Gold Price Forecast: XAU/USD marches towards $1,800 on lower consensus for US Inflation

- Gold price is advancing towards $1,800 as the US CPI is seen lower at 8.7%.

- The inflation rate is required to display a series of downward shifts to claim exhaustion.

- Gold price as defended the 20-EMA while the 50-EMA has remained untouched in a corrective move.

Gold price (XAU/USD) has slowed down its upside momentum after printing a high above $1,790.00 in the Asian session. The upside momentum has not been exhausted yet and the precious metal is balancing in a higher market profile after a sheer rally. The bright metal is advancing towards the psychological resistance of $1,800.00 on lower estimates for the US Consumer Price Index (CPI).

As per the market consensus, the US Consumer Price Index (CPI) is likely to trim to 8.7% from the prior release of 9.1%. A drop by 40 basis points in the consensus is backed by declining oil prices over the past few weeks. The black gold lost its mojo on accelerating recession fears and trimming supply worries. This may delight the Federal Reserve (Fed) to head a little soft this time on interest rates.

Investors should be aware of the fact that a one-time decline in the price pressures doesn’t warrant that the laborious job for the Federal Reserve (Fed) is over. The inflation rate is required to display a series of downward shifts to claim that the price pressures have exhausted.

Gold technical analysis

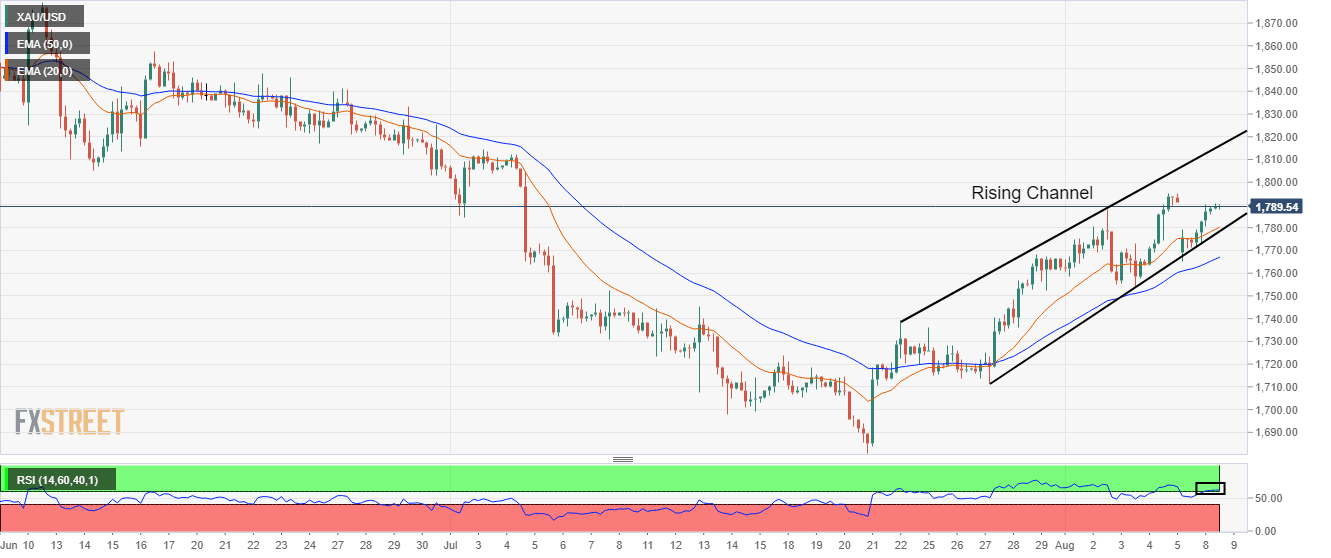

The gold prices have rebounded sharply after sensing bids around the lower portion of the Rising Channel formed on a four-hour scale. The upper portion of the above-mentioned chart pattern is placed from July 22 high at $1,739.37 while the lower portion is plotted from July 27 low at $1,711.55.

The gold bulls have defended the 20-period Exponential Moving Average (EMA) at $1,775.50. While, the 50-EMA at $1,767.11 has remained untouched despite a corrective move, which indicates that the short-term trend is extremely bullish.

Adding to that, the Relative Strength Index (RSI) (14) has attempted a break above 60.00 and an establishment above the same will strengthen the gold bulls further.

Gold four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.