Japanese Yen languishes near daily low; USD/JPY eyes 148.00 amid modest USD strength

- The Japanese Yen kicks off the new week on a softer note amid reduced BoJ rate hike bets.

- The USD reverses a part of Friday’s post-NFP slump and further lends support to USD/JPY.

- Firming expectations for a September Fed rate cut might cap the USD and the currency pair.

The Japanese Yen (JPY) maintains its offered tone through the early European session on Monday, which, along with a modest US Dollar (USD) uptick, assists the USD/JPY pair to stick to gains below the 148.00 mark. The Bank of Japan (BoJ) last week acknowledged the uncertainty over the economic impact of higher US tariffs and signaled continued policy patience. Adding to this, domestic political uncertainty could further complicate the BoJ's policy normalization path, which turns out to be a key factor undermining JPY at the start of a new week.

The BoJ, however, left the door open for an imminent interest rate hike by the year-end. Moreover, a generally weaker risk tone offers some support to the safe-haven JPY and helps limit deeper losses. The USD, on the other hand, struggles to capitalize on its intraday gains amid the global acceptance that the Federal Reserve (Fed) will resume its rate-cutting cycle in September, bolstered by Friday's weaker-than-expected US jobs data. This contributes to keeping a lid on any meaningful upside for the USD/JPY pair and warrants some caution for bullish traders.

Japanese Yen bears seem non-committed amid bets that the BoJ could hike rates by the year-end

- The US Bureau of Labor Statistics (BLS) reported on Friday that the economy added 73K new jobs in July, compared to the market expectation of 110K. Adding to this, the change in total Nonfarm Payroll employment for May was revised down 144K to 19K, and the change for June was revised down from 147K to 14K.

- Other details of the report showed that the Unemployment Rate edged higher to 4.2% from 4.1% in June, as expected, while the Average Hourly Earnings rose to 3.9% from 3.8%. Traders were quick to react and are now pricing in over an 80% probability of a rate cut by the Federal Reserve at the September policy meeting.

- Moreover, the CME Group's FedWatch Tool now implies around 65 basis points of Fed easing by the end of this year. Adding to this, the Fed said that Governor Adriana Kugler is resigning early from her term on August 8, which triggered a steep decline in the US Treasury bond yields and weighed on the US Dollar on Friday.

- The USD/JPY pair tumbled over 350 pips from the vicinity of the 151.00 mark, or the highest level since late March, though it found some support near the 147.00 round figure during the Asian session on Monday. Diminishing odds for an immediate rate hike by the Bank of Japan cap the upside for the Japanese Yen.

- The BoJ revised its inflation forecast at the end of the July meeting last week and reiterated that it will continue to raise the policy rate if the economy and prices move in line with the forecast. BoJ Governor Kazuo Ueda, however, downplayed inflation risks and didn't show any real intention to hike rates anytime soon.

- Ueda further added that the BoJ will look at the data to come out without any preconception and make an appropriate decision at each meeting. Moreover, the ruling Liberal Democratic Party’s loss in July suggests that prospects for BoJ rate hikes could be delayed for a bit longer, which is seen weighing on the JPY.

- Traders now look forward to the release of US Factory Orders for some impetus later during the North American session and ahead of the BoJ Monetary Policy Meeting Minutes on Tuesday. Apart from this, the broader risk sentiment and the USD price dynamics should contribute to producing short-term trading opportunities around the USD/JPY pair.

USD/JPY needs to surpass 148.00 immediate hurdle to back the case for any further appreciation

