Gold Price Analysis: Well-supported as Trump floats delaying the elections – Confluence Detector

Gold has been consolidating its gains achieved earlier in the week and failed in its second attempt to surge above the $1,981 level after the Federal Reserve's rate decision. The Fed painted a gloomier picture of the economy and opened the door to more stimulus.

The central bank's worries were echoed with weak Gross Domestic Product and a rise in jobless claims. President Donald Trump tweeted that perhaps the elections should be postponed given the virus. While his comments seemed to divert attention from the economic figures, it triggers new worries.

Will that result in more demand for XAU/USD? The precious metal seems well-positioned on the charts.

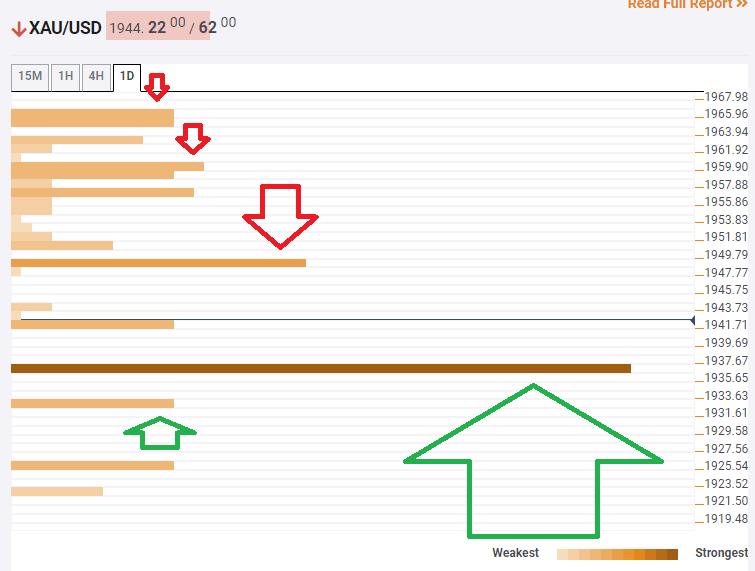

The Technical Confluences Indicator is showing that gold has substantial support at $1,936, which is the convergence of the Pivot Point one-month Resistance 3 and the PP one-week R1.

It is backed up by weaker support at $1,941, which is where the previous daily low hits the price.

Some resistance awaits at $1,948, which is where the Bollinger Band one-hour Lower, the PP one-day Support 1, and other lines all meet up.

Further above, the next hurdle is $1,959, which is where the SMA 10-4h, the previous 4h-high, and the BB 15min-Upper converge.

Next, $1,965 is the confluence of the Fibonacci 38.2% one-day and the Simple Moving Average 5-4h.

Key XAU/USD resistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.