Mexican Peso feels the heat from April slowdown, anticipates GDP release

For the latest news on the Mexican Peso click here.

- Mexican Peso edges down 0.30% against US Dollar, trading at 16.64.

- Mexico's April Economic Activity Indicator shows minimal growth with Q1 2024 GDP expected to be downwardly revised.

- Gloomy economic outlook with falling Retail Sales may pressure Peso despite favorable interest rate differential.

Mexican Peso registers losses versus the US Dollar during the North American session amid a slew of Federal Reserve (Fed) officials hitting the wires. Data from Mexico suggests the economy barely grew in April, according to the Instituto Nacional de Estadistica Geografia e Informatica (INEGI), ahead of revealing the release of the Gross Domestic Product (GDP) figures on May 22. Therefore, the USD/MXN trades at 16.64, up 0.30%.

Mexico’s docket featured the Economic Activity Indicator for April, saying the economy slowed, according to non-seasonally adjusted figures on a yearly basis. It showed signs of a minuscule improvement on a monthly basis, yet compared to March’s contraction, the Mexican economy didn’t grow.

Citibanamex analysts anticipate an economic slowdown, suggesting that GDP Q1 2024 figures will be downwardly revised.

This data, along with the plunge in Retail Sales in March, paints a gloomy economic outlook for Mexico. This could depreciate the Mexican Peso, even though the currency is favored by the interest rate differential set by the Bank of Mexico (Banxico) and the Fed.

In the US, Fed officials remain cautious about their stance regarding monetary policy. Atlanta Fed President Raphael Bostic, Fed Governor Christopher Waller and Michael Barr have all hit the wires.

Daily digest market movers: Mexican Peso tumbles despite diverging views amid Banxico’s board

- Mexico’s Gross Domestic Product for Q1 2024 is expected to show the Mexican economy is slowing amid higher borrowing costs of 11.00% on fears of higher inflation and the risks of depreciation of the Peso.

- Retail Sales in March plunged -0.2% MoM, below February’s 0.5% increase. On a yearly basis, sales plummeted -1.7%, missed estimates of 0%, and trailed the previous month's 3% growth.

- Diverging views surface in Banxico as Governor Victoria Rodriguez Ceja said last Monday that the bank would discuss lowering rates in the upcoming meeting on June 29. Conversely, Deputy Governor Espinosa commented that lowering rates in March might have delayed inflation convergence toward the central bank’s target by two quarters.

- Atlanta Fed President Raphael Bostic said he isn’t in a hurry to reduce rates and prefers to keep them steady. The Fed’s higher priority remains tackling inflation.

- Fed Governor Christopher Waller said that April’s CPI showed progress but that he needs to see several months of good inflation data before supporting a rate cut. His colleague, the Vice-Chair of Supervision Michael Barr, commented, “We still need to finish the job on inflation.”

- Data from the Chicago Board of Trade shows investors are expecting 35 basis points (bps) of Fed easing toward the end of the year.

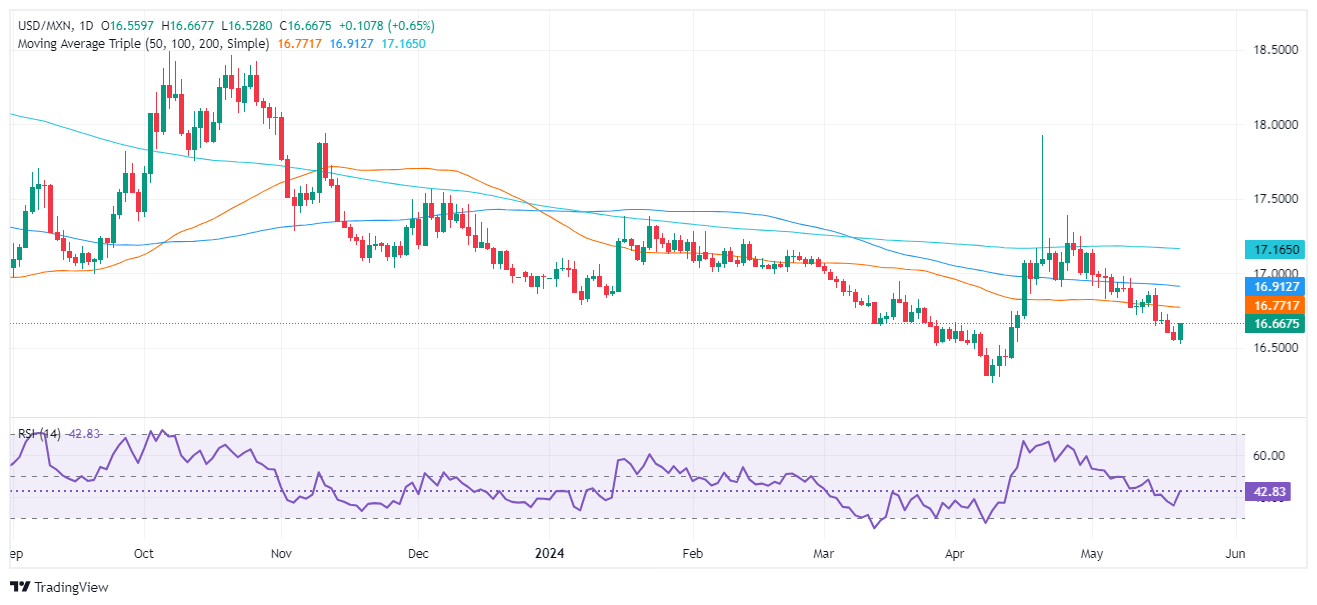

Technical analysis: Mexican Peso trips down as USD/MXN climbs above 16.60

The USD/MXN remains downwardly biased, an indication of the strength of the Mexican currency, yet it remains shy of challenging the year-to-date low of 16.25, which could pave the way to test the 16.00 psychological figure. The seller momentum has stalled as the Relative Strength Index (RSI) is bearish but flat.

On the other hand, if buyers lift the USD/MXN toward the 50-day Simple Moving Average (SMA) at 16.76, it could exacerbate a rally toward the 100-day SMA at 16.91. Once cleared, the next supply zone would be the 17.00 psychological level. In that event, the next stop would be the 200-day SMA at 17.17.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.