Gold prices come under pressure as US political pressures mount

- Gold prices trade flat as markets balance the Fed's data-dependent stance with rising geopolitical risks.

- The US Dollar temporarily stalls as US President Trump meets with his national security team to discuss the next steps in addressing the Israel-Iran conflict.

- XAU/USD trades in a narrow range as markets await developments on Middle East tensions

Gold (XAU/USD) is trading within a tight range on Thursday, consolidating between $3,360 and $3,400.

These levels have repeatedly served as key short-term support and resistance over recent sessions.

With the United States (US) observing the Juneteenth holiday, lower trading volumes have resulted in subdued price movements, although underlying risks remain pronounced.

Geopolitical tensions persist as significant drivers of Gold prices. Russia has issued a stark warning against potential US military involvement in Iran, describing it as an "extremely dangerous step" with "unpredictable negative consequences."

Meanwhile, Israeli Defense Minister Israel Katz emphasized the need for intensified attacks following recent escalations, underscoring ongoing risks tied to the Israel-Iran conflict.

Katz specifically targeted Iranian Supreme Leader Khamenei, asserting the goal to neutralize nuclear and missile threats.

On the economic front, Gold prices face pressure from renewed US Dollar strength following the Federal Reserve's latest policy update. Although the Fed held interest rates steady at 4.25%–4.50 % on Wednesday, Chair Jerome Powell’s unexpectedly cautious commentary suggested that monetary policy might remain tighter than anticipated.

Long-dated US Treasury yields declined, but short-term yields rose, reflecting lingering concerns about inflation.

Daily digest market movers: Factors to watch for Gold

- Iran’s growing stockpile of enriched uranium has escalated fears about its nuclear ambitions, prompting the US and Israel to reiterate their opposition to a nuclear-armed Iran.

- Russia cautioned that any US military intervention in Iran would be an "extremely dangerous step with truly unpredictable negative consequences," according to Foreign Ministry spokesperson Maria Zakharova.

- Israeli Defense Minister Israel Katz declared that Iran’s Supreme Leader Khamenei "cannot continue to exist," further fueling geopolitical tension.

- President Donald Trump is scheduled to hold a second Situation Room meeting this week to evaluate potential US involvement in the Middle East crisis.

- Reports suggest the meeting will include discussions on Iran's underground Fordow nuclear facility, raising stakes over potential preemptive action.

- Risk to Oil and energy flows through the Strait of Hormuz. With roughly 20% of global energy products passing through this chokepoint, any disruption could lead to a spike in oil prices, increased inflation, and pressure on central banks.

- The Fed kept interest rates unchanged at 4.25%–4.50% on Wednesday.

- While Fed projections signal two cuts by year-end, Chair Jerome Powell struck a cautious tone, emphasizing a data-dependent approach and noting risks related to inflation and tariffs.

- Gold briefly rallied toward $3,400 following the rate decision, but the US Dollar rebounded, capping further gains in the metal.

