wall Street remains bullish on Nio ahead of its earnings report for the second quarter next week. Call options are out numbering Put option contracts by a fair margin, signalling that institutional investors are anticipating a knockout quarter once again. It should be noted that the Wall Street price target for Nio remains high with an average price target of $64.50, with a Street high target of $72.00 per share.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet