Gold Price News and Forecast: XAU/USD bulls looking to the dollar to give back some ground

Gold sell-off pauses as US dollar retreats from two-month high

Gold bears are taking a hiatus amid the US dollar's pullback from two-month highs. The yellow metal witnessed two-way business and closed on a flat note on Thursday, forming a Doji candle – an indecision sign.

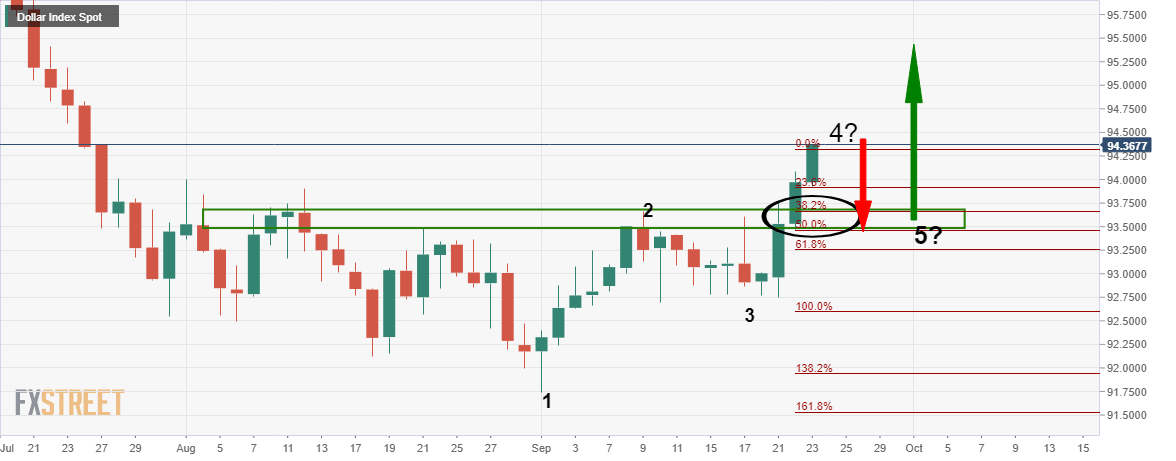

The selling ran out of steam at $1,848 as the uptrend in the dollar index (DXY) paused at 94.59, the highest level since July 24. The DXY closed Thursday at 94.33 and remains sidelined near that level at press time. Meanwhile, gold is currently trading near $1,863 per ounce, having ended Thursday at $1,867.

Gold Price Analysis: XAU/USD bulls looking to the dollar to give back some ground

The price of gold is currently trading at $1,868.30 between $1,867.51 and $1,871.37 following a session in North America where the precious metal managed a bid from a low of $1,847.90 to a session high of $1,877.03. Gold's bullish case has been challenged by the broad dollar's gains of late which have catalyzed an aggressive positioning squeeze in the yellow metal.

To date, there have been a number of fundamentals going for the US dollar, including the Justice Ginsberg's passing and its implications for a Phase 4 deal, election uncertainty and the global spread of the coronavirus.

Author

FXStreet Team

FXStreet