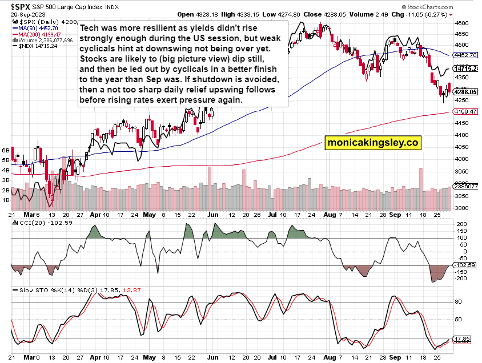

Keeping SPY bulls in check

S&P 500 ran higher on BoJ unannounced bond purchases and core PCE better by 0.1% in yet another Fed pivot bet replay. The juice though ran out relatively fast, and stocks started reversing in the 4,365 area already – and yields did the same, meaning the bear was slowly waking up. Quarter end positioning resulted in buying spree at the close, which gives a preview for what to expect in Q4 – I think a general stock market upswing on still robust economic data without too many job market or manufacturing cracks in the dam, with bond market volatility making for a slightly less volatile quarter towards its end.

October will be probably marked with more selling still before both sticky inflation (see here core and headline, going beyond oil prices) and approaching recession (that would be easily recognized by normalizing yield curve), sink the stock market advance coinciding with the Santa Claus rally in terms of time. Also the 10y yield hasn‘t yet peaked – this being apparent in XLF performance – and is to target 4,85 till 4.90% easily.

If I were to highlight once again what‘s amiss in the market, it‘s the FOMC projections that contradict each other, indirectly proving that recession next year is the most likely outcome required if inflation can be brought down towards 2%. Similarly, the job market expectations are too rosy, if wage pressures (private sector cost employment index) that‘s also feeding inflation, is to ease. Speaking of recession, only the time of its inevitability being realized, is when long-dated Treasuries catch a fine bid. During this resilient real economy with high fresh debt issuance and tightening Fed, not really.

Consider that within the last 1 year roughly, extra fiscal boost via Inflation Reduction Act and later ($1T), bullish institutional equities positioning in futures (pendulum swinging towards longs and closing prior shorts to the tune of almost $1T), and drawdown in reverse repos from the Nov 2022 top of $2.6T to $1.4T now, have all kept equities and real economy afloat through 2023, and only reverse repos are what can kick in next year on arriving recession, practically speaking as discretionary spending is constrained via the debt ceiling deal and institutional posioning is just about maxed out by historical comparisons. Reverse repo drawdowns can be viewed as negating the tight Fed, and enabling direct bid for Treasuries, which is what the Treasury welcomes…

As usual, check out please Saturday‘s video for extra nuggets in the explanations, as regards stocks too.

Keep enjoying the lively Twitter feed via keeping my tab open at all times (notifications on aren't enough) – combine with subscribing to my Youtube channel, and of course Telegram that always delivers my extra intraday calls (head off to Twitter to talk to me there), but getting the key daily analytics right into your mailbox is the bedrock.

So, make sure you‘re signed up for the free newsletter and make use of both Twitter and Telegram - benefit and find out why I'm the most blocked market analyst and trader on Twitter.

S&P 500 and Nasdaq Outlook

Source: www.stockcharts.com

4,340 weren‘t overcome on a closing basis, and once 4,315 are broken on a closing basis, the downswing starts again. The fact that XLY was strong Friday (TSLA), means that the buyers won‘t give up too easily. Financials, those I see still struggling while Nasdaq relative resilience to rates (be it on their rise or magnitude of taking advantage of temporary rates retreat) will determine just when we see the decline towards 4,260 at least continuing. Monday‘s close above 4,265 means that the bears have gone to sleep again, and downleg continuation is called off.

Ouf of the weekend news, one is bullish, the other bearish. The temporary solution for avoiding shutdown vs. AAPL iPhone 15 balance themselves out to a certain degree – therefore, the opening gap and direction taken within first hour of Globex open, would be telling.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.