Gold Price News and Forecast: XAU/USD may wake up and resume its rise

Gold Price Analysis: Levels to watch as coronavirus panic grips markets

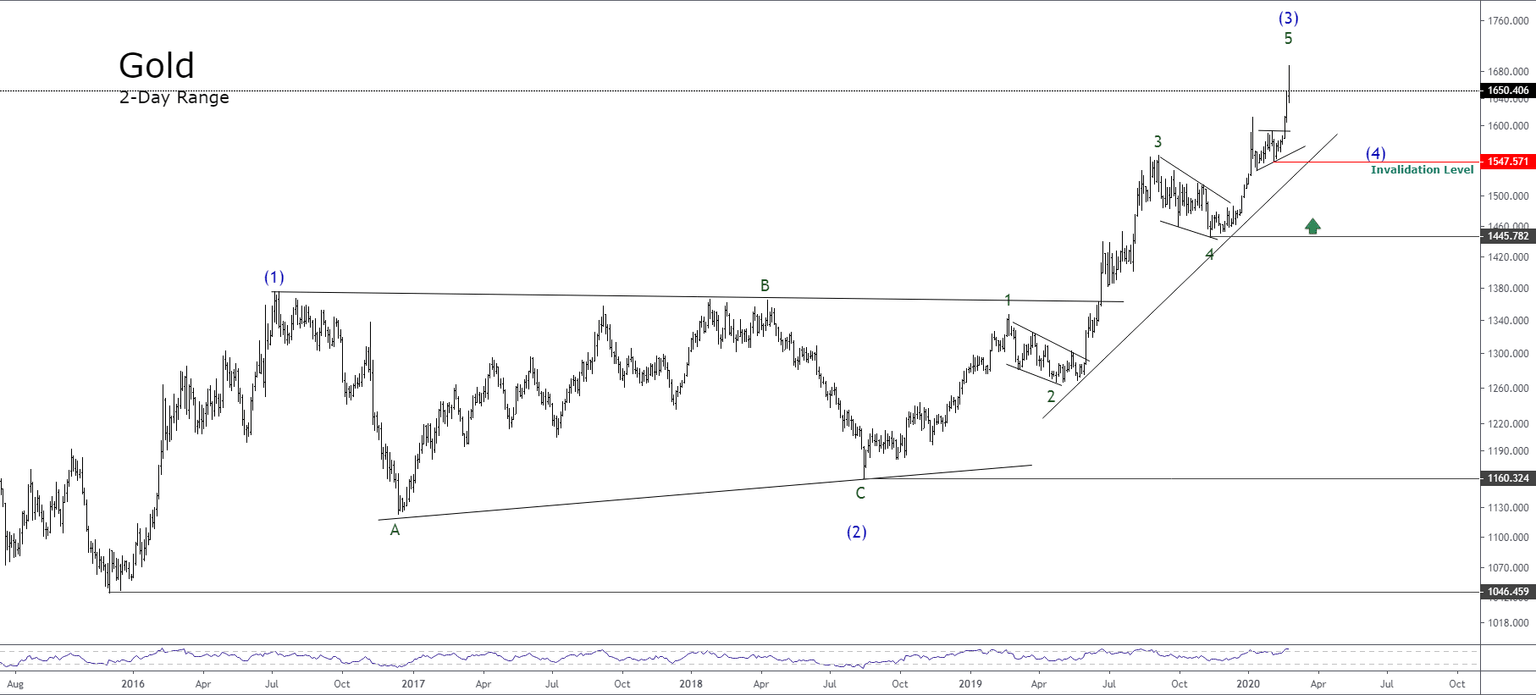

Gold has been trading around $1,650, stabilizing after several turbulent days that have sent the price of the precious metal to nearly $1.690 before a substantial correction.

Gold: Consolidation with the Eyes on New Highs

The Gold price backtracked on Tuesday after a volatile session driven by coronavirus worries and its impact on the global economy, which encouraged Gold's visit of the 2013's highs, at $1,683.38 per ounce.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637182446768567774-637182546193685257.png&w=1536&q=95)