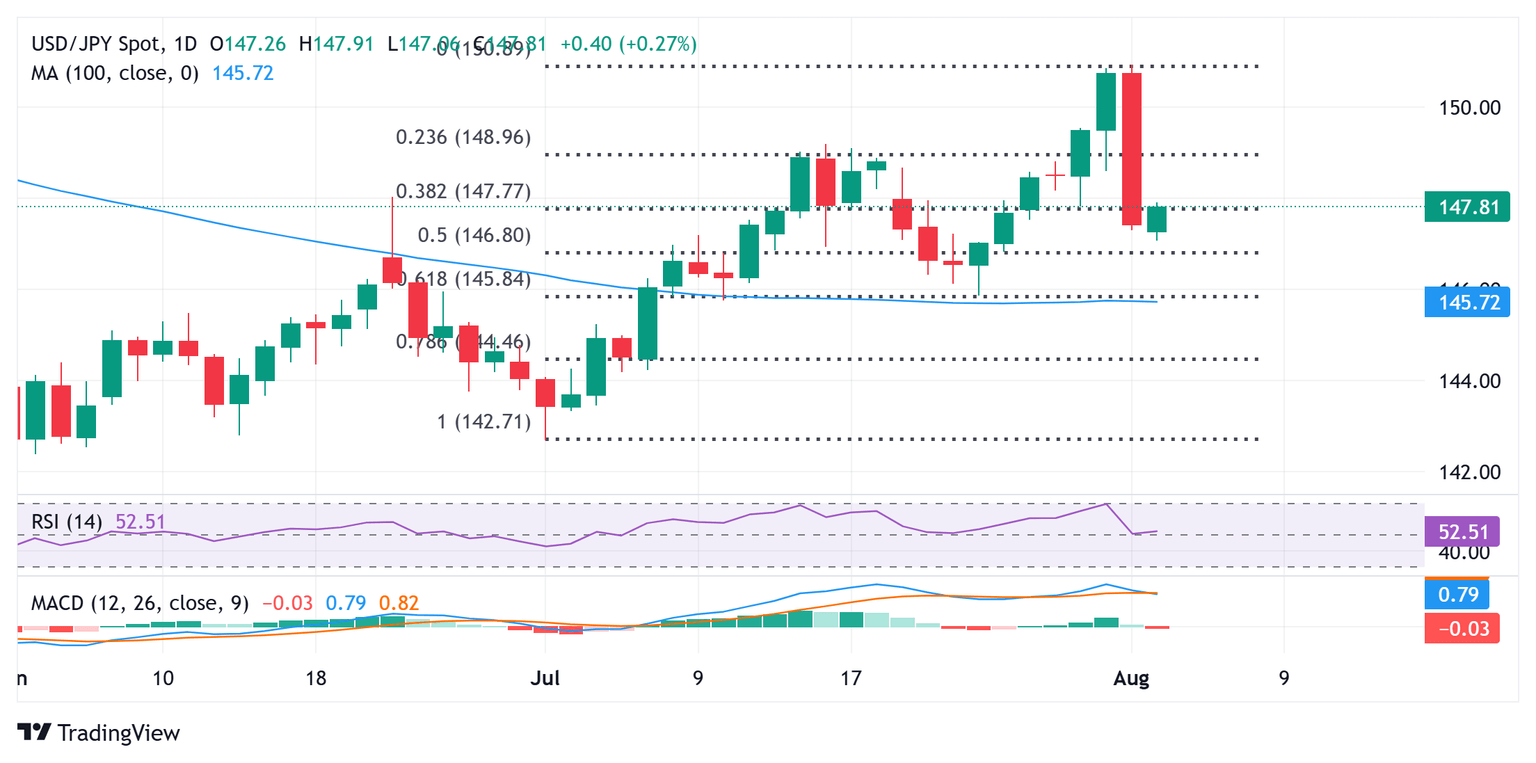

Friday's breakdown and close below the 38.2% Fibonacci retracement level of the rally from the July swing low was seen as a key trigger for the USD/JPY bears. However, oscillators on the daily chart – though they have retreated from higher levels – are still holding in positive territory. This, in turn, assists the currency pair to find some support ahead of the 50% retracement level, which is pegged near the 146.80-146.75 region and should act as a pivotal point. A sustained break below the said support should pave the way for a fall towards the 146.00 mark en route to the 145.85 zone, or the 61.8% Fibo. retracement level.

On the flip side, any subsequent recovery is more likely to confront an immediate hurdle near the 148.00 mark, above which the USD/JPY pair could climb to the 148.60 horizontal barrier. The subsequent move up could lift spot prices to the 149.00 mark, or the 23.6% Fibo. retracement level. A sustained strength beyond the latter will shift the bias back in favor of bullish traders and allow the currency pair to reclaim the 150.00 psychological mark with some intermediate resistance near the 149.50 region, or the very important 200-day Simple Moving Average (SMA).

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.