Gold advances as US Dollar declines after US court blocks Trump's tariffs

- Gold price recovers its early losses as the US Dollar falls back, with the legal roadblock of Trump’s tariffs raising global economic uncertainty.

- The US court orders the administration to lift reciprocal import duties and tariffs related to fentanyl and immigration controls.

- US businesses are expected to suspend their investment plans until they receive clarity on levies.

Gold price (XAU/USD) claws back the majority of its initial losses and recovers to near $3,320 in Thursday’s North American trading session from the weekly low of $3,245 posted earlier in the day. The yellow metal bounces back as the US Dollar (USD) gives up its early gains in the aftermath of the legal roadblock on United States (US) President Donald Trump’s tariff policy.

The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, surrenders initial gains and declines to near 99.50 at the time of writing. Technically, a lower US Dollar makes the Gold price a value bet for investors.

On Wednesday, New York’s federal court accused US President Trump of violating the constitutional limit of the International Emergency Economic Powers Act (IEEPA) for fulfilling his tariff agenda, the Associated Press (AP) reported. The Manhattan-based court ordered the administration to lift import duties within ten days, to which the White House immediately appealed the decision.

In April, Trump announced reciprocal tariffs for all of his trading partners and additional duties on Canada, Mexico, and China for border negligence and pouring fentanyl into the US economy. He declared a national emergency under the IEEPA to justify levies. This suggests that the imposition of tariffs by Trump on automobiles, steel, aluminum, and semiconductors remains intact.

During North American trading hours, the White House has assured that the US court's decision striking down tariffs will be overturned. "Confident in success of tariff ruling appeal," White House Economic Adviser Kevin Hassett said in an interview with Fox Business Network.

Daily digest market movers: Gold price gains at US Dollar's expense

- The US court blocking Trump’s tariffs came as relief for financial market participants who were cautious over the economic outlook, assuming that new international policies would be stagflationary for the economy. This led to a sharp decline in the demand for US bonds, which spiked 10-year US Treasury yields over 1% to above 4.53%, lifting demand for the US Dollar and US equity futures.

- However, the US Dollar is off from its day’s high as the event has renewed concerns over its credibility. The stop-and-go announcements on levies are expected to force domestic companies to revise their business plans, which were designed considering the import duty policy as the new normal. Businesses had started preparing investment plans to boost domestic manufacturing.

- US President Trump stated numerous times that his campaign to bring manufacturing back to the nation will be beneficial for the labor market. Last week, he also threatened to impose 25% tariffs on smartphone makers for not producing them in the US.

- "My big worry is that companies start to put off things like hiring or capital expense or giving people raises for these factories or manufacturing," according to analysts at Invesco. They added that the event could certainly put a “damper on company earnings” and “consumption could also be impacted”.

- On the economic front, investors await the US Personal Consumption Expenditure Price Index (PCE) data for April, which will be released on Friday. The US core PCE inflation data, which is the Federal Reserve’s (Fed) preferred inflation gauge, is expected to have grown at a moderate pace of 2.5% on year, compared to the prior release of 2.6%. The impact of the inflation data is expected to be limited on the Fed’s monetary policy outlook as the US court striking down Trump’s tariffs has heightened uncertainty over economic prospects.

- Meanwhile, revised US Q1 Gross Domestic Product (GDP) data has shown that the economy declined at a slightly slower pace of 0.2%, compared to preliminary expectations of 0.2%.

Technical Analysis: Gold price gains above $3,300

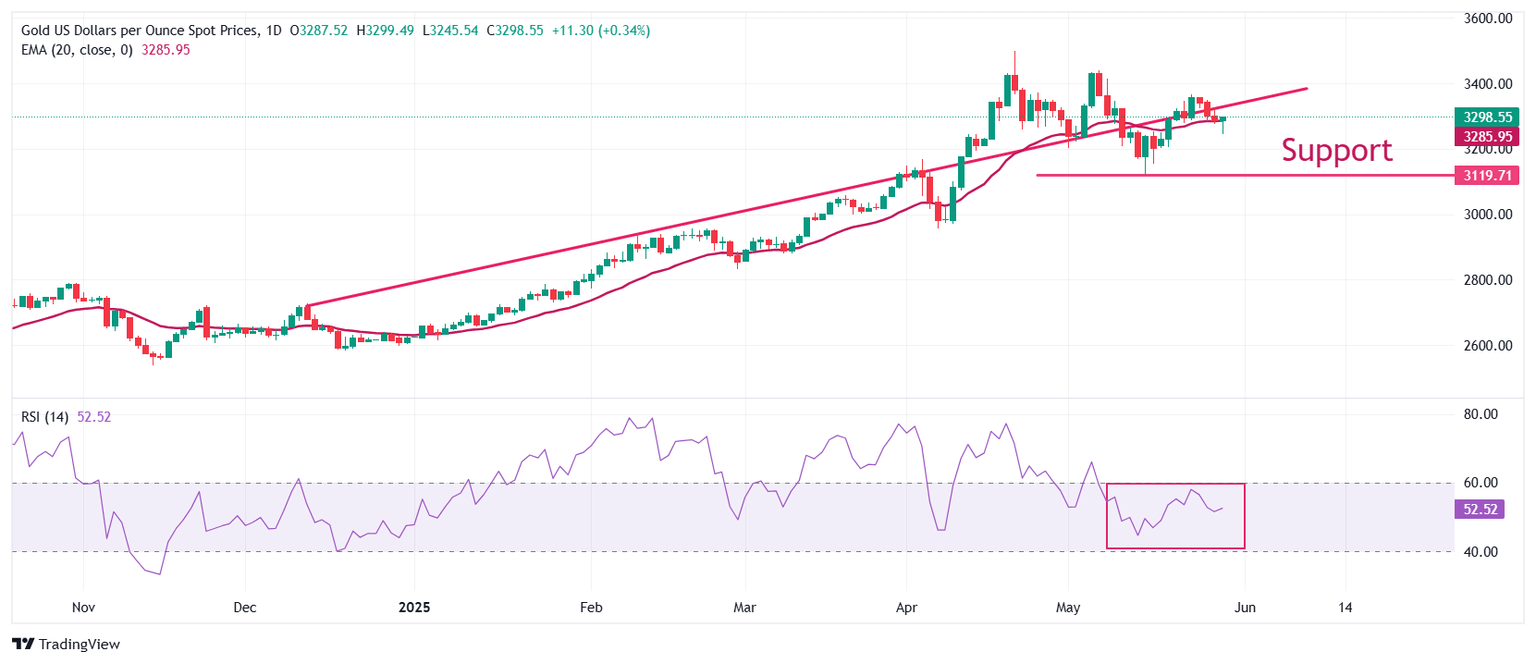

Gold price recoups early losses but continues to struggle around the upward-sloping trendline on a daily timeframe around $3,335, which is plotted from the December 12 high of $2,726. The near-term trend of the precious metal is remains bullish as it manages around the 20-day Exponential Moving Average (EMA), which trades near $3,286.

The 14-day Relative Strength Index (RSI) oscillates inside the 40.00-60.00 range, suggesting indecisiveness among market participants.

Looking up, the May 7 high around $3,440 will act as key resistance for the metal. On the downside, the May 15 low at $3,120.83 will be the key support zone.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.