Gold Price News and Forecast: XAU/USD bears keep reins below $1,900 amid US dollar strength

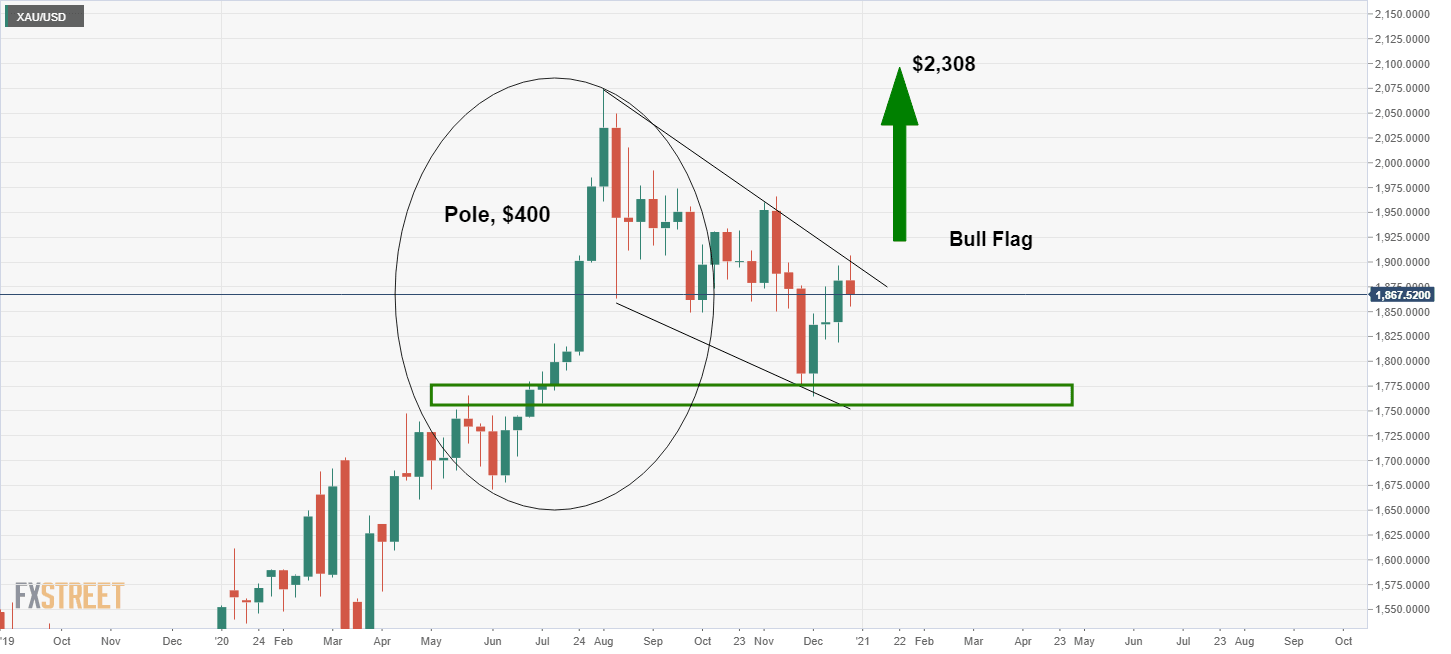

Gold Price Analysis: XAU/USD stalls within bull flag at weekly resistance

The price of gold is trading at $1,867.52, down some 0.5% on the day having travelled between $1,860.82 and $1,884.33.

Holiday-thin markets on a shortened week are making for unusual price behaviour across the spectrum of instruments, not least in the precious metals arena.

However, the US dollar is perky within its corrective phase within the fresh bearish cycle and despite the passage of a new $900 billion stimulus package.

Following weeks of negotiations, Congress overwhelmingly approved billions of dollars for American households and businesses that have been hurt by the pandemic.

Gold Price Analysis: XAU/USD bears keep reins below $1,900 amid US dollar strength

Gold prices hold lower ground near $1,860 amid the early Wednesday morning in Asia. The yellow metal dropped the most since December 09 amid broad US dollar strength. While the greenback benefited from the passage of the US coronavirus (COVID-19) aid package and broad risk-off mood, sentiment remains downbeat as Brexit deadlock prevails while markets worry from the fresh covid variant.

Although major market chatters blame risk-off for the latest surge in the US dollar index (DXY), other reasons also contribute to the greenback’s strength. Firstly, the passage of the US covid aid package and government funding with nearly $2.3 trillion amount in total suggest that the world’s largest economy will have a good start to 2021. Secondly, hopes that America will be in better shape under Joe Biden’s leadership also back the greenback. Additionally, other developed economies like Europe and the UK are jostling with Brexit whereas China has less acceptance in the West, which in turn direct market players towards the USD.

Author

FXStreet Team

FXStreet