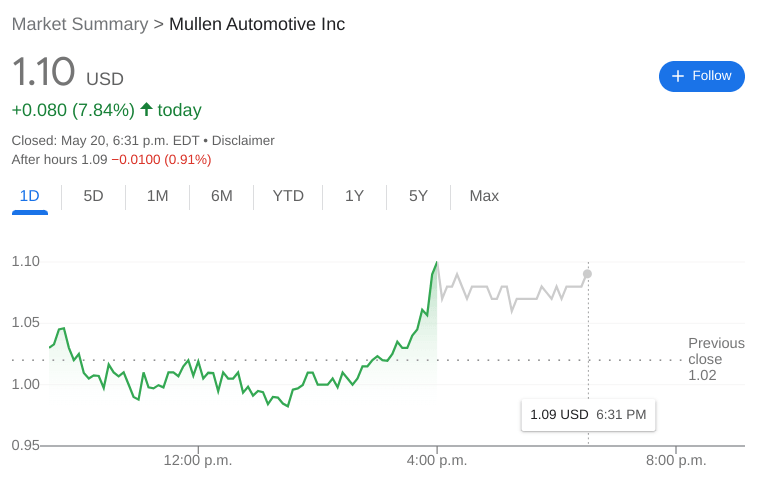

MULN Stock News: Mullen Automotive posts a 7.8% gain even as EV Stocks retreat

- NASDAQ:MULN gained 7.8% during Friday’s trading session.

- EV Stocks pull back as market volatility and Tesla weakness continues.

- Hyundai announces its plans to launch a $5.5 billion EV plant in Georgia.

NASDAQ:MULN closed out another volatile trading week, although after rising on Friday, the stock managed to post a 6.8% gain for the week. Shares of MULN spiked by 7.8% and closed the trading session at $1.10. US markets could not decide on a direction during intraday trading before whipsawing higher into the closing bell. The Dow Jones managed to gain 8 basis points, while the S&P 500 closed 0.01% higher after briefly dropping into bear market territory earlier in the day. The NASDAQ posted a 0.30% as the downward pressure on tech stocks extended into Friday’s session.

Stay up to speed with hot stocks' news!

Electric vehicle stocks were mostly in decline on Friday as more weakness from the industry leader Tesla (NASDAQ:TSLA) sent the sector reeling. CEO Elon Musk was at the center of another controversy as allegations of sexual misconduct against a SpaceX employee surfaced online. Shares of TSLA closed 6.42% after hitting an intraday low price of $633.00. Other EV stocks that followed Tesla lower include Nio (NYSE:NIO), Lucid (NASDAQ:LCID), and Rivian (NASDAQ:RIVN) which all posted losses for the day.

MULN stock forecast

Korean automaking giant Hyundai officially announced its first electric vehicle production facility in the US. The project will cost $5.5 billion and will focus on electric vehicle and battery manufacturing. At its peak, Hyundai expects the factory to be capable of producing 300,000 vehicles annually after it opens for production in the first half of 2025. Hyundai chose Georgia as the location of the plant which is also where Rivian has set up its second factory.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet