Gold Price Forecast: XAU/USD renews eight-month high near $1,880 on China concerns, softer US Dollar

- Gold price grinds higher after refreshing multi-day high.

- China unlock, PBOC’s gold stocking underpins XAU/USD run-up.

- US Dollar bears the burden of downbeat data, mixed Fedspeak.

- Light calendar, cautious mood ahead of US inflation figures probe Gold buyers.

Gold price (XAU/USD) rises to the highest levels since early May 2022 as the risk-on mood joins the softer US Dollar to begin the key week comprising inflation numbers from the US, China and Japan. Also adding strength to the yellow metal’s upside momentum is Beijing’s recent stockpiling of Gold. In doing so, the XAU/USD bulls attack a $1,880 hurdle by the press time.

The risk profile remains firmer as China reopens national borders after a three-year pause. On the same line could be the early signals suggesting China’s heavy shopping during the festive season, as well as comments from People’s Bank of China (PBOC) Official suggesting optimism surrounding China’s growth conditions.

It’s worth observing that China is one of the world’s biggest Gold consumers and hence the risk-positive headlines from Beijing influence the XAU/USD bulls.

On the same line could be the PBOC’s announcement of Gold buyers as it holds around 2,010 tonnes of the metal as reserves after the latest addition of nearly 30 tonnes. That said, the recent piling of gold by the PBOC is the third notable instance, after September 2019 and October 2016.

Elsewhere, Friday’s downbeat prints of US wage growth, ISM Services PMI and Factory Orders weighed on the US Dollar Index (DXY) and added strength to the risk-on mood, which in turn propels the Gold price. That said, mixed comments from the Fed policymakers and hopes of an upbeat US earnings season also seem to favor the XAU/USD buyers.

While portraying the mood, the S&P 500 Futures print mild gains but a holiday in Japan limits the bond market moves in Asia, as well as during early Monday morning in Europe.

Looking forward, a light calendar for the day and upbeat headlines from China could keep the Gold buyers hopeful. However, inflation data from Tokyo, China and the US will be important for precious metal traders as central bankers brace for shifting gears.

Gold price technical analysis

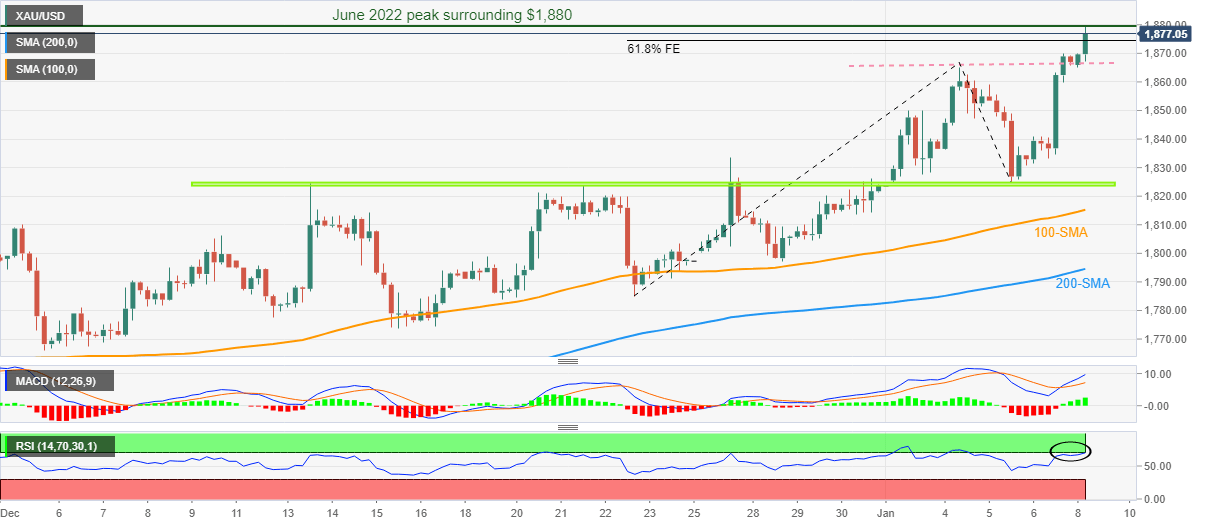

Gold buyers cheer upside break of the previous weekly top surrounding $1,865, as well as the 61.8% Fibonacci Expansion (FE) of its December 22 to January 05 moves, near $1,875, as the XAU/USD bulls jostle with the June 2022 high of around $1,880.

That said, the bullish MACD signals and the metal’s sustained trading beyond the 100-SMA and the 200-SMA, respectively ear $1,815 and $1,795, favor the XAU/USD buyers. On the same line could be the metal’s U-turn from a one-month-old horizontal support region of around $1,823.

Hence, the Gold buyers are in the driver’s seat unless the quote drops below $1,795.

However, the overbought RSI (14) suggests limited upside and hence a clear break of the $1,880 hurdle becomes necessary for the XAU/USD to aim for the May 2022 peak of $1,910.

Gold price: Four-hour chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.