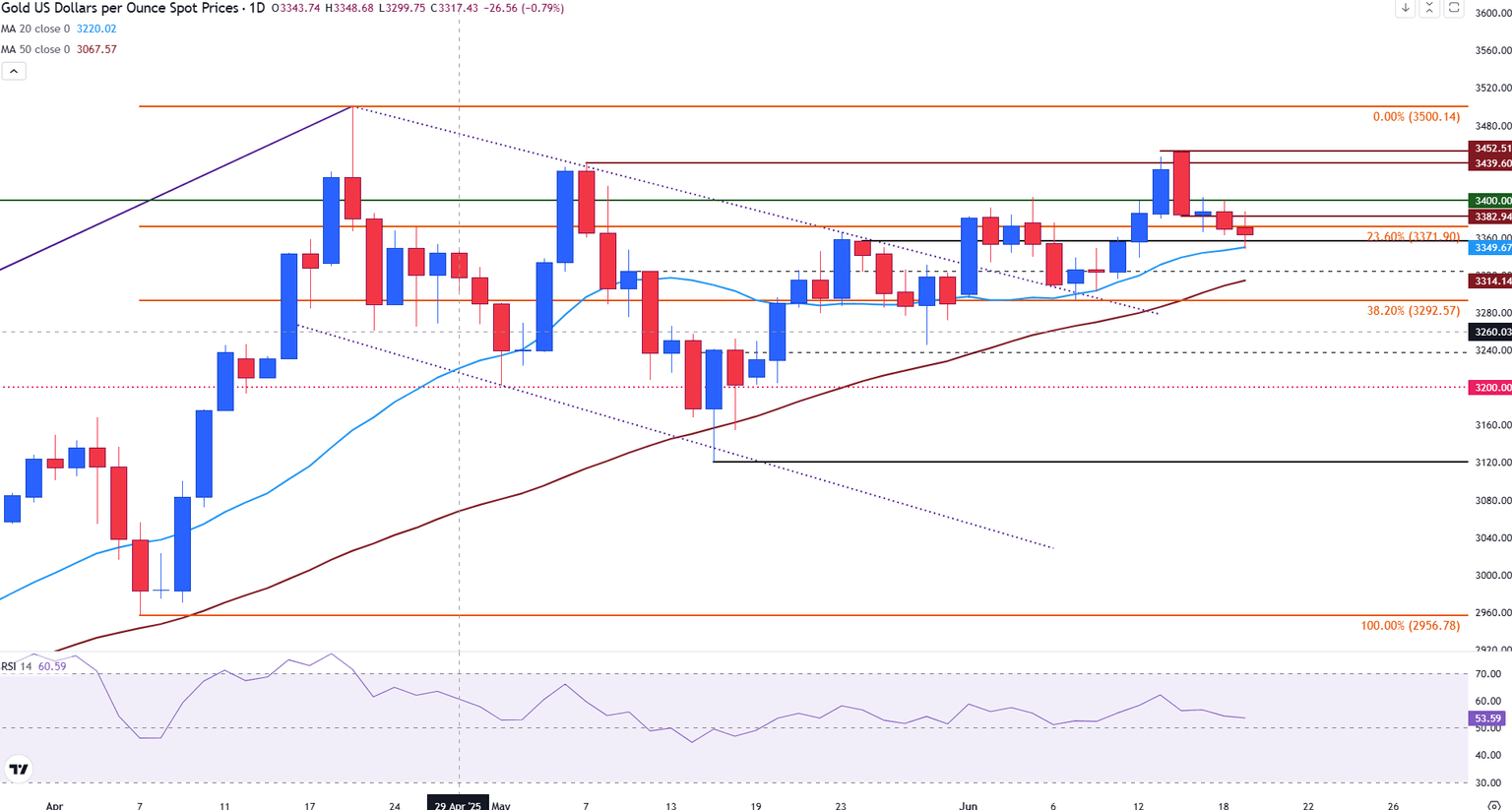

Technical analysis: Gold bulls turn cautious near $3,370

From a technical standpoint, the Fibonacci retracement drawn from the April low near $2,955 to the April high at $3,500 highlights several key levels that traders are closely watching.

At the time of writing, prices are currently trading around $3,365, with immediate resistance located at the 23.6% Fibonacci retracement of the April move, at $3,371. This level lies just above the 20-day Simple Moving Average (SMA) at $3,350, reinforcing the short-term significance of this zone.

For XAU/USD to resume along its upward trajectory, a break above $3,371 could open the door to the next level of psychological resistance at $3,400. Above that is the weekly high of $3,452, which could lead prices to the April record high of $3,500.

On the downside, a break of the 20-day SMA could bring the 50-day SMA into sight at $3,314 and toward another zone of psychological support at $3,300.

At the same time, the momentum of the bull trend is showing signs of easing with the Relative Strength Index (RSI) resting at 54, signalling a more neutral tone compared to the 60 reading seen last week.

Gold daily chart:

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.