Gold price drops under $3,400 amid Middle East escalation

- Gold price drops after spiking to $3,452 on heightened geopolitical risk in the Middle East.

- Iran signals openness to nuclear talks, cooling safe-haven demand for Bullion.

- Traders await Fed, BoJ, BoE decisions amid busy week of US economic data.

Gold price tumbled below $3,400 during the North American session, down over 1.45% despite tensions in the Middle East remaining high as the Israel-Iran conflict escalates. At the time of writing, XAU/USD trades at $3,383 after reaching an eight-week peak of $3,452.

On Friday, Israel attacked Iran’s military and nuclear facilities and targeted major officials after arguing that Tehran could produce nuclear bombs within days – an argument in opposition to US intelligence. Talks between the United States (US) and Iran have halted due to Israel launching the war.

In breaking news, Gold rallied sharply. Nevertheless, Bullion has retreated as Iran signaled that it's ready to end hostilities and resume talks about its nuclear program – according to the Wall Street Journal (WSJ) – which has improved risk appetite. However, some Iranian officials have denied that report.

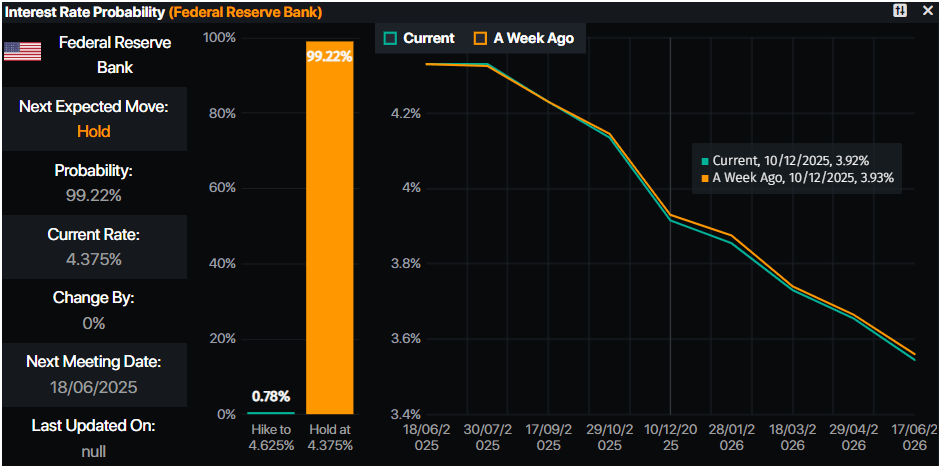

Major central banks are expected to deliver their latest monetary policy decisions. The Federal Reserve (Fed) is projected to hold rates steady. Traders are also eyeing the decisions of the Bank of Japan (BoJ) and the Bank of England (BoE).

Ahead in the week, following the Fed’s decision, the US docket will feature the release of Retail Sales, housing, and business activity data revealed by the Fed's regional banks.

Daily digest market movers: Gold retreats, but rising geopolitical risks loom

- Despite retreating, Gold is expected to edge higher as major central banks, such as the People’s Bank of China (PBoC), are likely to continue their buying spree.

- The latest inflation reports in the US warrant further easing by the Fed. Any dovish hints by the US central bank could boost Gold prospects as the non-yielding metal fares well in lower interest rate environments.

- Geopolitical risks would keep Bullion prices higher. The lack of progress in Russia-Ukraine talks and the Middle East conflict broadening to include Iran would keep the yellow metal underpinned by risk aversion.

- US Treasury yields are recovering, with the US 10-year Treasury yield rising over three and a half basis points (bps) to 4.446%. US real yields followed suit, edging up almost four bps to 2.166%, capping Bullion’s advance.

- The US Dollar Index (DXY), which tracks the value of the Dollar against a basket of peers, is down 0.16% at 97.98, close to hitting a multi-year low of 97.60.

- Money markets suggest that traders are pricing in 46 basis points of easing toward the end of the year, according to Prime Market Terminal data.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold price consolidates near $3,400 ahead of FOMC meeting

Gold price uptrend remains in place even though XAU/USD fell below $3,400. Price action indicates that the precious metal is maintaining its higher high and higher lows market structure, confirming the bullish bias. The Relative Strength Index (RSI) remains bullish, even though buyers are losing some steam, as the RSI continues to aim downward toward its neutral line.

If XAU/USD closes daily below $3,400, anticipate a pullback toward the $3,350 area. A breach of this level would expose the 50-day Simple Moving Average (SMA) at $3,281, followed by the April 3 high-turned-support at $3,167.

On the side, if Gold stays above $3,400, look for a test of $3,450, as it clears the path to challenge the record high of $3,500 in the near term.

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.