Marvell Technology earnings foreshadow a bad September ahead

- Marvell Technology dumps over 16% after Q2 earnings.

- Marvell missed Q2 revenue projections, but Wall Street is more concerned with Q3 outlook.

- Michigan Consumer Sentiment and Expectations miss forecasts.

- As Wall Street cuts price targets, MRVL could sink back to $48.

Marvell Technology (MRVL) had a solid quarter. But you wouldn't know that from the over 16% drop in its share price on Friday.

The 30-year-old semiconductor company, valued for its AI system-on-a-chip (SoC) integrated circuits used in artificial intelligence (AI) applications, reported adjusted earnings per share (EPS) of $0.67, in-line with Wall Street consensus, and revenue of $2.01 billion that rose more than 57% from a year earlier.

But the fact that revenue missed the Street's heady estimates by $10 million and Q3 guidance left a lot to be desired led traders to call it yet another sign that the AI rally is slowing down.

Wednesday's Nvidia earnings also offered a miss on data center revenues, pushing that leading AI company's shares down 3% at the time of writing. On Friday, Alibaba (BABA) added insult to injury by announcing that it had developed an AI inference chip to compete with Nvidia's H20 GPU, which Chinese authorities view as an inferior product to the H200 chip that Washington has barred from export to China. BABA stock surged more than 13% on the news.

Though core Personal Consumption Expenditures (PCE) for July came in-line with expectations, meaning the Federal Reserve (Fed) is now considered more likely to cut interest rates in September, the market chose to focus on the poor results from the University of Michigan's Consumer Expectations and Consumer Sentiment indices instead.

