Natural Gas Futures: Further upside in the pipeline

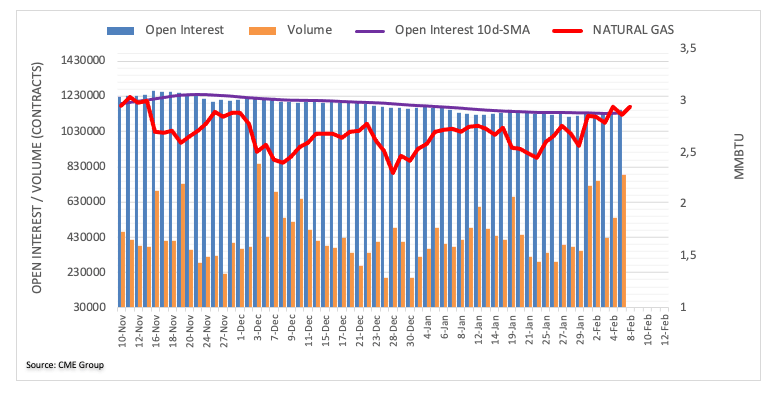

Advanced figures for natural gas futures markets from CME Group noted investors trimmed their open interest positions by just 206 contracts on Friday, partially reversing the previous build. Volume, instead, increased for the second session in a row, this time by around 248.5K contracts.

Natural Gas looks to $3.00/MMBtu

Friday’s brief test of levels above the $3.00 level and the subsequent close with losses was amidst shrinking open interest, removing strength for a deeper pullback and leaving potential upside still on the cards. That said, the key $3.00 mark per MMBtu still emerges as a key resistance in the very near-term for natural gas.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.