Gold Price News and Forecast: XAU/USD stays below $1,680 as trade sentiment recovers

Gold stays below $1,680 as trade sentiment recovers

With the global policymakers showing action plans to tame coronavirus (COVID-19), Gold buyers trim profits from the multi-year high to $1,671 as most markets in Asia open for trading on Tuesday. The yellow metal recently took clues from the US Coronavirus Task Force briefings that suggested the US policymakers’ readiness to take measures as well as the availability of sources.

US President Donald Trump said ‘major’ economic measures will be taken in response to the virus while Vice President Mike Pence took a U-turn from Friday’s comments signaling a lack of enough testing kits in the labs. Further, the US Treasury Secretary Steve Mnuchin mentioned his regular conversations with the Fed Chair Jerome Powell while readiness to work with small businesses that need liquidity.

Gold Asia Price Forecast: XAU/USD parked below $1700/oz at multi-year highs

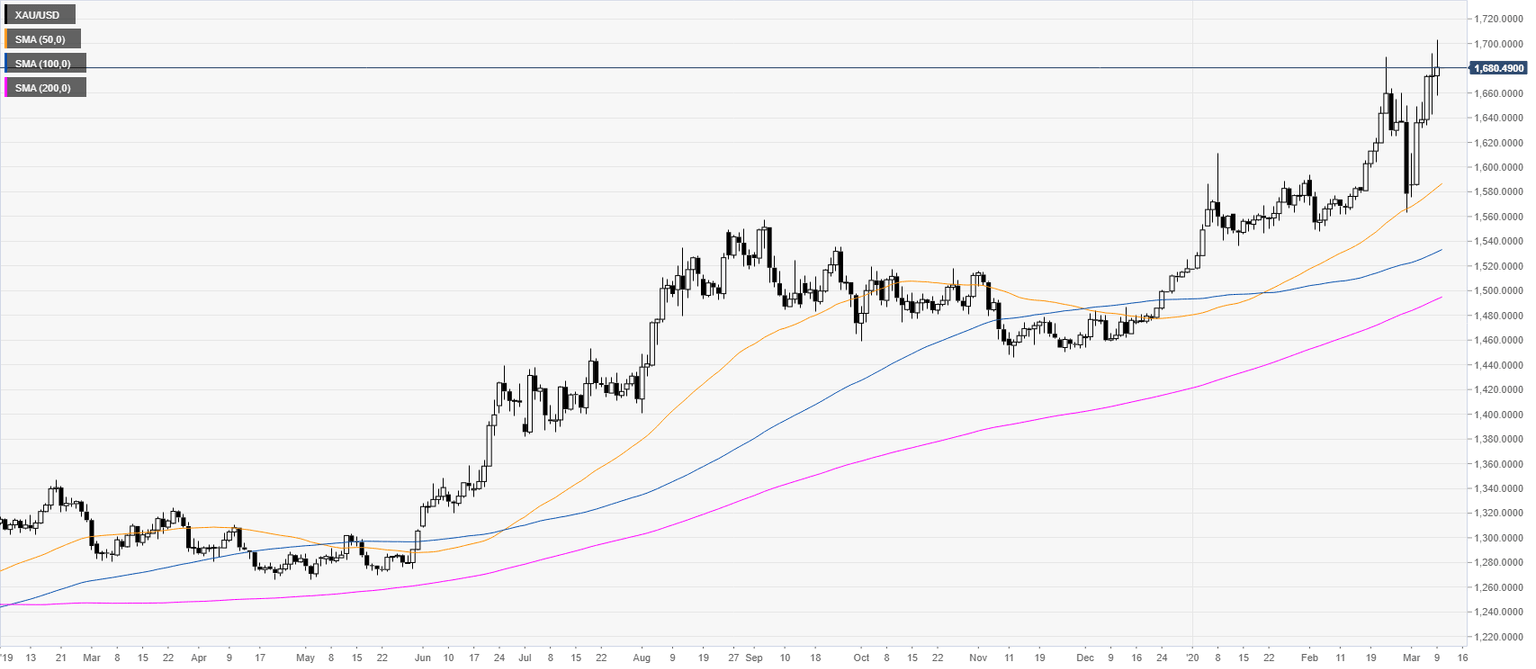

XAU/USD is trading close to multi-year highs while above its main daily simple moving averages (SMAs). The yellow metal hit a new 2020 high amid increasing Coronavirus fears. Prime Minister Conte stated that all Italy is now 'protected zone'.

After reaching the 1700.00 mark, XAU/USD is consolidating gains while trading above its main SMAs. Buyers stay in control although the metal arguably formed a double top/higher high with the February highs which bulls have now to overcome. Support should be expected in the 1674.72/1663.00 price zone, according to the Technical Confluences Indicator.

FXStreet Indonesian Site - new domain!

Access it at www.fxstreet-id.com

Author

FXStreet Team

FXStreet