MicroStrategy (NASDAQ: MSTR) Elliott Wave technical blueprint

MicroStrategy (NASDAQ: MSTR) remains Bitcoin’s largest corporate holder, driving its stellar performance. Yet while BTC tests all-time highs, MSTR trails 20% below its peak – creating a compelling divergence.. In today’s article, we explore MSTR’s Elliott Wave blueprint and outline the bullish paths that may unfold next.

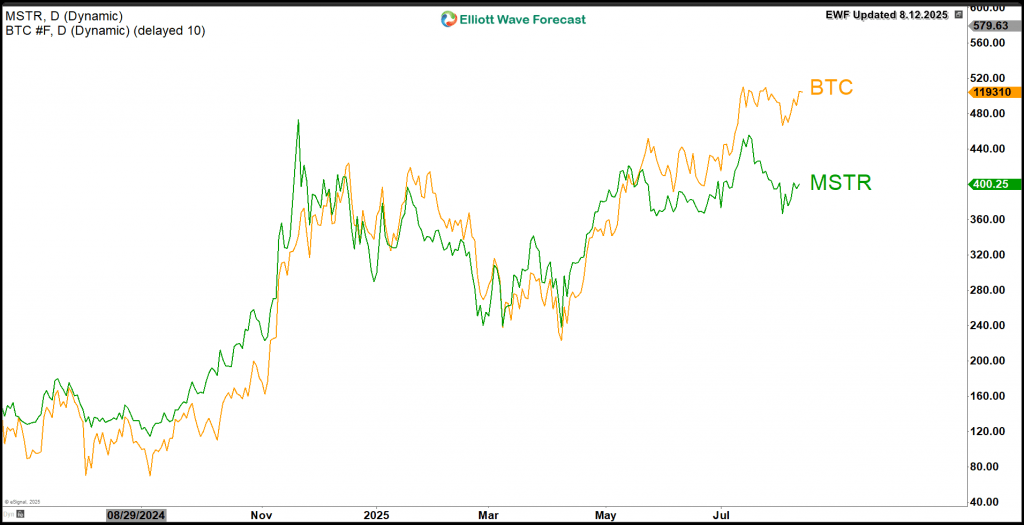

The correlation divergence

MSTR typically outperforms Bitcoin’s moves, offering traders leveraged BTC exposure. Yet recent months revealed troubling divergence. The chart below shows this decoupling clearly.

Two factors could explain the underperformance:

1. Equity risk premium – Macro concerns weighed on stocks.

2. Liquidity shifts – Capital rotated to pure-play crypto ETFs.

The key metric to watch: 30-day correlation coefficient (currently 0.82 vs. 0.93 historic average).

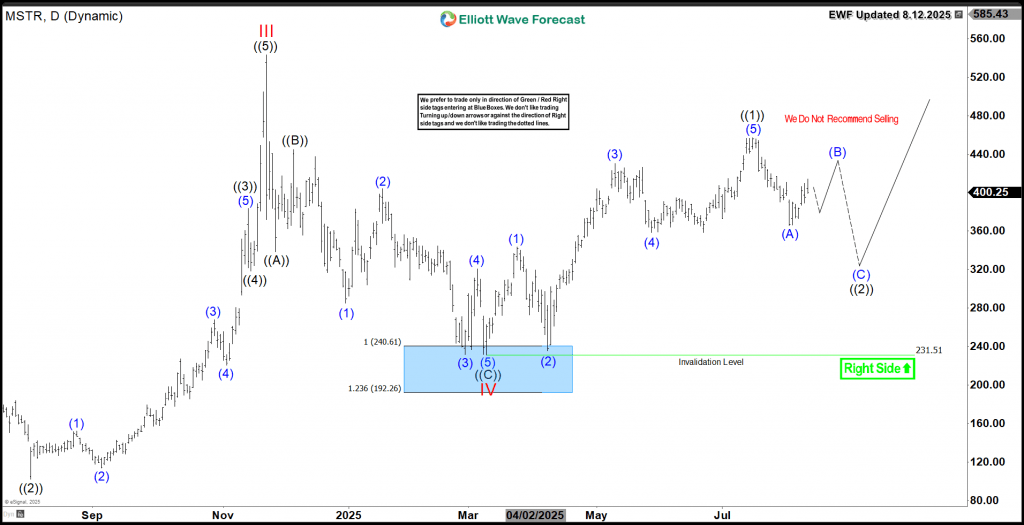

Elliott Wave structure

MSTR completed a zigzag correction from November 2024, hitting the $240-$192 Blue Box target. The subsequent 5-wave advance into July marked Wave ((1)), establishing $231.51 as critical support. Now, any 3/7/11-swing pullback should complete Wave ((2)) before the next surge.

Aggressive traders note August’s dip may have already finished Wave ((2)). A break above July’s $457 peak confirms Wave ((3)) toward $590-$644.

The key question: Will Wave ((3)) restore MSTR’s leverage advantage?

MicroStrategy MSTR daily chart 8.12.2025

Conclusion: A High-Probability Catch-Up Trade

MicroStrategy (MSTR) maintains its bullish Elliott Wave sequence, poised to close its performance gap with Bitcoin. The stock will build momentum through Wave ((3)), typically the strongest phase. Traders can leverage daily pullbacks using our Blue Box strategy

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com