Japan sounds out BoJ deputy Amamiya for central bank governor

The Nikkei reported that Japan's government has approached Bank of Japan Deputy Gov. Masayoshi Amamiya as a possible successor to central bank chief Haruhiko Kuroda while Tokyo prepares for the first change of leadership at the BOJ in a decade.

''Government and ruling coalition officials said the subject had been discussed with Amamiya. The 67-year-old career central banker is the architect of most BOJ policies under Kuroda.''

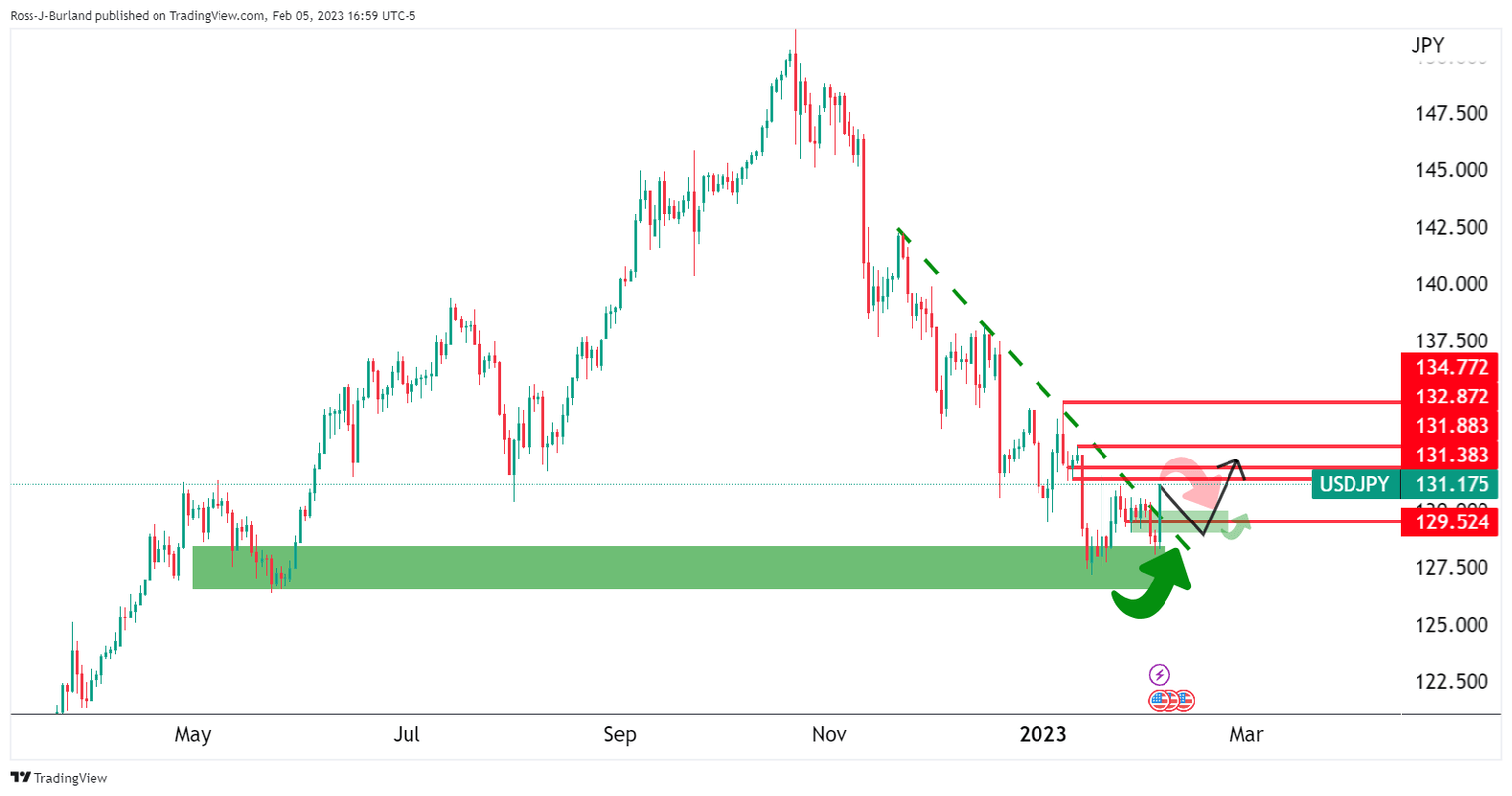

USD/JPY update

USD/JPY has popped and is targeting 13250 in the open with eyes on 132.80 and the 134.70s thereafter following Friday's strong US Nonfarm Payrolls report. The United States added 517,000 jobs in January, well more than the average analyst estimate for a 187,000-job rise. The robust increase showed the US economy continues to surge despite rising interest rates. the key here is that the data arrived at a time when markets were positioning for a Fed pivot.

Development

"BoJ deputy Governor Amamiya did not comment to reporters on report he has been sounded out about becoming BoJ Governor," said Jiji News.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.