Gold Price News and Forecast: XAU/USD surrenders modest intraday gains, back around $1805 level

Gold Futures: Potential for extra gains

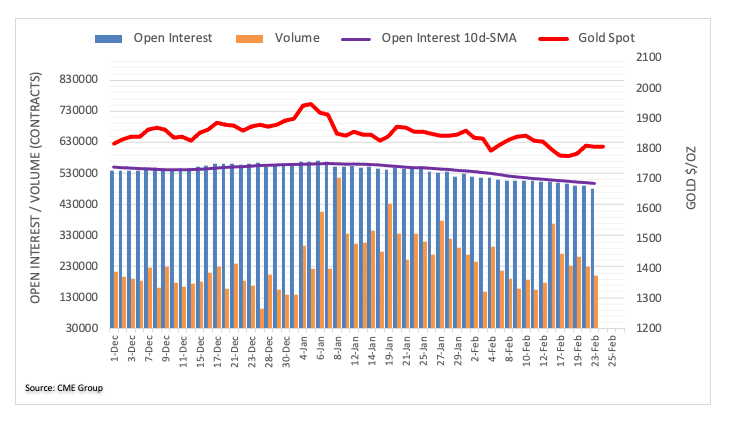

Open interest in gold futures markets extended the downtrend for yet another session on Tuesday, this time by nearly 9K contracts according to preliminary data from CME Group. In the same line, volume retreated for the second session in a row, now by more than 31K contracts.

Tuesday’s negative performance in gold prices was on the back of shrinking open interest and volume, leaving further decline not favoured in the very near-term. On the upside, the next hurdle emerges at the $1,850 mark per ounce. Read more...

Gold Price Analysis: XAU/USD surrenders modest intraday gains, back around $1805 level

Gold struggled to preserve its intraday gains and retreated to the lower end of its daily trading range, around the $1805 region during the early European session.

The precious metal gained some traction during the first half of the trading action on Wednesday and built on the overnight bounce from the sub-$1800 level. The treasury yields witnessed a modest pullback after Fed Chair Jerome Powell on Tuesday reiterated a very dovish policy stance, saying that interest rates will remain low and the Fed will keep buying bonds to support the US economic recovery. Read more...

Gold Price Analysis: Bullish sentiment caps gains for XAU/USD

A goodish USD rebound and an uptick in the US bond yields prompted some selling around gold on Tuesday. The yellow metal was last seen trading around the $1810 region as bulls are trying to seize control but optimism is capping gains for XAU/USD, FXStreet’s Haresh Menghani briefs.

“The key focus will remain on Powell's second day of testimony to the Senate Banking Committee. This will play a key role in influencing the USD and produce some meaningful trading opportunities around the XAU/USD.” Read more...

Author

FXStreet Team

FXStreet