Gold Price Forecast: XAU/USD readies for a fresh upswing towards $1,884 – Confluence Detector

- Gold price consolidates the upside before the next push higher.

- Gold remains undeterred by the global tightening calls after hot US inflation.

- Gold price turns bullish on falling bond yields, technical breakout.

With hot US inflation bringing back rate hike expectations on the table from the Fed and the ECB, gold price continues to benefit from its increased demand as an inflation hedge. Holiday-thinned market conditions are also boding well for the bright metal, as attention shifts towards Friday’s US Michigan Consumer Sentiment data. In the meantime, expectations of global tightening will continue to influence gold price.

Read: Gold Price Forecast: Will US inflation trigger a sustained move above $1,834 in XAU/USD?

Gold Price: Key levels to watch

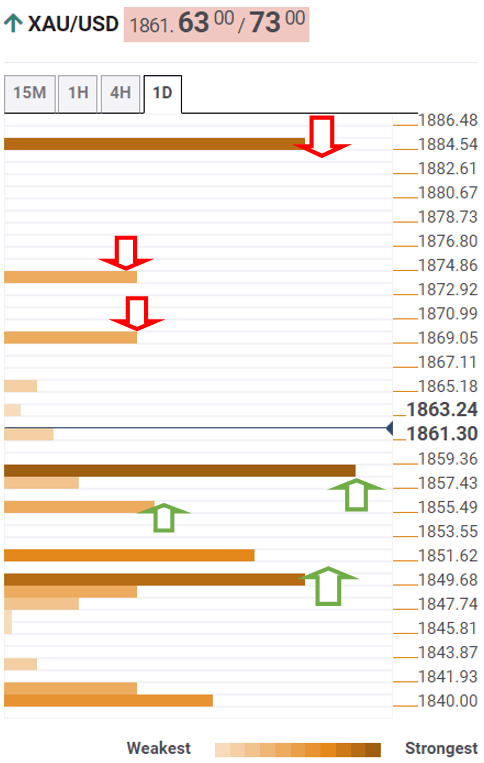

The Technical Confluences Detector shows that gold price needs acceptance above the previous day’s high of $1,869 to extend the bullish momentum towards the daily R1 pivot point, at $1,873.

A firm break above the latter will open doors towards $1,884, where the R3 monthly pivot point aligns.

Alternatively, if sellers manage to find a strong foothold below the confluence of the Fibonacci 23.6%, the daily pivot point and weekly R2 pivot at $1,859, the corrective pullback could gain traction.

The next downside target is seen at the previous hourly low at $1,855, below which fierce support around $1,850 will come into play.

That area is the intersection of the R2 monthly pivot point, the Fibonacci 38.2% level and the 5-4hr SMA.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find these useful entry points for counter-trend strategies, scalping a few points at a time. If you are a medium-to-long-term trader, this tool will give you advance notice of the price levels where a medium-to-long-term trend may stop and rest, as well as where to unwind positions, or where to increase your position size.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.