Gold Price News and Forecast: XAU/USD further downside remains on the cards

Gold Price Analysis: XAU/USD challenges 50-HMA on the road to recovery towards $1700

Gold (XAU/USD) looks to extend its recovery from nine-month lows of $1677, heading into the European session this Tuesday, having found solid bids around the $1685 region.

At the time of writing, gold is wavering within a potential two-week-old falling wedge formation, challenging the bearish 50-hourly moving average (HMA) at $1694. Read more...

Gold Futures: Further downside remains on the cards

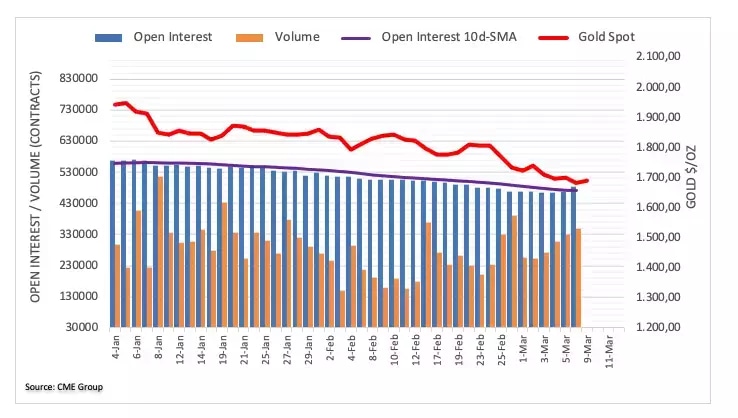

Traders increased their open interest positions for the third session in a row on Monday, this time by around 15.2K contracts according to preliminary readings from CME Group. Volume, in the same line, went up by around 20.3K contracts, reaching the fourth consecutive daily build.

Gold prices seem to have met some decent contention in the $1,680 region so far. Monday’s pullback was on the back of rising open interest and volume, allowing for the continuation of the downtrend in the very near-term. Oversold conditions, however, might prompt some bouts of strength. Read more...

Gold Price Analysis: XAU/USD clings to strong recovery gains above $1700 mark

Gold held on to the strong recovery gains and was placed near the top boundary of its daily trading range, just below the $1710 level during the mid-European session.

The US bond yields retreated further from over one-year tops touched last week amid expectations that the Fed will take some action to curb the rapid rise in long-term borrowing cost. This prompted traders to lighten their bullish US dollar bets, which, in turn, triggered a short-covering bounce around the dollar-denominated commodity. Read more...

Author

FXStreet Team

FXStreet