Mexican Peso advances against US Dollar ahead of US and Mexico central bank decisions

Most recent article: Mexican Peso gains ahead of Fed’s decision, USD/MXN dips

- Mexican Peso weakens in early North American trading as US Dollar gains strength.

- Mexican data is mixed though the economy finished 2023 on a higher note.

- Central bank divergence between Fed and Banxico could bolster USD/MXN pair.

The Mexican Peso appreciates in late trading during the North American session as the US Dollar climbed some 0.25%, based on the US Dollar Index (DXY). Speculation that the Bank of Mexico (Banxico) would ease policy on Thursday grew while traders continued to trim odds for the Federal Reserve’s first rate cut. The USD/MXN trades at 16.82, clocking a loss of 0.05%.

Mexico’s economic docket featured the release of Aggregate Demand and Private Spending, with both figures exceeding Q3 2023 readings, suggesting the economy ended the year on a higher note. Across the border, US housing data exceeded estimates and improved compared to January’s data, and now all heads turn toward the Federal Open Market Committee (FOMC) decision on Wednesday.

Daily digest market movers: Mexican Peso on defensive amid dovish Banxico

- Estimates that Banxico will lower the interest rate from 11.25% to 11% puts “some” pressure on the Mexican currency, which could lift the USD/MXN toward the 17.00 mark.

- Mexico’s economic data released on Tuesday:

- Aggregate Demand rose by 0.3% QoQ in Q4, up from 0%. On an annual basis decelerated from 2.7% to 2.6%.

- Private Spending on a quarterly basis slowed from 1.2% to 0.9%. On a yearly basis, it improved from 4.3% to 5.1%.

- The USD/MXN is being driven by the reduction of interest rate spreads between Mexico and the United States. This could bolster and set the USD/MXN direction toward the 17.00 figure.

- On March 21, Banxico is expected to decrease interest rates, even though it could feature a 3-2 vote split. Recent speeches and media appearances show that Banxico’s Governing Council is divided, with Governor Victoria Rodriguez Ceja, Omar Mejia Castelazo and Galia Borja Gomez leaning dovish. On the hawkish front lie Jonathan Heath and Irene Espinosa Cantellano.

- An economic slowdown in Mexico is the main event that could spark Banxico’s first rate cut as the central bank has adjusted its economic projections to the downside. Mexico’s central bank expects the economy to grow 2.8% YoY in 2024, down from 3% and maintaining at 1.5% for 2025.

- US Building Permits in February rose 1.9% from 1.495 million to 1.518 million, suggesting that demand continues to increase.

- Housing Starts increased by 10.7% compared to January’s data as starts jumped from 1.425 million to 1.521 million.

- The latest inflation figures in the United States prompted investors to price in a less dovish stance. Money market futures had adjusted their rate cut expectations more in line with the Fed as they foresee the Federal Funds Rate (FFR) at 4.71% toward year end. The next Fed meeting is scheduled for March 19-20 next week, and analysts estimate no change to its Federal Funds Rates (FFR).

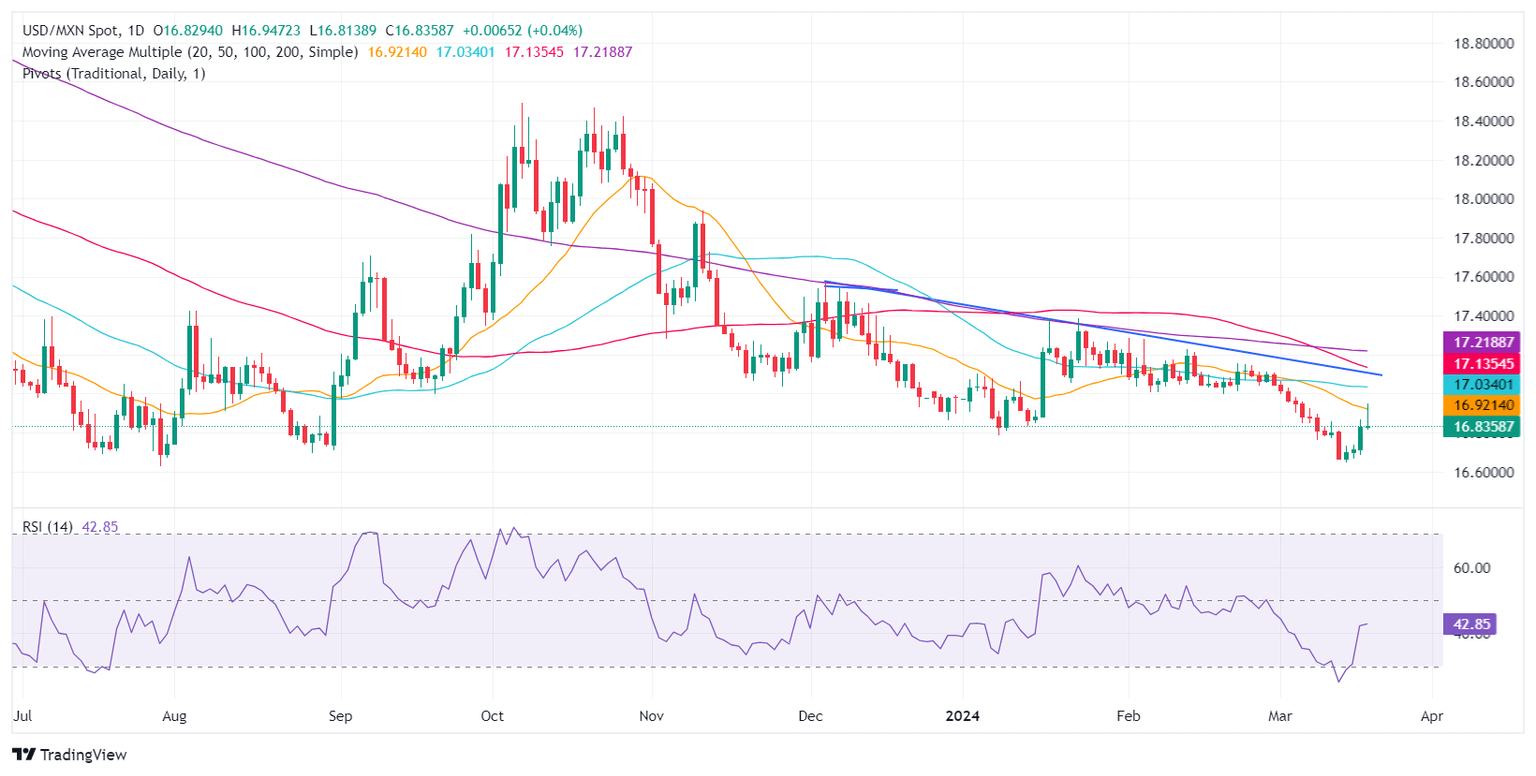

Technical analysis: Mexican Peso begins to weaken as USD/MXN aims above 16.80

The USD/MXN has shifted to a neutral bias as buyers stepped in and lifted the exchange rate above the January 8 swing low of 16.78. After breaching that level, the pair clocked a new two-week high of 16.94, though buyers are taking a breather before launching an assault toward 17.00. Once that hurdle is overcome, the next resistance would be the 50-day Simple Moving Average (SMA) at 17.02, followed by the 100-day SMA at 17.16 and the 200-day SMA at 17.21.

On the flip side, the exotic pair must drop below 16.80, which could pave the way for a test of last year’s low of 16.62, followed by October 2015’s low of 16.32 and the 16.00 psychological level.

USD/MXN Price Action – Daily Chart

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.