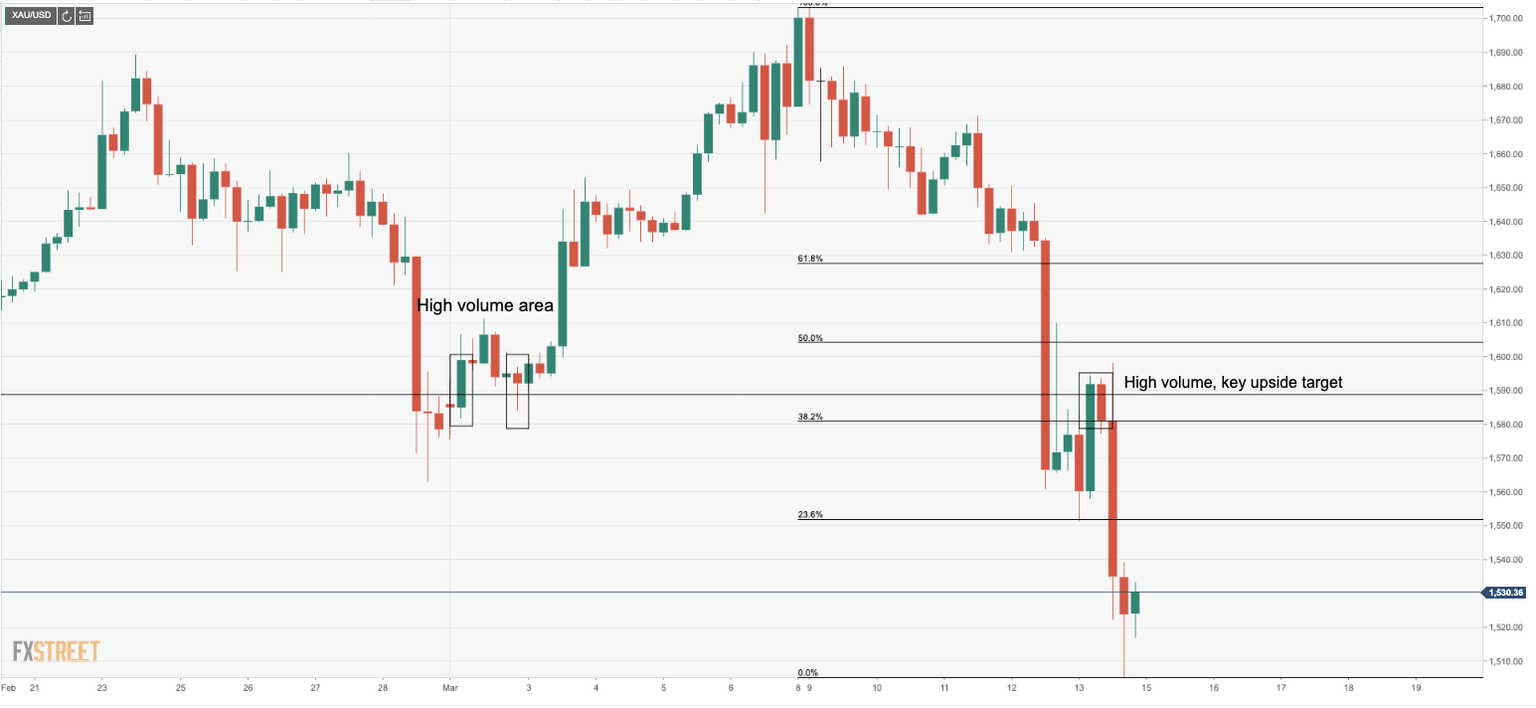

Gold Price News and Forecast: XAU/USD holds weekly support, eyes a 38.2% Fibo retracement

Gold Price Analysis: Looks to stabilize around $1550 after Fed-led wild ride

Having witnessed a volatile early Asian session, gold (futures on Comex) is stabilizing near the mid-1550s, as investors await fresh catalysts for the next direction in the prices.

The yellow-metal opened with a $45 bullish opening gap this Monday, as traders sold-off the greenback across its main competitors, responding to the surprise rate cut delivered by the US Federal Reserve (Fed) late Sunday.

The dollar sank in tandem with the US Treasury yields, as the demand for the US bonds rose, with markets unwilling to buy into the Fed rate cut decision that is said to cushion the blow of the coronavirus impact on the economy.

Chart of the week: Gold holds weekly support, eyes a 38.2% Fibo retracement

The return of risk appetite was adverse to gold prices, suffering a flight to cash to pay-up for margin calls mid-week. On Friday, the nail in the coffin came from US President Donald Trump declaring a national emergency and allowing more than $40 billion of FEMA funds to deal with the COVID crisis.

The move sent stocks much higher and US treasuries lower, pressuring yields and the US higher, subsequently taking down gold prices to a weekly support line. Gold reverted to the levels seen during the last bout of liquidity selling in late February, around $1,560/oz and then dropped all the way to a low of $1,504.34/oz (just above the 200-DMA, $1,497) as investors sold winners to generate liquidity and cover losses.

Author

FXStreet Team

FXStreet