Japanese Yen gains ground due to hawkish BoJ, focus on Fed Beige Book

- The Japanese Yen edges higher following the Jibun Bank Services PMI on Wednesday.

- Japan’s Yoshimasa Hayashi monitors domestic and international market developments with urgency.

- The US Dollar holds ground as traders adopt caution ahead of US employment data.

The Japanese Yen (JPY) continues to strengthen against the US Dollar (USD) following the release of the Jibun Bank Services PMI data on Wednesday. The index was revised to 53.7 in August from an initial estimate of 54.0. Although this marks the seventh consecutive month of expansion in the service sector, the latest figure remains unchanged from July.

Japan’s Chief Cabinet Secretary Yoshimasa Hayashi stated on Wednesday that he is "closely monitoring domestic and international market developments with a sense of urgency." Hayashi emphasized the importance of conducting fiscal and economic policy management in close coordination with the Bank of Japan (BoJ). He also stressed the need for a calm assessment of market movements but declined to comment on daily stock fluctuations.

The US Dollar receives support as traders adopt caution ahead of US employment data, particularly the August Nonfarm Payrolls (NFP). This data may provide further insights into the potential timing and scale of Federal Reserve (Fed) rate cuts.

Daily Digest Market Movers: Japanese Yen extends gains due to the hawkish mood surrounding BoJ

- The US ISM Manufacturing PMI inched up to 47.2 in August from 46.8 in July, falling short of market expectations of 47.5. This marks the 21st contraction in US factory activity over the past 22 months.

- On Tuesday, Japan announced plans to allocate ¥989 billion to fund energy subsidies in response to rising energy costs and the resulting cost-of-living pressures.

- The US Bureau of Economic Analysis reported on Friday that the headline Personal Consumption Expenditures (PCE) Price Index increased by 2.5% year-over-year in July, matching the previous reading of 2.5% but falling short of the estimated 2.6%. Meanwhile, the core PCE, which excludes volatile food and energy prices, rose by 2.6% year-over-year in July, consistent with the prior figure of 2.6% but slightly below the consensus forecast of 2.7%.

- Tokyo's Consumer Price Index (CPI) increased to 2.6% year-on-year in August, up from 2.2% in July. Core CPI also rose to 1.6% YoY in August, compared to the previous 1.5%. Additionally, Japan’s Unemployment Rate unexpectedly climbed to 2.7% in July, up from both the market estimate and June's 2.5%, marking the highest jobless rate since August 2023.

- Federal Reserve Bank of Atlanta President Raphael Bostic, a prominent hawk on the FOMC, indicated last week that it might be "time to move" on rate cuts due to further cooling inflation and a higher-than-expected unemployment rate. FXStreet’s FedTracker, which gauges the tone of Fed officials’ speeches on a dovish-to-hawkish scale from 0 to 10 using a custom AI model, rated Bostic’s words as neutral with a score of 5.6.

- The US Gross Domestic Product (GDP) grew at an annualized rate of 3.0% in the second quarter, exceeding both the expected and previous growth rate of 2.8%. Additionally, Initial Jobless Claims showed that the number of people filing for unemployment benefits fell to 231,000 for the week ending August 23, down from the previous 233,000 and slightly below the expected 232,000.

- Japan’s Finance Minister Shunichi Suzuki stated last week that foreign exchange rates are influenced by a variety of factors, including monetary policies, interest rate differentials, geopolitical risks, and market sentiment. Suzuki added that it is difficult to predict how these factors will impact FX rates.

