Gold Price Forecast: XAUUSD bears eye $1,650, focus on US mid-term elections, inflation

- Gold price takes offers to extend Monday’s losses from a three-week high.

- Bearish candlestick formation, risk-off mood keeps XAUUSD sellers hopeful.

- US mid-term elections appear interesting as Donald Trump teases a ‘very big’ announcement for November 15.

- US CPI, China’s covid conditions are extra catalysts to watch for immediate directions.

Gold price (XAUUSD) takes offers to refresh intraday low near $1,668 during early Tuesday morning in Europe. The yellow metal’s latest losses could be linked to the market’s deteriorating sentiment, as well as the recent rebound in the US dollar. The same joins bearish technicals to justify the XAUUSD’s second daily loss.

The biggest jump in China’s daily coronavirus numbers since May 01 joins the market’s anxiety amid the US mid-term elections buzz could be considered the main catalyst behind the recent swing in the mood.

“COVID-19 cases sharply escalated in Guangzhou and other major Chinese cities, official data showed on Tuesday, with the global manufacturing hub fighting its worst flare-up ever and testing its ability to avoid a Shanghai-style citywide lockdown,” said Reuters. The news also mentioned that the new locally transmitted infections climbed to 7,475 nationwide on November 7, according to China's health authority, up from 5,496 the day before and the highest since May 1.

Elsewhere, an otherwise uninteresting US mid-term elections gain the market’s attention as ex-President Donald Trump teased a “very big” announcement coming on November 15. “If Republicans secure a House majority, they plan to use the federal debt ceiling as leverage to demand deep spending cuts. They would also seek to make Trump's 2017 individual tax cuts permanent and protect corporate tax cuts that Democrats have unsuccessfully tried to reverse over the past two years,” said Reuters.

Amid these plays, the US stock futures print mild losses whereas the US Treasury yields grind higher and the US Dollar Index (DXY) recover from the eight-day low.

Moving on, headlines surrounding the US elections and China’s covid conditions will join the central bankers’ speeches to entertain XAUUSD traders ahead of the inflation numbers from China and the US, up for publishing on Wednesday and Thursday respectively.

Technical analysis

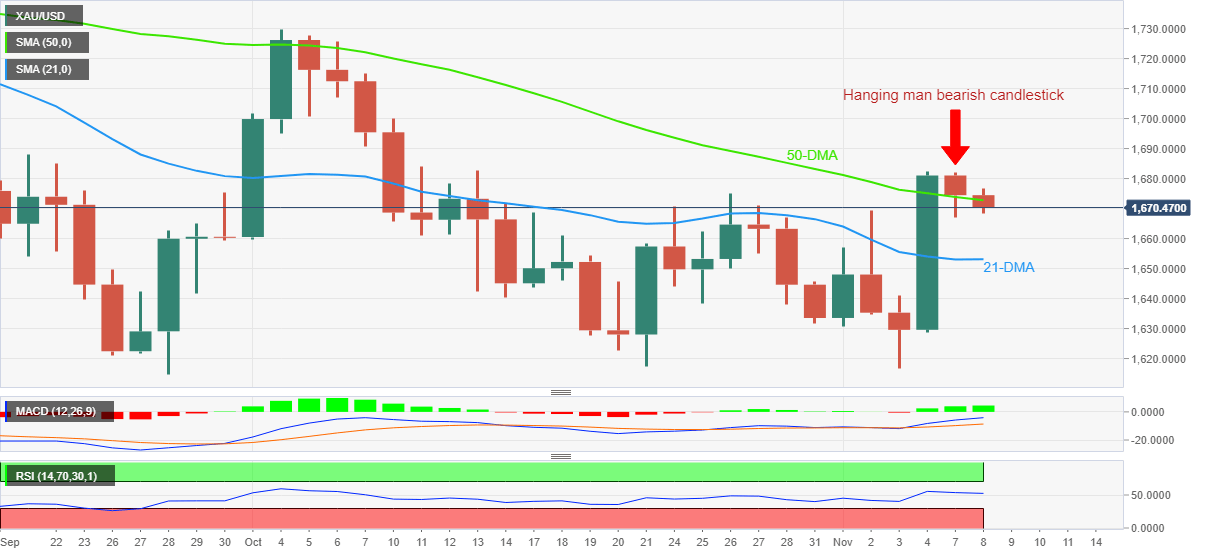

Gold price justifies the previous day’s “hanging man” bearish candlestick as it extends the pullback from a one-week high below the 50-DMA.

Given the recently steady RSI (14), coupled with Monday’s bearish candle and a clear break of the 50-DMA, XAUUSD is likely to decline further toward the 21-DMA support near $1,653.

Even if the bullion breaks the $1,653 support, lows marked the last Thursday and in October, could challenge the further downside near $1,616. Also acting as the downside filter is the yearly low surrounding $1,614-15.

Meanwhile, a daily closing beyond the recent high of $1,683 defies the bearish candlestick formation, which in turn can quickly propel the metal price toward the $1,700 threshold.

In a case where the gold price remains firmer past $1,700, the previous monthly top near $1,730 will gain the market’s attention.

Gold price: Daily chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.