GRWG Stock Price: GrowGeneration Corp set to extend falls yet short-sellers may exhaust their hand

- NASDAQ: GRWG investors are bracing for the week to kick off with fresh losses.

- GrowGeneration Corp has hit back at Hindenburg Research for its allegations.

- Short-sellers may exhaust their hand and the pendulum may swing back up.

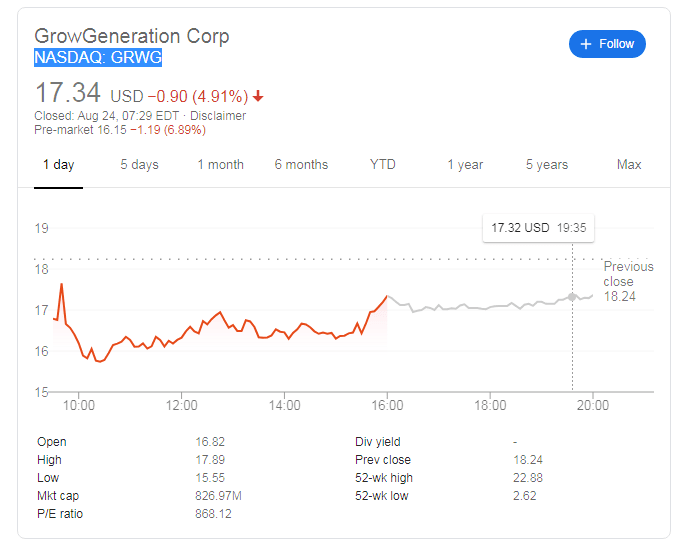

High volatility is set to continue for the company that helps cannabis producers go high – NASDAQ: GRWG is changing hands at around $16.15, down some 9% in Monday's pre-market session. Such an open would extend on Friday's fall of nearly 5%.

GrowGeneration Corp's shares have been hit by short-sellers – and their allegations against the company. Hindenburg Research, which has a significant short position against GRWG, has published a paper suggesting the stock price is rich. The group sees a fall of no less than 70% for the shares.

The sellers allege that that GrowGen's management has "extensive ties to alleged pump & dump schemes, organized crime, and various acts of fraud." The company hit back by saying it is set to take action against Hindenburg for defamation and called the paper "criminal."

The other accusation seems to have more merit – the valuation of the cannabis equipment firm is too high. While GrowGeneration says the global hydroponics system market is estimated to reach approximately $16 billion – growth has not been so fast as anticipated in the sector. Aurora Cannabis, a Canadian marijuana company, continues to extend its losses.

Nevertheless, the Denver-based company has 28 locations across the US and produces a wide range of products from hydroponic and organic gardening tp lighting and nutrients for the burgeoning pot sector.

At some point, NASDAQ: GRWG shares may turn from overvalued to undervalued – triggering buying from bargain-seekers. Are short-sellers already exhausting their hand?

GRWG stock forecast

GrowGen stocks are down over 20% from the 52-week high of $22.88 but are well above the pre-surge levels of around $9 seen in early August. Where is the point of equilibrium?

The closing level on Friday, August 14, of $13.24, could be an inflection point where buyers jump in. However, it may come sooner than that. An initial upside target is $17.67, the level preceding the surge to the all-time highs.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.