Iqiyi (IQ): On the verge of a major bull run or doomed to fail? [Video]

![Iqiyi (IQ): On the verge of a major bull run or doomed to fail? [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Industries/Utilities/pexels-pixabay-257700-637435399652652113_XtraLarge.jpg)

iQIYI Inc (IQ), a Chinese online video platform, offers movies, television dramas, variety shows, and other video contents to over 500 million monthly active users. The platform provides internet video, online games, live broadcasting, online literature, animations, e-commerce, and social media services to its customers. Additionally, it engages in talent agency and IP licensing activities and is developing a video community app. IQ is listed on NASDAQ as ADR.

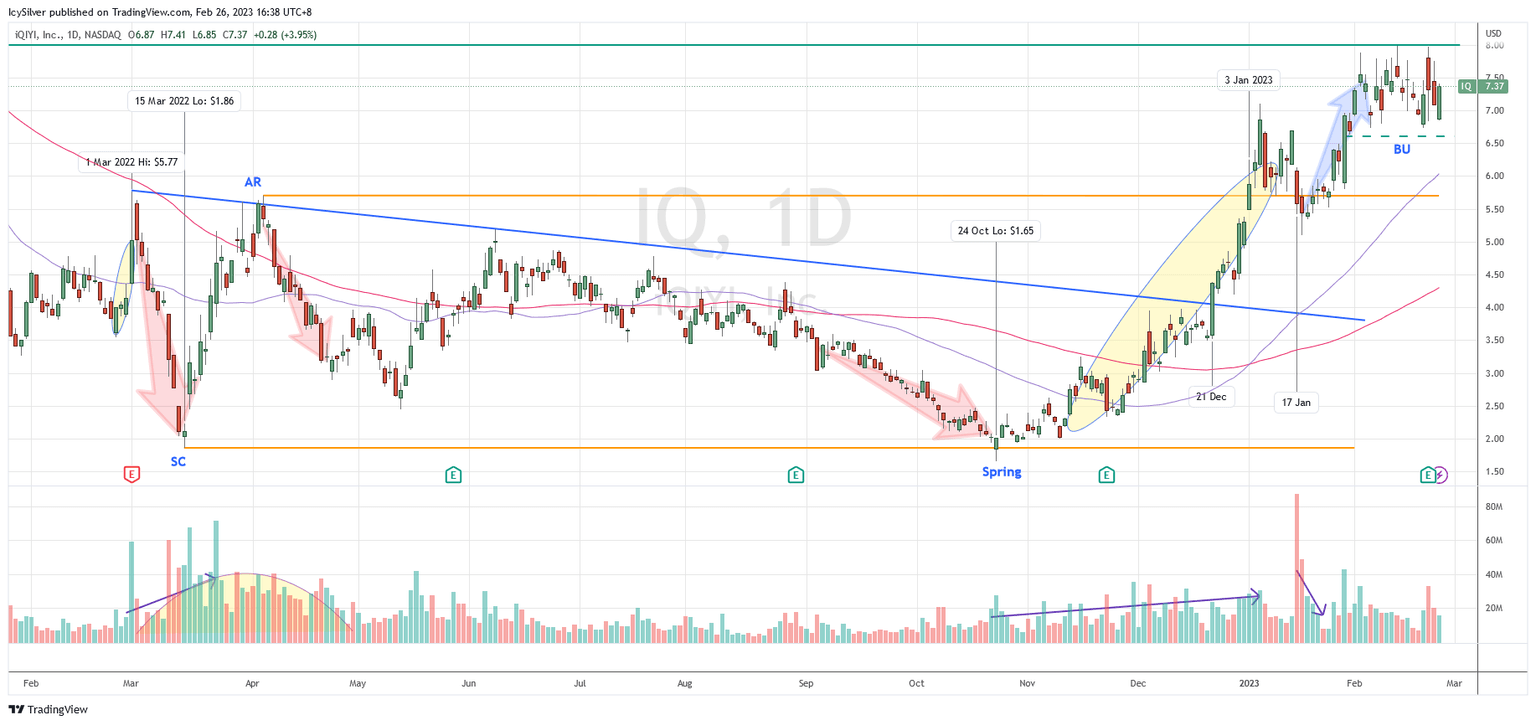

Impulsive wyckoff sign of weakness (SOW) turned accumulation

IQ has been in a down trend since March 2021. The Wyckoff change of character (CHoC) on 24 Mar marked the start of a prolonged down trend for IQ.

Let’s focus on the analysis in 2022. The price rallied to hit $5.77 on 1 March with a spike in volume. The rejection tail suggests the presence of supply and weakness ahead. This was confirmed by the impulsive Wyckoff sign of weakness (SOW) in next bars where the price accelerated down to around $1.86 on 15 Mar. The Wyckoff selling climax (SC) was followed by a rapid automatic rally up to around $5.70. The volume during this period is higher, likely suggesting absorption of the supply, changing the down trend into a trading range. The price then retraced but less impulsive compared to early March. With this, a trading range was defined between $1.86 and $5.70.

In the next several months, the price gradually drifted down to retest the low of the low of the trading range. The volume has been low hinting on exhaustion of supply. On 24 Oct the price did a Wyckoff spring at $1.65 with localized increase in volume. Next, IQ started a Wyckoff sign of strength (SOS) rally around mid November with consistent high demand. This was the best rally so far since March.

The price broke above the downtrend line on 21 Dec with momentum. The subsequent reaction was a continuation of the SOS rally and breaking above $5.70 resistance on 3 Jan 2023. This also signaled the completion of a Wyckoff accumulation phase. The volume spike on 17 Jan was very significant yet the price did not break below $5. In fact, the following day saw the price showing demand tail with decreasing volume. The increasing effort (volume) behind the pull back did not result in an impulsive retracement. These are signs of absorption of supply and presence of demand.

Another SOS rally brought the price to test the $8 resistance. IQ is consolidating in the Wyckoff backup (BU) phase between $6.60 and $8.

Bias

Bullish. According to the Wyckoff method, IQ is consolidating in the BU phase after completing a 10-month accumulation phase. The price is expected to challenge the $8 resistance if the support of 6.5 holds. If the price is able to break above $8, it is likely to challenge $15.50.

If the price breaks below $6.60, it is likely to retest the support zone between $5.40 and $5.70.

IQ was discussed in detail in my weekly live group coaching on 31 Jan 2023 before the market opened. The improving market breadth together with many bullish trade entry setups could suggest a new bull run as discussed in the video below.

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.