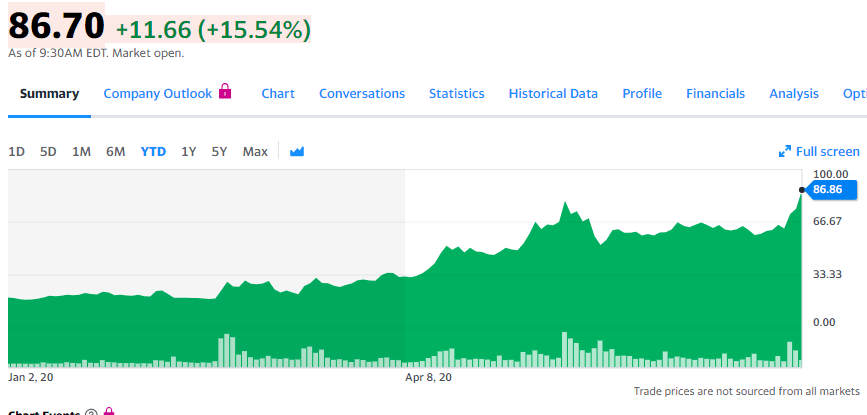

MRNA Stock Price: Moderna hits record high amid coronavirus vaccine progress, new test underway

- NASDAQ: MRNA shares are set to jump to around $85, a record high.

- Moderna Inc reported progress in its COVID-19 vaccine efforts

- Broader stock markets are also on the rise in the hopes of a broad turnaround.

Moderna Inc. (MRNA) is trading around $87, the highest on record and above the previous peak in May. The company has been at the forefront of efforts to develop immunization for the disease that is gripping the world and is now benefiting from progress as the trial produces a "robust immune response".

MRNA Stock News

The prestigious New England Journal of Medicine reported details about Moderna's vaccine efforts. The Massachusetts-based pharmaceutical firm tested its candidate on 45 humans, which all showed a robust amount of antibodies – as much as four times the level seen in recovered coronavirus patients.

Moreover, side-effects were minimal among those that were tested, showing the vaccine is safe. There still is a long road to approving, producing, and administering a vaccine to the globe's population is still long. Moderna's next step is a broad test of 30,000 people.

Contrary to the previous publication – when Moderna only issued a press release – the publication by the highly regarded magazine is already applauded by the medical community.

It is essential to note that other efforts are in play, most notably cooperation between the University of Oxford and AstraZeneca.

The S/P 500 has turned positive for the year, boosted by the NASDAQ: MRNA news.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.