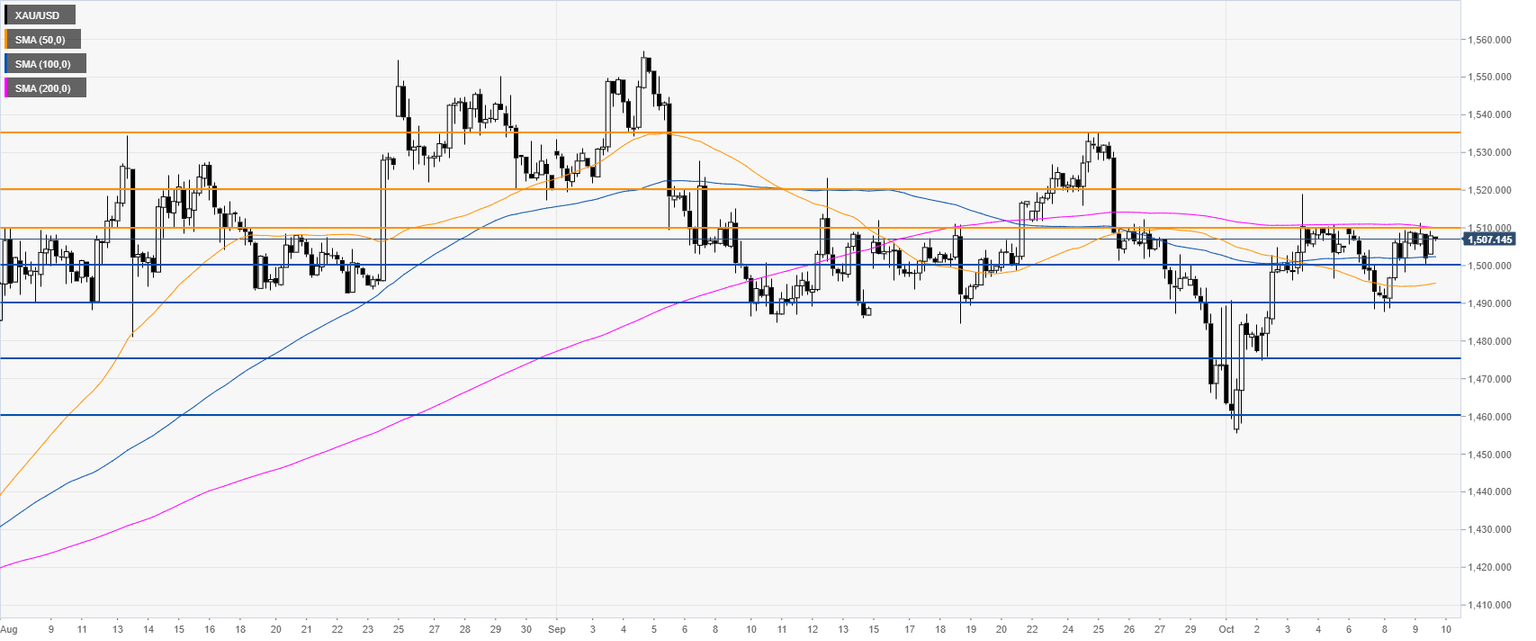

Gold technical analysis: Facing 1,510 brick wall ahead of the FOMC Minutes

- Gold is challenging the October highs near 1,510 resistance.

- The FOMC Minutes are scheduled at 18:00 GMT; the news can lead to some volatility.

Gold four-hour chart

Additional key levels

Author

Flavio Tosti

Independent Analyst