Gold pares losses as US Dollar eases; Fed turmoil keeps sentiment cautious

- Gold pares intraday declines, bouncing back to its two-week high around $3,394.

- Political uncertainty deepens as Trump pushes to remove Fed Governor Lisa Cook.

- Light economic calendar in the US turns focus to Thursday’s Initial Jobless Claims and Friday’s core PCE inflation.

Gold (XAU/USD) pares intraday losses on Wednesday after trading defensively for most of the day, pressured by a stronger US Dollar (USD). At the time of writing, the metal trades near $3,395 during the American session, recovering from a dip to $3,373 in Asian hours as the Greenback eases and bullion finds support.

Gold is trading near a fresh two-week high as buyers step back in after earlier selling pressure tied to a stronger US Dollar. The recovery reflects easing Dollar momentum and resilient demand, with sentiment underpinned by political uncertainty surrounding the Federal Reserve’s (Fed) independence and the shifting monetary policy outlook. President Trump’s unprecedented bid to remove Governor Lisa Cook has raised concerns about the erosion of central bank autonomy, amplifying safe-haven demand. At the same time, Fed Chair Jerome Powell’s dovish message at Jackson Hole — signaling that conditions “may warrant” interest rate cuts — reinforces expectations of an easier monetary stance ahead.

Amid growing pressure on the central bank, Trump’s push to remove Fed Governor Lisa Cook appears less about disputed mortgage-fraud allegations and more about reshaping monetary policy to suit his political objectives. On Tuesday, he declared that he expects to soon command a “majority” on the Fed’s Board of Governors, a shift that could tilt the institution toward more aggressive rate cuts. Cook, however, has refused to resign and is preparing to challenge the move in court, setting up a legal battle that could test the limits of presidential power over the Fed.

Market movers: US Dollar eases, yields diverge, Fed independence under spotlight

- The US Dollar Index (DXY), which measures the value of the Greenback against a basket of six major currencies, is drifting lower on Wednesday after edging higher earlier in the day. At the time of writing, the index is hovering near 98.20, easing from an intraday high of 98.73.

- US Treasury yields are showing a mixed picture on Wednesday. The 2-year yield plunged to 3.66%, its lowest since early May, as markets price in higher odds of near-term Fed interest rate cuts. The 10-year yield steadies, hovering around 4.27% after coming under pressure from renewed concerns over the Fed’s independence. Meanwhile, the 30-year yield remains elevated near 4.92%, reflecting lingering inflation worries and broader caution over the long-term policy outlook.

- The Federal Reserve, for its part, has pushed back firmly, stating that Governor Cook’s status remains unchanged unless a court rules otherwise. In a statement, the central bank underscored that governors serve fixed 14-year terms and can only be removed “for cause,” describing tenure protections as a vital safeguard for monetary policy independence. With Cook vowing to sue and the Fed standing its ground, markets now face the prospect of a prolonged legal and political standoff. For Gold, this tug-of-war reinforces its safe-haven appeal, as investors hedge against both institutional uncertainty and the risk of deeper political interference in the monetary policy. According to CNBC, Cook’s lawsuit could be filed as soon as this Wednesday.

- In an interview with CNBC on Wednesday, New York Fed President John Williams described the US as a “slowing economy, not a stalling economy,” noting GDP growth has eased to around 1%-1.5% and hiring momentum has cooled. He stressed that policy remains in a “modestly restrictive” stance, with rates above neutral, and reiterated that if the economy evolves as expected, interest rates will eventually need to move closer to neutral, meaning cuts could be appropriate over time. Williams highlighted that the labor market is still solid, with the unemployment rate at 4.2%, a level he described as low by historical standards, and wage growth consistent with inflation moderating toward the Fed’s 2% target. However, he warned that progress on inflation has been “very slow,” particularly in services, and that tariff effects are difficult to separate. Balancing these risks, Williams said the Fed must remain data-dependent while keeping “a little bit of downward pressure” on the economy to ensure inflation continues to ease.

- On the trade front, US tariffs on Indian imports doubled to 50% on Wednesday after a new 25% levy took effect, targeting a wide range of goods — from textiles and footwear to jewelry and chemicals. The move, aimed at pressuring New Delhi over its continued purchases of discounted Russian Oil, puts nearly half of India’s $87 billion in annual exports to the US at a sharp competitive disadvantage.

- The European Union (EU) is preparing to propose removing tariffs on US industrial goods this week to meet US President Trump’s demands, according to Bloomberg. In return, Washington is expected to lower auto tariffs on EU vehicles from 27.5% to 15%, potentially backdated to August 1. The proposal would also expand access for American seafood and agricultural goods, aiming to ease escalating trade tensions between the two economies.

- On the economic data front, US releases painted a mixed picture on Tuesday. Durable Goods Orders fell 2.8% in July on weaker aircraft bookings, but Durable Goods Orders ex Transportation rose 1.1%, showing underlying resilience. Meanwhile, the Conference Board’s Consumer Confidence Index slipped to 97.4 in August from 98.7, with the expectations gauge dropping below the 80 threshold that often signals recession risks.

