How Russell 2000’s rise signals opportunities beyond S&P 500? [Video]

![How Russell 2000’s rise signals opportunities beyond S&P 500? [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Mexbolsa/currency-exchange-rate-board-5927602_XtraLarge.jpg)

Watch the video extracted from the WLGC session before the market open on 30 Jan 2024 below to find out the following:

-

The one key you need to know to compare the relative strength (or outperformance).

-

The real difference in the market structure between the S&P 500 and Russell 2000.

-

The potential implications of a market rotation on the S&P 500.

-

The bullish (and bearish) scenarios for the S&P 500.

-

and a lot more...

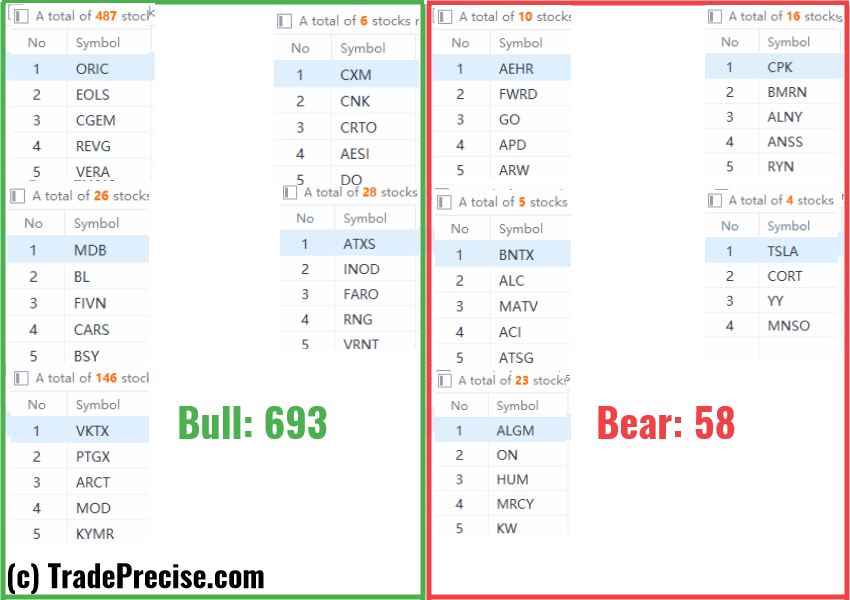

The bullish vs. bearish setup is 693 to 58 from the screenshot of my stock screener below. This is a positive and healthy market environment with plenty of complacency and greed (which we should be aware of).

Although the bullish scenario as discussed in the tweet below is unfolding, it is time to prepare for the potential market rotation as the S&P 500 is overbought and overextended.

If that's supporting and we keep getting higher level for the short term breath, we could see some consolidation and then keep pushing to a higher level to even 5000. #SP500 $ES $SPX pic.twitter.com/s3aXNvuQ3Q

