Gold Price Forecast: XAU/USD bears stay on top in familiar grounds, Fed eyed

- Gold under pressure after US data, ahead of FOMC meeting.

- XAU/USD break short-term barrier of $1780.

- US dollar remains mostly in recent ranges versus most of its rivals.

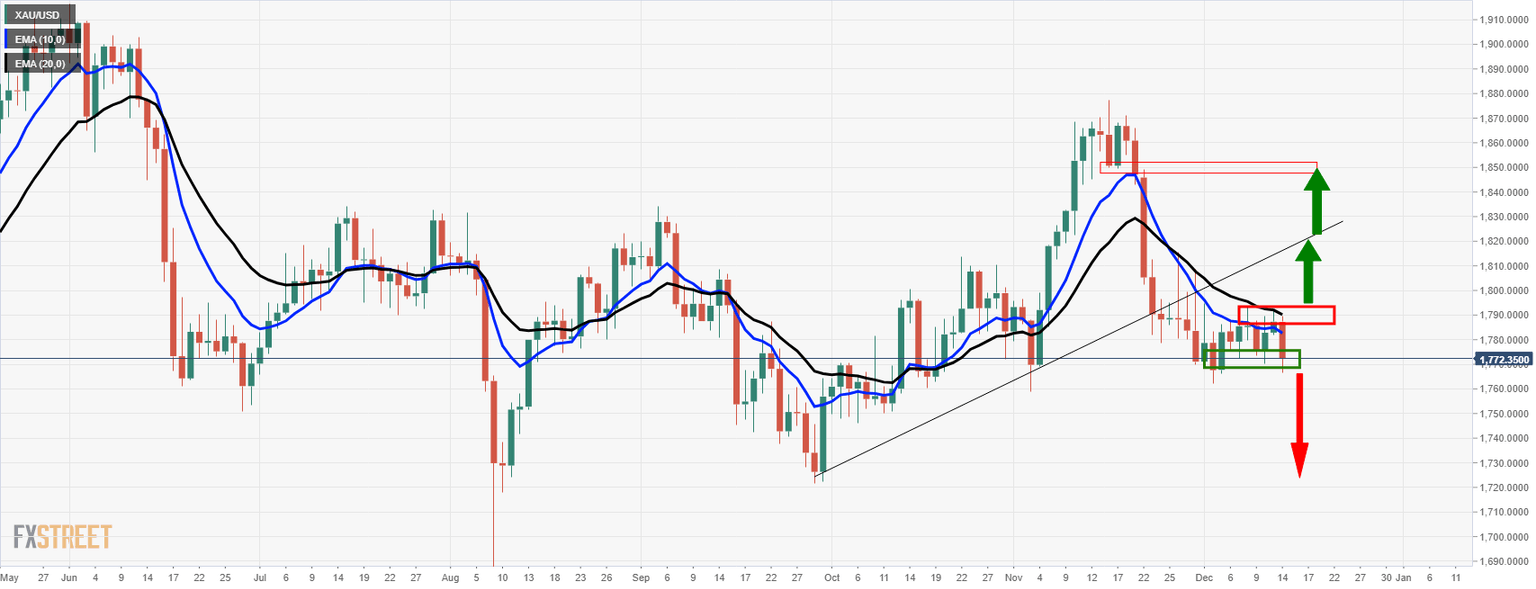

Update: Gold, XAU/USD, remains better offered, albeit within sideways consolidation. The month of December has not given traders much in the way of volatility in the gold price that has been accumulated between $1,762 and $1,808 without a direction either way. With that being said, the 10 EMA crossed below the 20 EMA at the end of November which leaves the bias to the downside.

Today's slide is one of the largest we have seen so far for the month and with the US inflation report and the Federal Reserve around the corner, there are risks of a surge in the US dollar. This comes at a time where the greenback may well be favoured as one of the more reliable of safe-haven plays as the covid variant continues to spread around the world, leaving a sombre tone in financial markets.

Technically, the price could be on the verge of breaking the daily support. However, failures to do so could lead to an upside breakout as follows:

End of update

Gold prices are under pressure on Tuesday following US data and ahead of the Federal Reserve decision. The yellow metal broke below the $1780 support and tumbled to $1766, reaching the lowest level since December 3.

From the bottom, XAU/USD rebounded to as highs at $1777 and as of writing it is moving toward $1770, still facing a negative momentum. The decline started after the release of US PPI numbers that sent US yields higher.

The US 10-year rose from 1.44% to 1.47% and the 30-year to 1.86% from 1.82%. The move in the bond market weakened gold. At the same time, the dollar gained momentum but posted limited gains. The greenback still remains in negative ground for the day against most of its main rivals, although trading in the recent range.

Market participants await the outcome of the FOMC meeting. On Wednesday the central bank will announce its decision on monetary policy. The central bank is expected to announce a faster reduction of its bond-buying program.

From a technical perspective, XAU/USD still is under pressure. A recovery above $1780 would alleviate the pressure. The next support stands at $1760 followed by $1745. On a wider perspective, $1795 is the critical resistance; a daily close clearly above should open the doors to a recovery above $1800 and more.

Technical levels

Author

Matías Salord

FXStreet

Matías started in financial markets in 2008, after graduating in Economics. He was trained in chart analysis and then became an educator. He also studied Journalism. He started writing analyses for specialized websites before joining FXStreet.