- Wednesday’s calendar is relatively light, keeping markets in a consolidative mood. Traders are looking ahead to Thursday’s weekly US Initial Jobless Claims for fresh signals on the labor market, followed by Friday’s US core Personal Consumption Expenditure (PCE) inflation report — the Fed’s preferred gauge — which is expected to be the week’s key event risk.

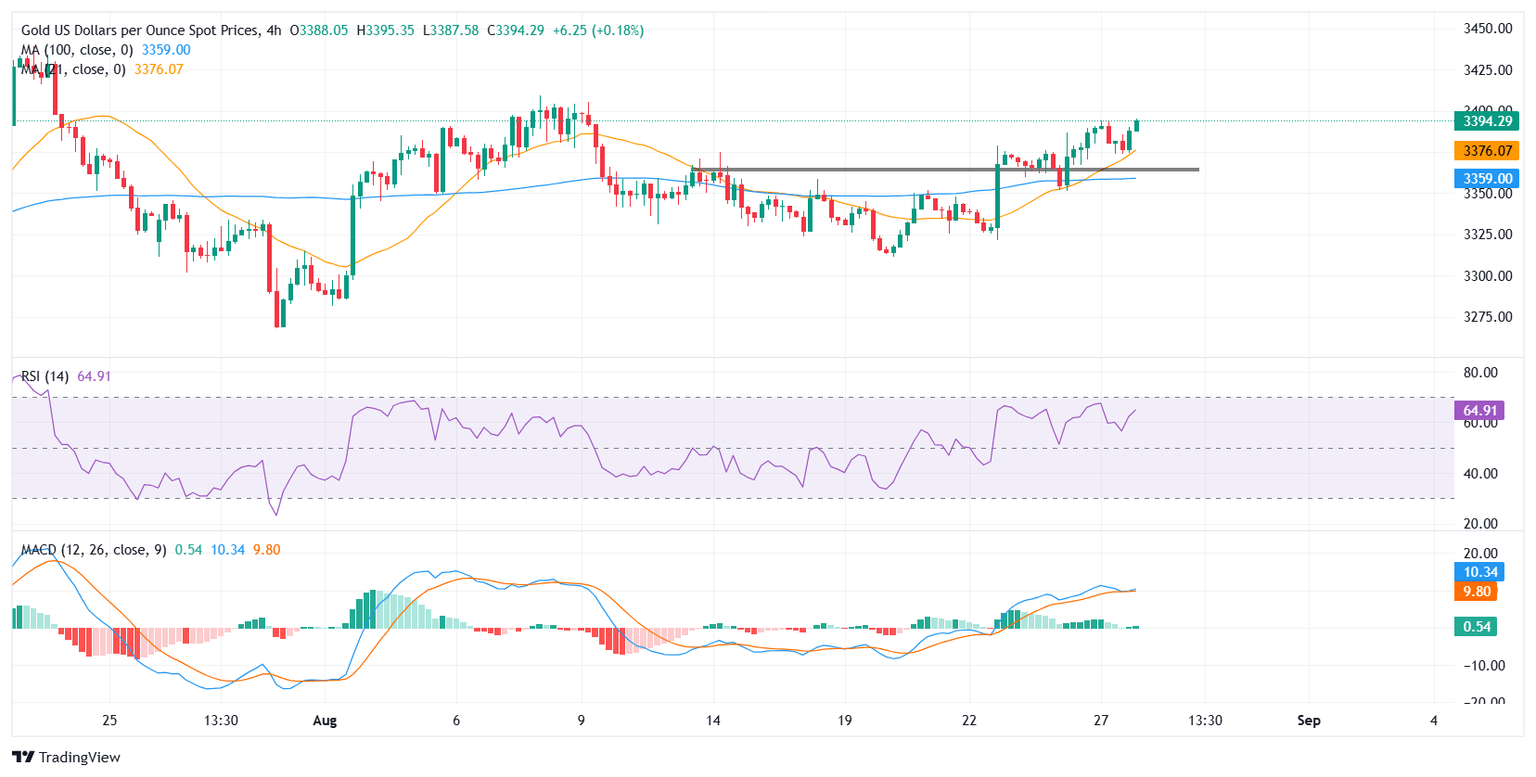

Technical analysis: XAU/USD slips from two-week peak, bullish structure intact

XAU/USD is consolidating near a fresh two-week high around $3,395 after rebounding from intraday lows of $3,373. Buyers remain in control as profit-taking and US Dollar strength earlier in the day failed to spark a deeper pullback.

On the downside, immediate support is aligned between the 21-period Simple Moving Average (SMA) at $3,370 and the 100-period SMA at $3,358, making this confluence zone around $3,370-$3,350 a crucial floor for near-term price action. As long as Gold holds above this area, the broader bullish structure remains intact. However, a decisive break lower would expose the $3,340 level, followed by the next support at $3,320.

Momentum indicators remain constructive but show signs of moderation. The Relative Strength Index (RSI) has eased to 55, slipping from near overbought territory, while the Moving Average Convergence Divergence (MACD) still trades above the signal line but with narrowing histogram bars, signaling fading upside momentum.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.