Gold Price News and Forecast: XAU/USD bears testing bullish commitments above $1700

Gold analysis: Breaks patterns and drops

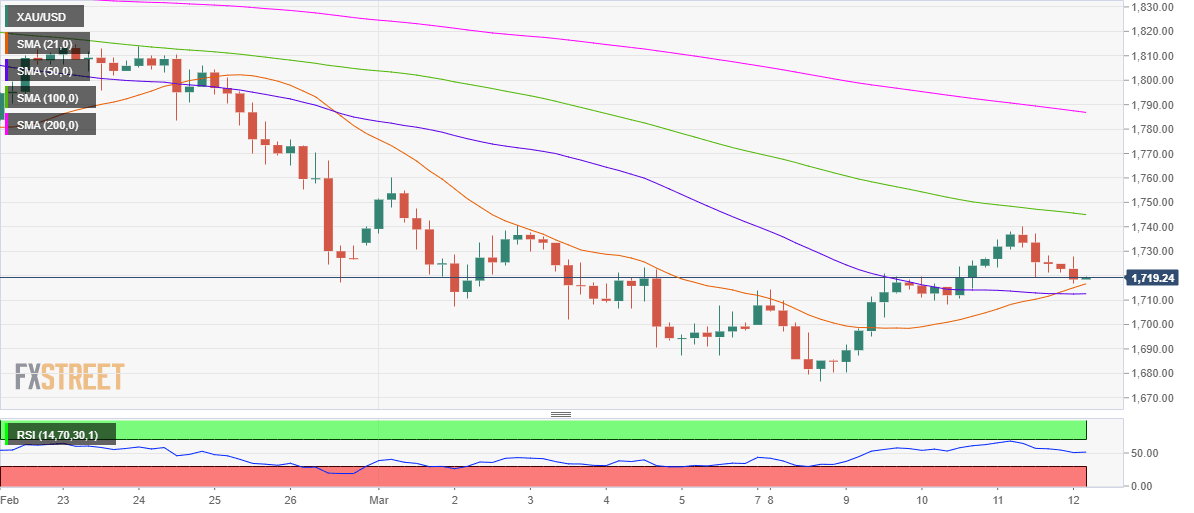

The yellow metal found resistance in the 1,740.00 level, which was enough for it to decline. The decline was only slowed down by the 55-hour simple moving average. However, eventually the SMA failed. By mid-day on Friday, the metal had reached the 1,700.00 mark.

If the 1,700.00 mark provides support, the metal's price could trade sideways or retrace back up to the 100 and 200-hour simple moving average near 1,710.00. On the other hand, a failure to provide support could result in a decline to the recent low levels of 1,690.00 and 1,680.00. Read more...

Gold Price Forecast: XAU/USD bears testing bullish commitments above $1700

Gold (XAU/USD) failed to sustain at weekly highs around $1740 on Thursday, ending the day in the red at $1724. The rebound in the US Treasury yields from multi-day lows capped the recovery rally in the non-yielding gold. The returns on the markets rebounded, as the expectations of strengthening US economic recovery regained momentum after a strong jobs report. The number of Americans seeking jobless claim benefits dropped to a four-month low last week. Although the US dollar held onto the lower levels amid a record rally in Wall Street indices.

On the final trading day of this week, the reflation theme is back in play, thanks to the upbeat remarks from US President Joe Biden, who talked up the vaccine campaign amid the $1.9 trillion stimulus passage. Therefore, gold could bear the brunt if the uptrend in the US rates resumes. On the macro front, the US PPI release will be eyed while the focus will continue to remain on the yield play. Read more...

Gold Price Analysis: XAU/USD flirts with three-day lows, around $1710 area

Gold edged lower through the early European session and dropped to three-day lows, around the $1710-09 region in the last hour.

The precious metal extended the overnight retracement slide from the $1740 supply zone and witnessed some follow-through selling on the last trading day of the week. This marked the second straight day of a negative move and was sponsored by a combination of factors, though the cautious mood helped limit the downside. Read more...

Author

FXStreet Team

FXStreet