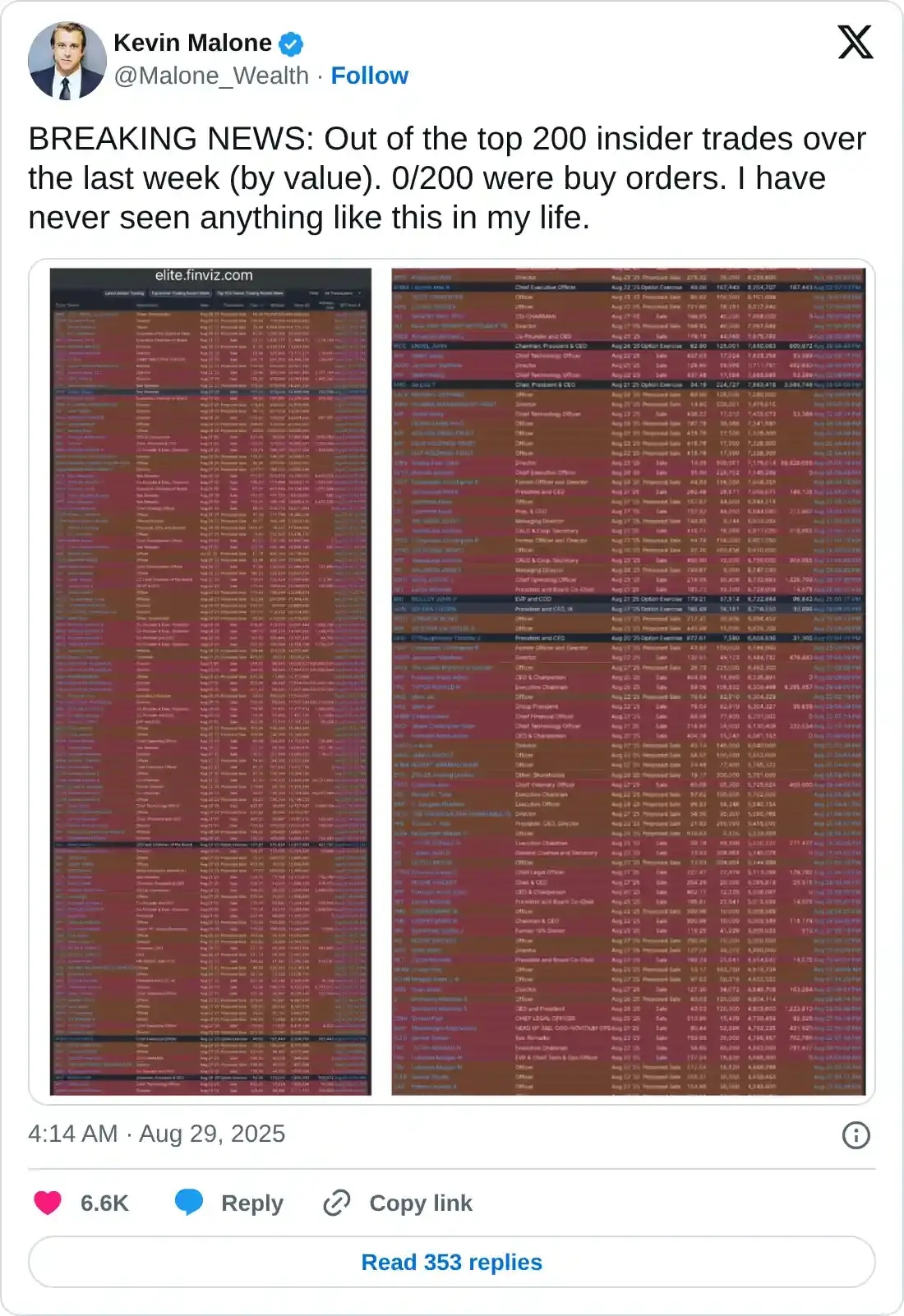

The NASDAQ Composite slumped some 1.2% by the afternoon, and the S&P 500 has slid 0.7%. Many observers are pointing to a large quantity of insiders taking money off the table:

@Malone_Wealth post on X.com from August 29, 2025

Marvell Technology earnings bode poorly for September

"Lumpiness" was the word that analysts used to describe Marvell's business prospects for the second half of the year.

Bank of America Securities analyst Vivek Arya said that "the same level of confidence/visibility” on Marvell's AI guidance was no where in sight. The company guided for a midpoint of $2.06 billion in Q3 revenue, while Wall Street was expecting $2.1 billion.

As a result, Arya cut his 2026 data center growth estimate to mid-teens on an annual basis from his 23-25% prior view. Bank of America cut its price target from $90 to $78, which is still well above the $64 level that the stock is garnering on Friday.

Needham analyst N. Quinn Bolton said that Marvell's custom chips designed for Microsoft (MSFT) and Amazon (AMZN) might be pushed to Q4, meaning that Q3 could see a quarterly 15% decline from Q2 in custom silicon.

Data center revenue grew 3.5% QoQ compared with the 5% run a quarter ago and the 25% clip witnessed three quarters earlier.

While Marvell is projecting $0.74 in adjusted EPS for Q3, analysts don't think it's much of a jump from the $0.73 consensus figure. Basically, Marvell is continuing to see a measurable expansion of its business, but this is just not enough growth compared with what the market desires.

Marvell Technology stock forecast

Marvel stock shot below both the 50-day and 100-day Simple Moving Averages (SMAs) on Friday. This is a poor sign heading into September, which has historically been a lackluster month for market gains. The 200-day SMA was already a notable overhang on the stock, sitting as it was above $83, owing to the January all-time high above $127.

Traders will now look to the 161.8% reverse Fibo Retracement at $58.20 for support. A break there would likely send MRVL down to its April support structure circa $48. Bulls now have the difficult task of pushing Marvell stock above the 50-day, now trading in the $74s, in order to put an end to this bearish picture.

MRVL daily stock chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Clay Webster

FXStreet

Clay Webster grew up in the US outside Buffalo, New York and Lancaster, Pennsylvania. He began investing after college following the 2008 financial crisis.