Gold steadies near record high as markets eye Fed and $3,700 breakout

- Gold attracts some follow-through buyers amid a combination of supportive factors.

- Rising Fed rate cut bets continue to weigh on the USD and benefit the yellow metal.

- Overbought conditions warrant caution for bulls ahead of the key central bank events.

Gold (XAU/USD) sticks to modest intraday gains near the all-time peak touched earlier this Tuesday, though it remains below the $3,700 mark through the first half of the European session. The growing conviction that the US Federal Reserve (Fed) will lower borrowing costs this week drags the US Dollar (USD) to its lowest level since July 7 and continues to benefit the non-yielding yellow metal. Apart from this, geopolitical risks stemming from the intensifying Russia-Ukraine war turn out to be another factor driving flows towards the safe-haven commodity.

The XAU/USD bulls, however, seem reluctant to place fresh bets amid extremely overbought conditions and might opt to move to the sidelines ahead his week's central bank event risks. The focus, meanwhile, will be on the outcome of a two-day FOMC policy meeting on Wednesday and the updated economic projections. Apart from this, Fed Chair Jerome Powell's speech during the post-meeting press conference will be scrutinized for cues about the future rate-cut path, which will play a key role in influencing the USD price dynamics and the precious metal.

Daily Digest Market Movers: Gold bulls retain control amid dovish Fed-inspired USD selling bias

- The XAU/USD bulls pause for a breather during the Asian session on Tuesday following the recent blowout rally to a fresh all-time high and ahead of the key central bank event risks. The downside for the XAU/USD pair, however, remains cushioned amid a supportive fundamental backdrop.

- Traders ramped up their bets for a more aggressive policy easing by the Federal Reserve following the release of a weaker US Nonfarm Payrolls (NFP) report for August. According to the CME Group's FedWatch Tool, the US central bank is expected to lower borrowing costs three times this year.

- The US Senate voted to confirm US President Donald Trump's aide, Stephen Miran, to join the Fed's Board of Governors. The decision came as a US federal appeals court ruling that Trump cannot fire Fed Governor Lisa Cook, and ahead of a two-day FOMC meeting due to begin this Tuesday.

- Meanwhile, the dovish outlook leads to an extension of the recent US Dollar (USD) downfall to its lowest level since July 24 and should continue to act as a tailwind for the non-yielding Gold. Apart from this, the intensifying Russia-Ukraine conflict could limit losses for the safe-haven commodity.

- Russian forces launched a massive attack on Ukraine’s southeastern city of Zaporizhzhia, following a series of strikes by the latter against its oil infrastructure in recent weeks. Moreover, Trump has repeatedly threatened tougher measures against Russia, keeping geopolitical risks in play.

- An emergency summit of Arab and Islamic country leaders has condemned Israel’s attack on Hamas leaders in Doha, Qatar's capital, on September 9. A joint statement from the summit urged member states to coordinate efforts aimed at suspending Israel's membership in the United Nations.

- Tuesday's release of the US monthly Retail Sales figures and Industrial Production data might do little to provide any impetus. Traders this week will also scrutinize monetary policy updates from the Bank of Canada on Wednesday, the Bank of England on Thursday, and the Bank of Japan on Friday.

