Gold Price Forecast: XAU/USD moves firmly to near $1,880 despite soaring hawkish Fed bets

- Gold price is expected to balance above $1,870.00 despite higher rate hike expectations.

- Higher addition in US CPI than Core CPI has indicated that US inflation is major contributed by food and oil.

- Investors should brace for an extreme hawkish stance by the Fed this week.

Gold price (XAU/USD) is oscillating in a narrow range of $1,868.92-1,879.25 in the early Asian session despite mounting bets on an extreme hawkish stance to be dictated by the Federal Reserve (Fed) this week. The precious metal displayed a juggernaut upside move after the release of the US Consumer Price Index (CPI) on Friday. The bright metal moved higher from $1,828.99 to $1,879.25 swiftly.

The US Bureau of Labor Statistics reported the US CPI at 8.6%, much higher than the prior print and forecasts of 8.3%. Also, the core CPI that doesn’t include food and oil prices rose to 6% from the expectations of 5.9%. It is worth noting that the contribution from the food and oil process in making the inflation situation more horrible is much higher. The core CPI that excludes oil and food is jumped lower than the plain-vanilla CPI in terms of percent-wise growth.

A higher-than-expected US inflation along with better-than-expected US Nonfarm Payrolls (NFPs) are compelling for a rate hike announcement by the Federal Reserve (Fed), which is due on Wednesday.

Gold technical analysis

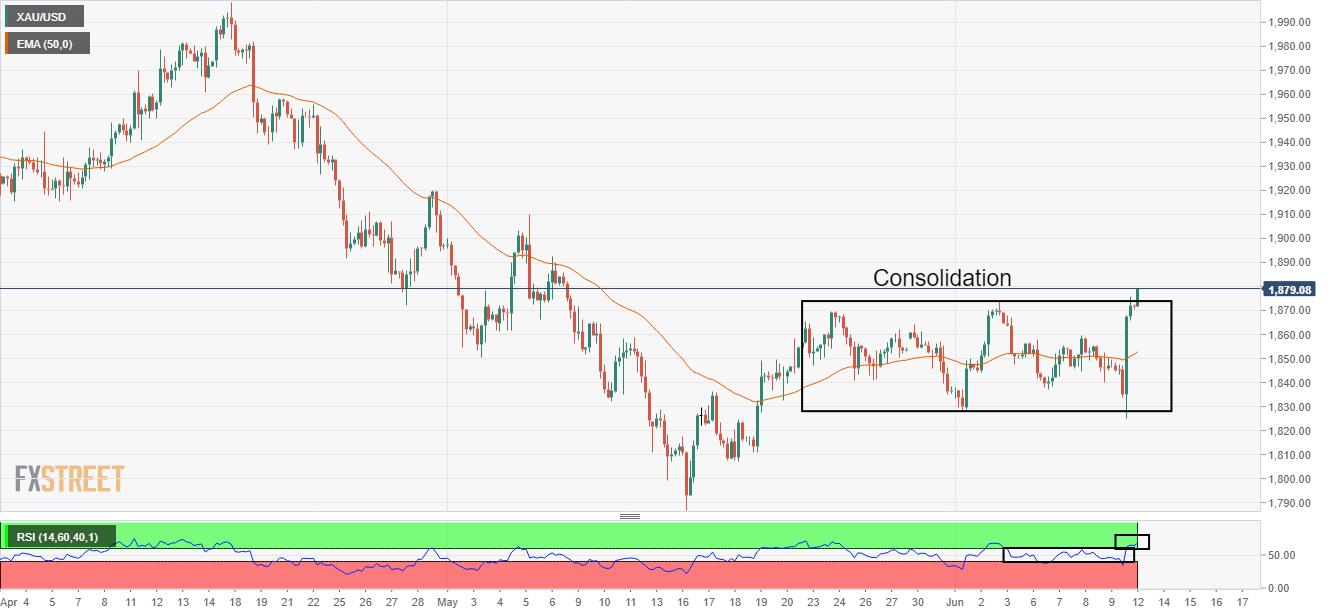

On a four-hour scale, the gold price is on the verge of delivering an upside break of its prolonged consolidation formed in a range of $1,825.10-1,876.01. A firmer responsive buying action reported last week from $1,825.10 has strengthened the bullish momentum. The precious metal is auctioning higher from the 50-period Exponential Moving Average (EMA) at $1,853.15. Meanwhile, the Relative Strength Index (RSI) (14) has shifted into a bullish range of 60.00-80.00, which adds to the upside filters.

Gold four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.