Gold Price Analysis: XAU/USD remains trapped between key averages, awaits US data

- Gold attempts a bounce, as the US dollar pulls back from multi-month tops.

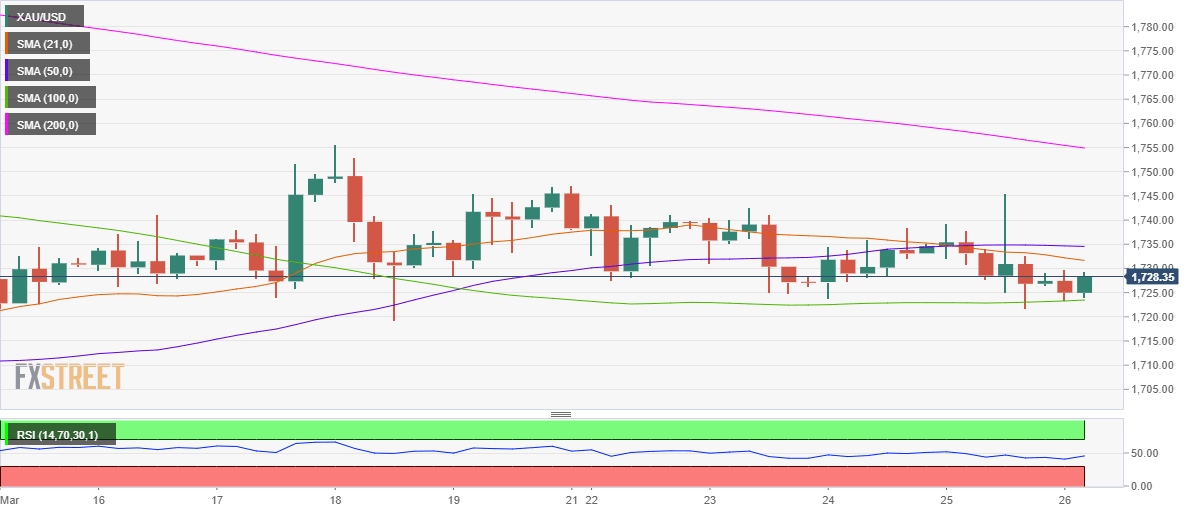

- XAU/USD wavers between 21 and 100-SMAs on the 4H chart.

- All eyes on the US data for a range breakout in gold.

Gold (XAU/USD) is looking to regain $1730, as the US dollar bulls take a breather after the recent advance to multi-month peaks.

The greenback remains buoyed by the US economic optimism and higher Treasury yields. Stronger US Jobless Claims further fuelled expectations of a faster economic recovery. Meanwhile, speeding vaccines rollout in America also backs the recent gains in the buck.

Gold markets now await a fresh batch of US economic releases, including the Fed’s preferred inflation gauge – the Core PCE Index, for fresh trading impetus.

From a short-term technical perspective, gold has entered a downside consolidative mode after Thursday’s reversal from $1746 levels.

Gold Price Chart: Four-hour

Gold remains locked in a tight range on the four-hour chart, looking for a fresh direction likely on the US data release.

The bearish 21-simple moving average (SMA) at $1732 caps the rebound from weekly lows of $1721.80.

Meanwhile, the downside appears cushioned by the horizontal 100-SMA at $1723.

The Relative Strength Index (RSI) has ticked higher to 45.59, still remains below the midline, suggesting that the bearish bias still remains intact for gold.

The previous month low of $1717 could offer some strong support, below which the $1700 mark could be put at risk.

Alternatively, a sustained move above the 21-SMA barrier could expose the 50-SMA hurdle at $1735. The XAU bulls would then gear up for a rally towards the descending 200-SMA resistance at $1755.

Gold: Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.