Gold Price News and Forecast: XAU/USD – Break to new all-time high in gold confirms bullish market

Gold Price Analysis: Well-supported as Trump floats delaying the elections – Confluence Detector

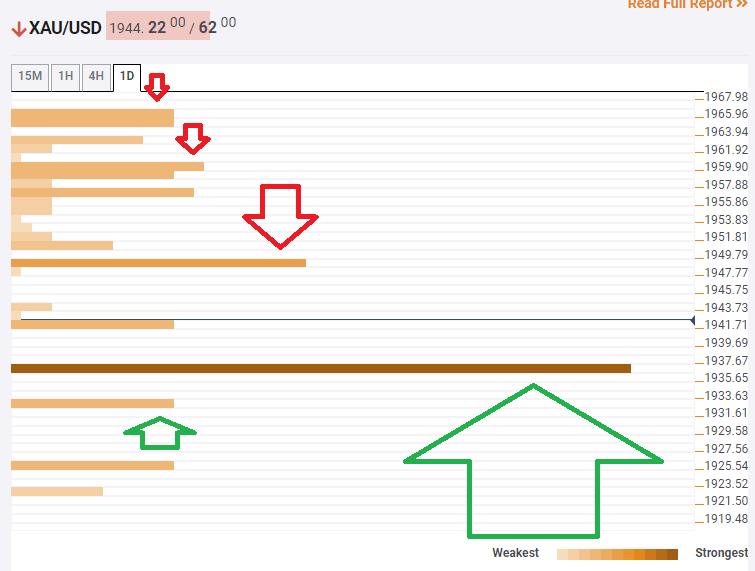

Gold has been consolidating its gains achieved earlier in the week and failed in its second attempt to surge above the $1,981 level after the Federal Reserve's rate decision. The Fed painted a gloomier picture of the economy and opened the door to more stimulus.

The central bank's worries were echoed with weak Gross Domestic Product and a rise in jobless claims. President Donald Trump tweeted that perhaps the elections should be postponed given the virus. While his comments seemed to divert attention from the economic figures, it triggers new worries. Read more...

Break to new all-time high in gold confirms bullish market

Gold has finally broken to a new record high this week, confirming the secular bull market has resumed. We know it’s a matter of time as it has made a new all time high to almost all other major world currency. In our public seminar in September 2019, we mentioned that XAUUSD should follow the path of Gold vs other major currencies. Read more...

Gold remains depressed near session lows, around $1950 post-US GDP

Gold maintained its offered tone near daily lows, around the $1950 region, and had a rather muted reaction to the US GDP report.

The precious metal witnessed some selling on Thursday and moved away from the previous day's all-time high, around the $1981 area retested in the aftermath of a dovish FOMC statement. A modest US dollar rebound from more than two-year lows was seen as one of the key factors that prompted some profit-taking around the dollar-denominated commodity. Read more...

Author

FXStreet Team

FXStreet