— Ming Jong Tey (@MingJong) January 24, 2024

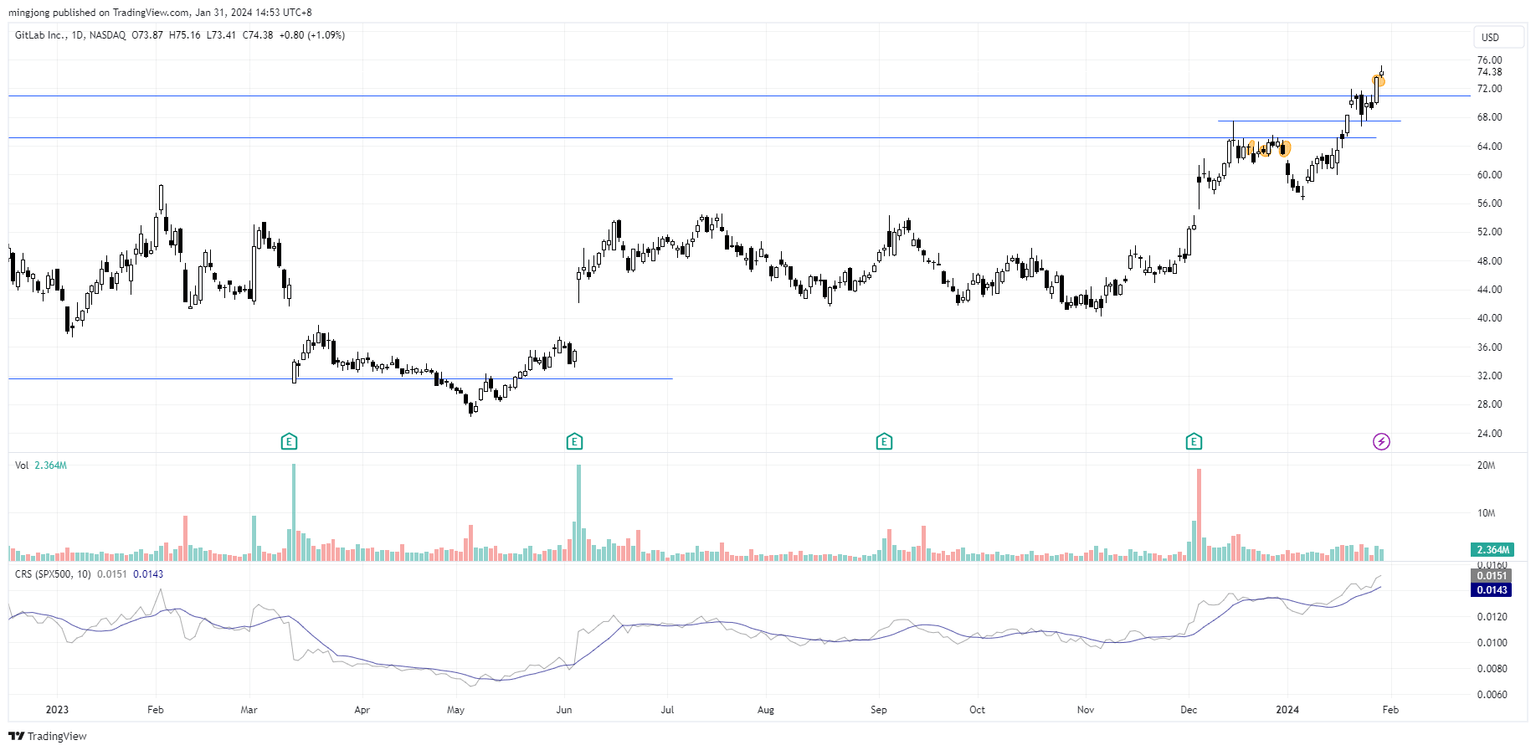

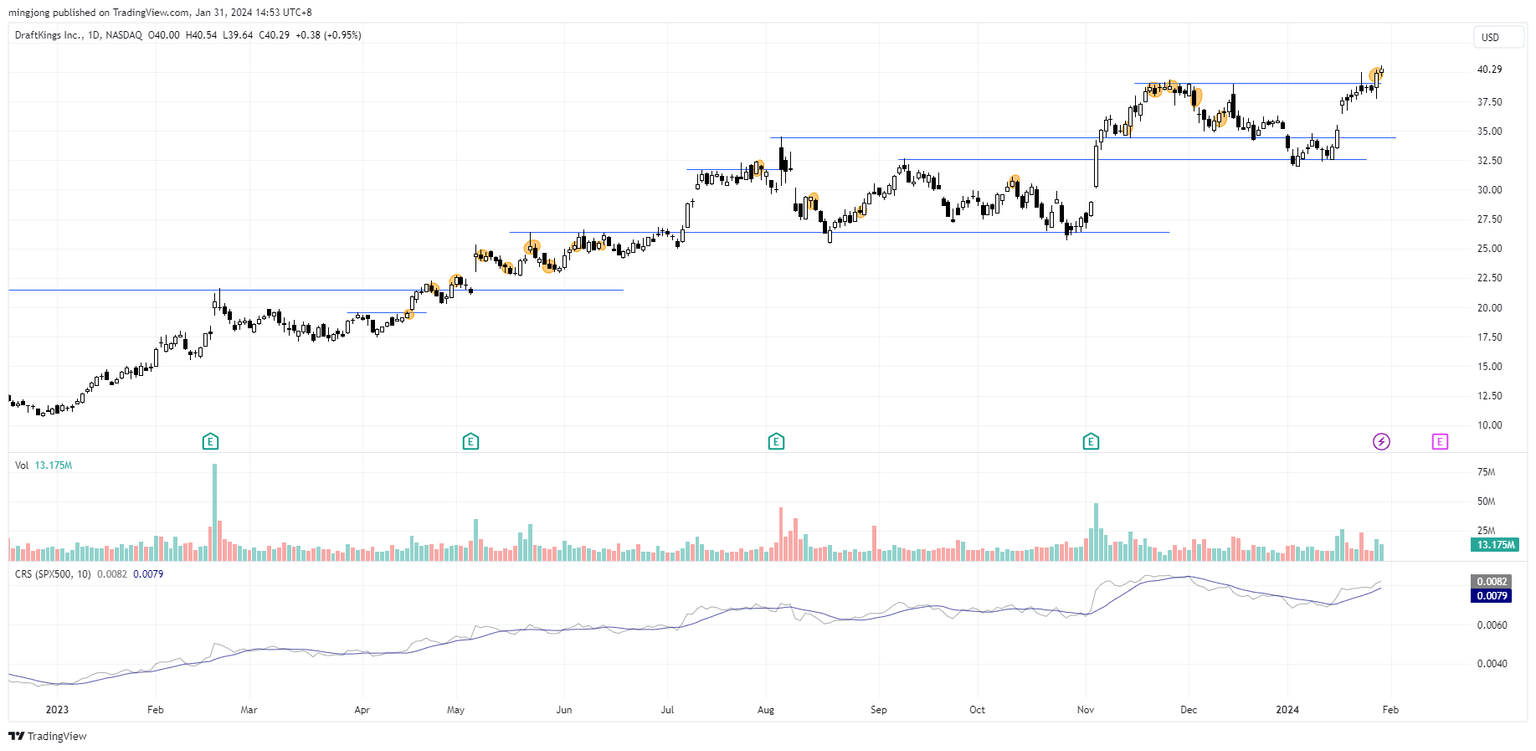

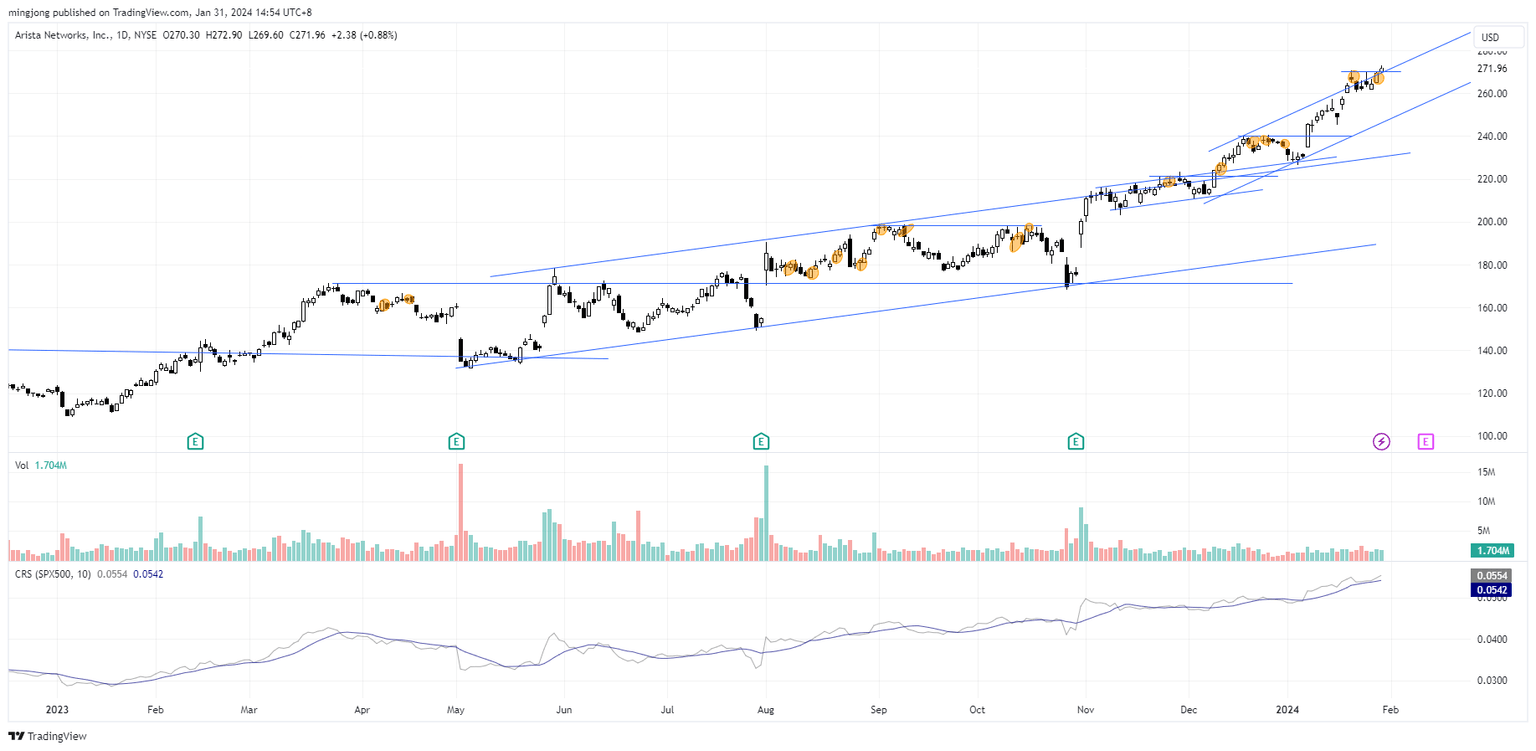

10 “low-hanging fruits” (GTLB, DKNG, etc…) trade entries setup + 15 actionable setups (ANET etc…) plus 14 “wait and hold” candidates are discussed in the video (34:28) below the paywall accessed by subscribing members.

GTLB

DKNG

ANET

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.