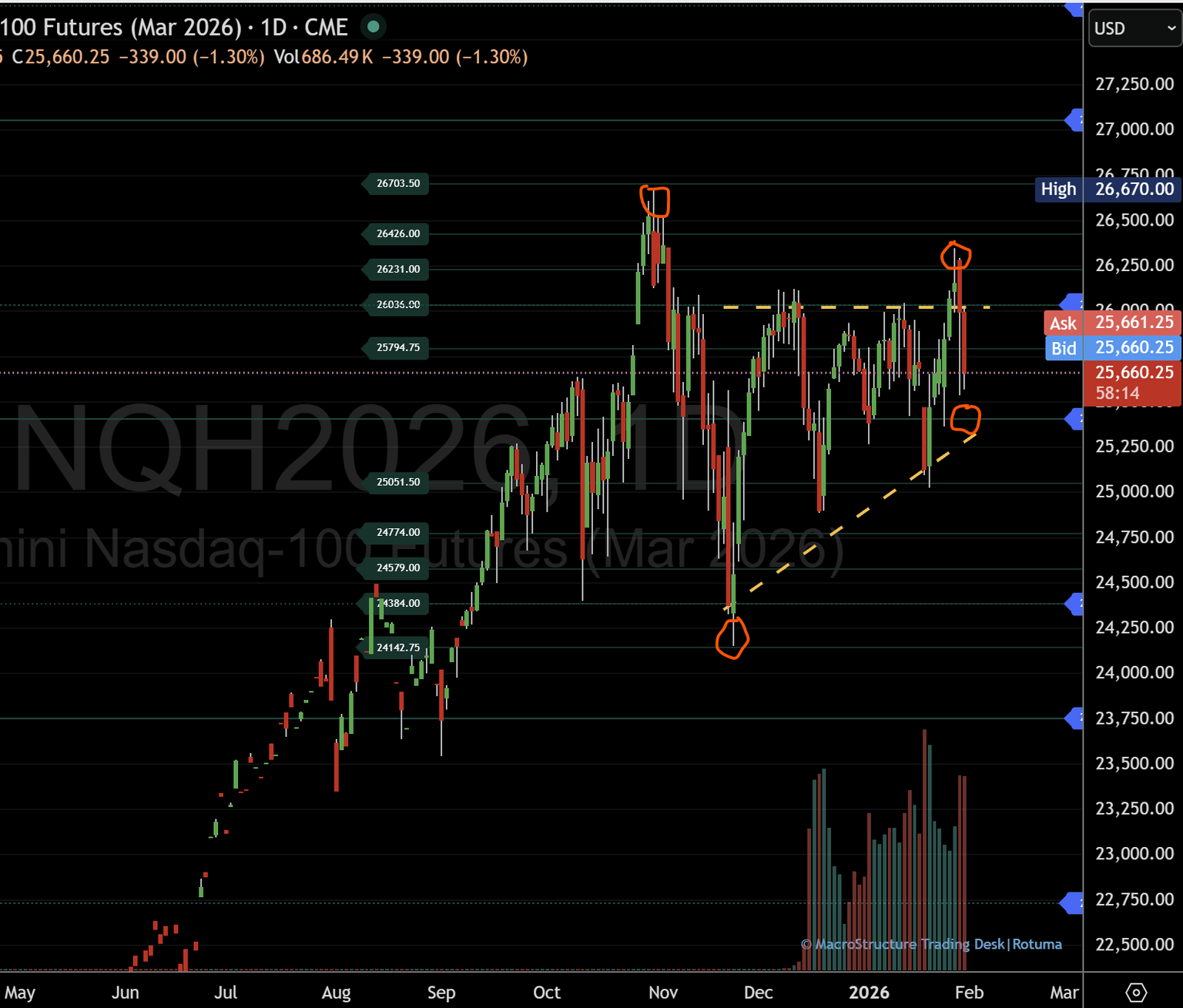

Nasdaq 100 futures: Failed breakout refocuses 25,405 pivot

The two-way daily structure remains intact, but failure to reclaim 25,794 could open a rotation toward 25,051 and 24,774

Nasdaq futures desk report — Jan 30, 2026

(Continuation of the MacroStructure desk sequence from Jan 23, 2026.)

Nasdaq 100 futures drop for a second session as the market heads into the end of the week, with the prior upside rotation losing traction. The breakout through the 25,794–26,036 supply band — the zone that had capped upside rotations since November 2025 — proved short-lived. As of this print, price is trading near 25,578, pulling back toward the daily central pivot at 25,405.

From a structure-first perspective, the two-way daily structure remains intact. That matters because it keeps the playbook state-dependent: the market can still rotate back into the upper band if it reclaims acceptance above the failed breakout area, but it can also migrate value lower if the pivot fails to hold.

Key reference levels on the daily map

- Upper supply / failed breakout band: 25,794–26,036

- Daily central pivot (decision point): 25,405

- Lower structure ceiling references: 25,051, then 24,774

- Deeper lower-structure references (if pressure persists): 24,579 → 24,142

What price is “saying” right now

The rejection back under 25,794 shifts attention away from “breakout continuation” and back to rotation management inside the existing range. In practical terms, the market is now testing whether the pullback is simply a reset (a pause before another attempt higher) or the start of a more meaningful migration toward the lower structure.

Scenario map

1) Reclaim scenario (stabilisation back into the upper band)

If price can recover and hold back above 25,794, the failed breakout becomes a shakeout rather than a reversal. In that case, the 25,794–26,036 band is the first area to watch for acceptance (not just a tag). Sustained trade back through the band would put the upper structure back on the table.

2) Pivot test scenario (25,405 becomes the battlefield)

If the market fails to recapture 25,794, the pullback naturally invites a retest of 25,405. This pivot is a key “decision node” on the daily chart:

- Hold/defend: supports another rotation attempt upward.

- Fail/accept below: increases the odds of value migrating toward the lower structure.

3) Lower rotation scenario (pressure extends into the lower structure)

Acceptance below 25,405 would bring the lower references into focus, starting with 25,051 and 24,774 (the lower-structure ceiling). If that ceiling doesn’t hold, the map opens toward the deeper band at 24,579–24,142.

Cross-market note: Bitcoin vs Nasdaq (pattern rhyme, different posture)

A similar “structure tension” is showing up across risk markets, but not in the same posture. Bitcoin is pressing into multiple monthly lows while Nasdaq futures are working the opposite side of the structure map (pulling back from a failed upside attempt). I treat this less as a signal and more as a reminder: correlations can rhyme without matching perfectly, especially around major decision levels.

Structure exists, and price evolves around it — until it breaks into the next phase.

For this session, the clean engagement question is simple: Is 25,405 holding or failing?

This desk report documents a structure-first process and is for informational purposes only; it does not constitute financial advice.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.