Gold Price News and Forecast: XAU/USD remains trapped between key averages, awaits US data

Gold Futures: Further rangebound in the pipeline

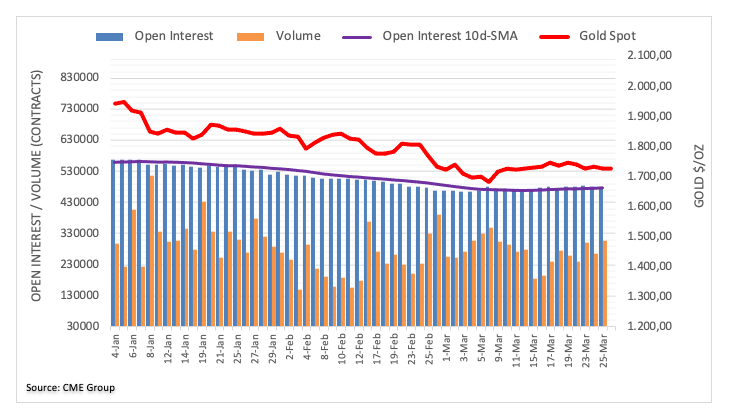

Traders scaled back their open interest positions in Gold futures markets for the second session in a row on Thursday, this time by more than 3K contracts according to advanced figures from CME Group. Volume, instead, reversed the previous drop and rose by nearly 41.5K contracts.

Thursday’s negative price action in Gold prices was on the back of shrinking open interest, leaving the prospects of further downside somewhat diminished and allowing for the continuation of the consolidative mood in the very near-term. On the upside, the $1,760 mark per ounce troy keeps limiting occasional bullish attempts for the time being. Read more...

Gold Price Analysis: XAU/USD remains trapped between key averages, awaits US data

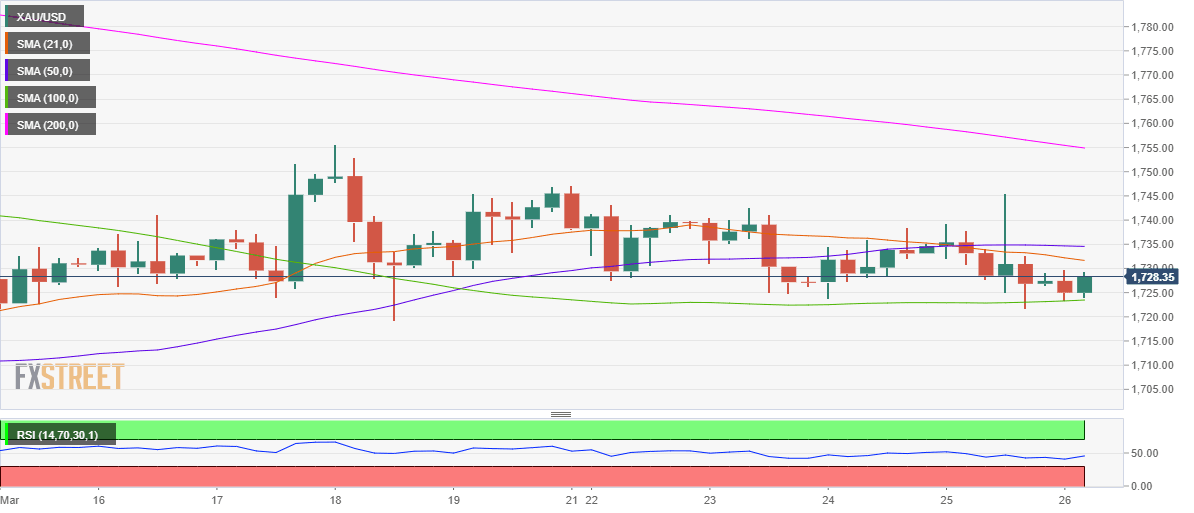

Gold (XAU/USD) is looking to regain $1730, as the US dollar bulls take a breather after the recent advance to multi-month peaks.

The greenback remains buoyed by the US economic optimism and higher Treasury yields. Stronger US Jobless Claims further fuelled expectations of a faster economic recovery. Meanwhile, speeding vaccines rollout in America also backs the recent gains in the buck.

Gold markets now await a fresh batch of US economic releases, including the Fed’s preferred inflation gauge –" the Core PCE Index, for fresh trading impetus. Read more...

Gold Price Analysis: XAU/USD struggles near weekly lows, bears await a break below $1720

Gold witnessed some selling during the mid-European session and was last seen hovering near the lower boundary of its weekly trading range, just above the $1720 region.

The precious metal has been struggling to gain any meaningful traction and has been oscillating in a narrow trading band since the beginning of this year. Investors remain worried that the third wave of COVID-19 infections and pandemic-related restrictions could derail the global economic recovery. This, in turn, was seen as a key factor that extended some support to the safe-haven XAU/USD. Read more...

Author

FXStreet Team

FXStreet