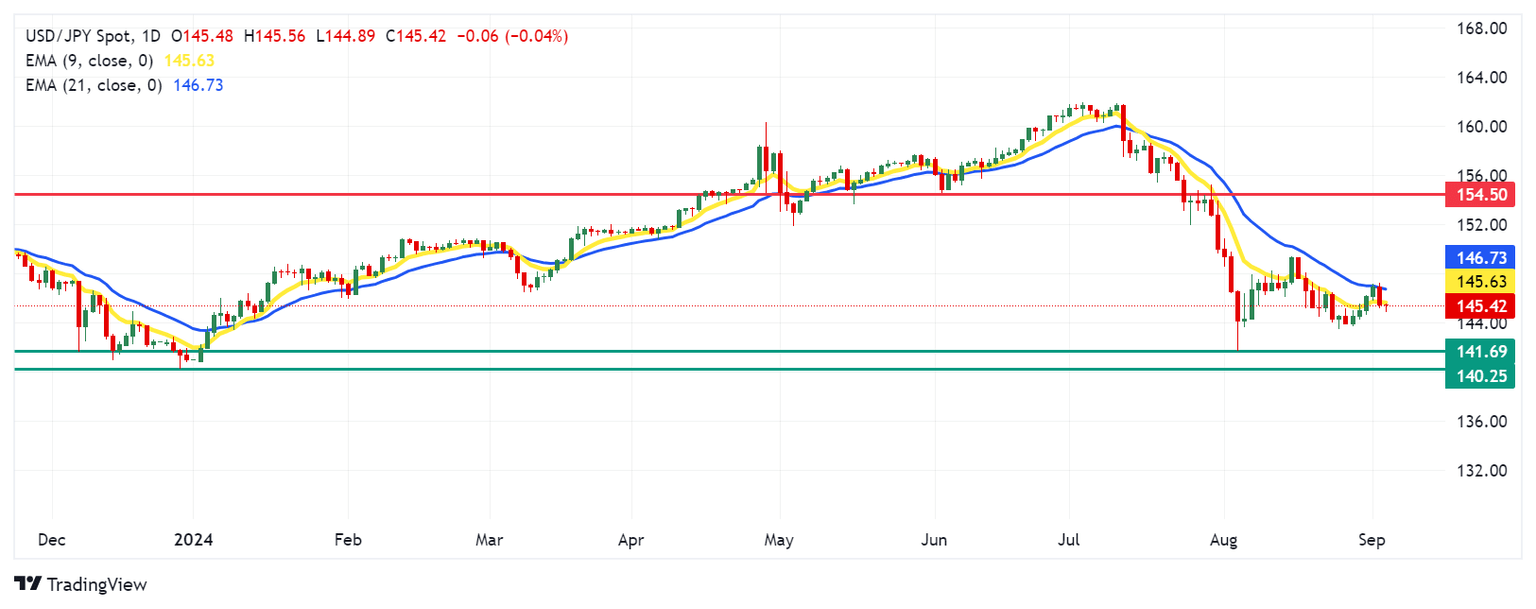

Technical Analysis: USD/JPY reacts off 21-day EMA, further downward pressure expected

USD/JPY trades around 145.40 on Wednesday. An analysis of the daily chart shows that the nine-day Exponential Moving Average (EMA) is below the 21-day EMA, signaling a bearish trend in the market. Additionally, the 14-day Relative Strength Index (RSI) remains below 50, further confirming that the bearish trend is still in place.

For the USD/JPY pair, support may be found around the seven-month low of 141.69, recorded on August 5, with the next key support level near 140.25.

On the upside, the pair might first encounter resistance at the nine-day EMA around 145.63, followed by the 21-day EMA at 146.73. A break above this level could pave the way for a move toward the psychological barrier of 150.00, with further resistance at the 154.50 level, which has transitioned from support to resistance.

USD/JPY: Daily Chart

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.10% | 0.03% | -0.20% | -0.08% | 0.20% | 0.17% | -0.19% | |

| EUR | 0.10% | 0.14% | -0.11% | 0.05% | 0.31% | 0.31% | -0.10% | |

| GBP | -0.03% | -0.14% | -0.25% | -0.09% | 0.17% | 0.19% | -0.24% | |

| JPY | 0.20% | 0.11% | 0.25% | 0.13% | 0.39% | 0.38% | -0.01% | |

| CAD | 0.08% | -0.05% | 0.09% | -0.13% | 0.26% | 0.28% | -0.15% | |

| AUD | -0.20% | -0.31% | -0.17% | -0.39% | -0.26% | 0.00% | -0.39% | |

| NZD | -0.17% | -0.31% | -0.19% | -0.38% | -0.28% | -0.00% | -0.41% | |

| CHF | 0.19% | 0.10% | 0.24% | 0.00% | 0.15% | 0.39% | 0.41% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan has embarked in an ultra-loose monetary policy since 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds.

The Bank’s massive stimulus has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy of holding down rates has led to a widening differential with other currencies, dragging down the value of the Yen.

A weaker Yen and the spike in global energy prices have led to an increase in Japanese inflation, which has exceeded the BoJ’s 2% target. With wage inflation becoming a cause of concern, the BoJ looks to move away from ultra loose policy, while trying to avoid slowing the activity too much.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.