Gold Price News and Forecast: XAU/USD

Gold Price Analysis: XAU/USD at highest in over a month amid dovish Powell comments

Spot gold (XAU/USD) prices hit their highest levels in over a month of just north of the 18 March $1755 high in recent trade and continue to hold in the upper-$1750s. The pair has been on the front foot for most of Thursday’s session, rising from Asia Pacific levels in the $1730s. That means gold is trading with gains of about 1.1% or just under $20 on the day. To the upside, short-term bulls will be looking for a test of the 50-day moving average at $1764.

Driving the day

The main driver of gold price action on Thursday has been US government bond markets. Yields are a little lower, with the 10-year down about 2bps to under 1.64%. Following dovish commentary from Fed Chair Jerome Powell, more downside in US government bond yields may well be in store, which would be a positive for gold. Though bonds have not yet reacted much to Powell’s remarks, the US dollar has been hit, with the DXY slipping all the way back to the 92.00 level. The weaker US dollar is also a supportive factor for gold.

U.S. labor market is recovering. Will Gold too?

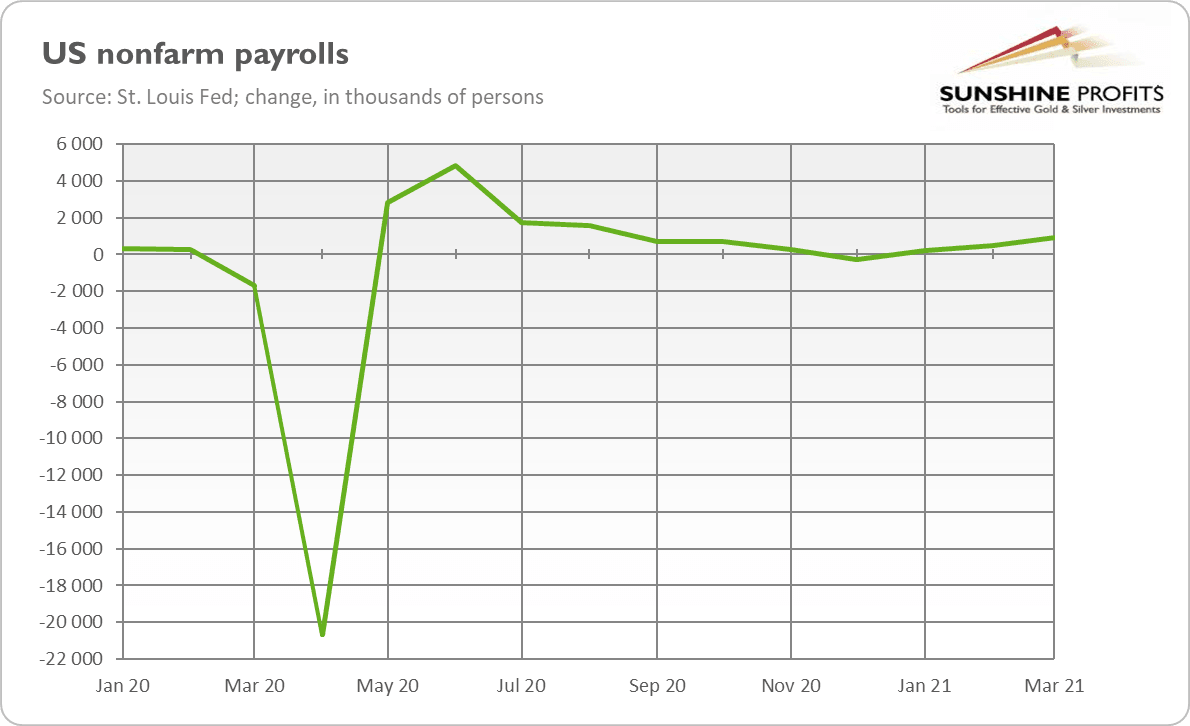

The March nonfarm payrolls were surprisingly strong. If the current favorable trend in the U.S. labor market continues, gold may struggle.

As the chart below shows, in March 2021, total nonfarm payrolls rose by 916,000 , following gains of 468,000 in February (after an upward revision). The latest gains were the largest since August 2020. It’s important to note here that job growth was widespread, although led by gains in leisure, hospitality, education, and construction.

Author

FXStreet Team

FXStreet