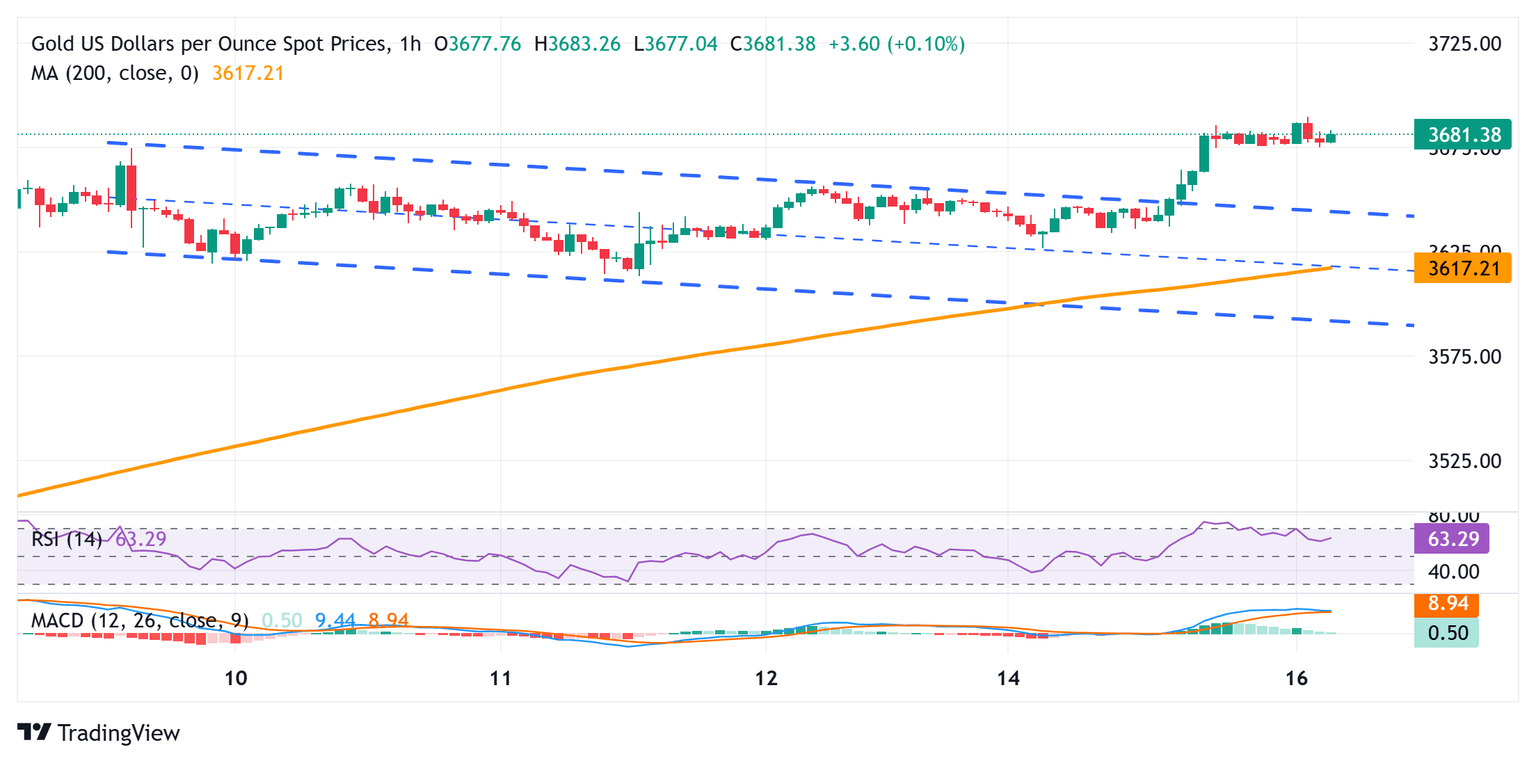

Gold could witness fresh bout of short-covering move above the $3,700 mark

The overnight strong move up marked a fresh breakout through a bullish flag pattern. That said, the daily Relative Strength Index (RSI) is holding well above the 70.0 mark, pointing to extremely overbought conditions and warranting some caution before positioning for any further gains. This suggests that the XAU/USD pair might struggle to build on the momentum beyond the $3,700 round figure, which should now act as a key pivotal point.

Meanwhile, any meaningful corrective slide is likely to attract fresh buyers and find decent support near the flag pattern breakout point, around the $3,645 region. However, some follow-through selling, leading to a subsequent fall below the $3,633 horizontal zone, could drag the Gold price to the $3,610-3,600 area. A convincing break below the latter could pave the way for deeper losses and expose the $3,500 psychological mark, with some intermediate support near the $3,562-3,560 region.

Economic Indicator

FOMC Press Conference

The press conference is about an hour long and has two parts. First, the Chair of the Federal Reserve (Fed) reads out a prepared statement, then the conference is open to questions from the press. The questions often lead to unscripted answers that create heavy market volatility. The Fed holds a press conference after all its eight yearly policy meetings.

Read more.Next release: Wed Sep 17, 2025 18:30

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.