Gold Price Forecast: XAU/USD glistens amidst geopolitical tensions to test 20-DMA

- Gold price to remain bid if geopolitical unrest escalates.

- Federal Reserve officials adopt a cautious and nimble approach toward mitigating high inflation.

- XAU/USD’s traders eye US inflation data and Fed commentary.

Gold price hit a weekly high of $1857.69, with the financial markets being hit by geopolitical unrest due to the conflict between Israel and Palestinian Islamist group Hamas during the weekend and bolstering the appetite for Gold’s safe-haven status. XAU/USD is trading at $1856.63, gains more than 1.30%, after printing a daily low of $1843.80.

Safe-haven appeal of Gold bolstered by Israel-Hamas fight and dovish Fed remarks

Investors' mood remains downbeat as the fight continues. US Federal Reserve (Fed) officials crossed newswires, led by Vice-Chair Philip Jefferson and the Dallas Fed President Lorie Logan.

Fed Vice-Chair Jefferson said that current monetary policy is restrictive, though emphasized “we need to do our work” to bring inflation down. He added they need to be nimble “with regards to what is happening in the economy.” Earlier, Dallas Fed President Logan commented she is focused on inflation risks and added they have more work to do. She stated the surprising strength of the economy creates upside risks on inflation.

Another reason that is sponsoring a leg-up in Gold prices is the drop in US Treasury bond yields, particularly real yields. the yield in the US 10-year Treasury Inflation-Protected Securities (TIPS), remains at 2.47% with the US bond markets closed, while the 10-year yield plummets 15-baiss points from 4.797% to 4.657%.

Aside from this, the US economic agenda was absent in the observance of Columbus Day. Ahead in the week, US inflation data on the producer and the consumer side would be crucial in dictating the US Federal Reserve’s next move.

Gold Price Analysis (XAU/USD): Technical outlook

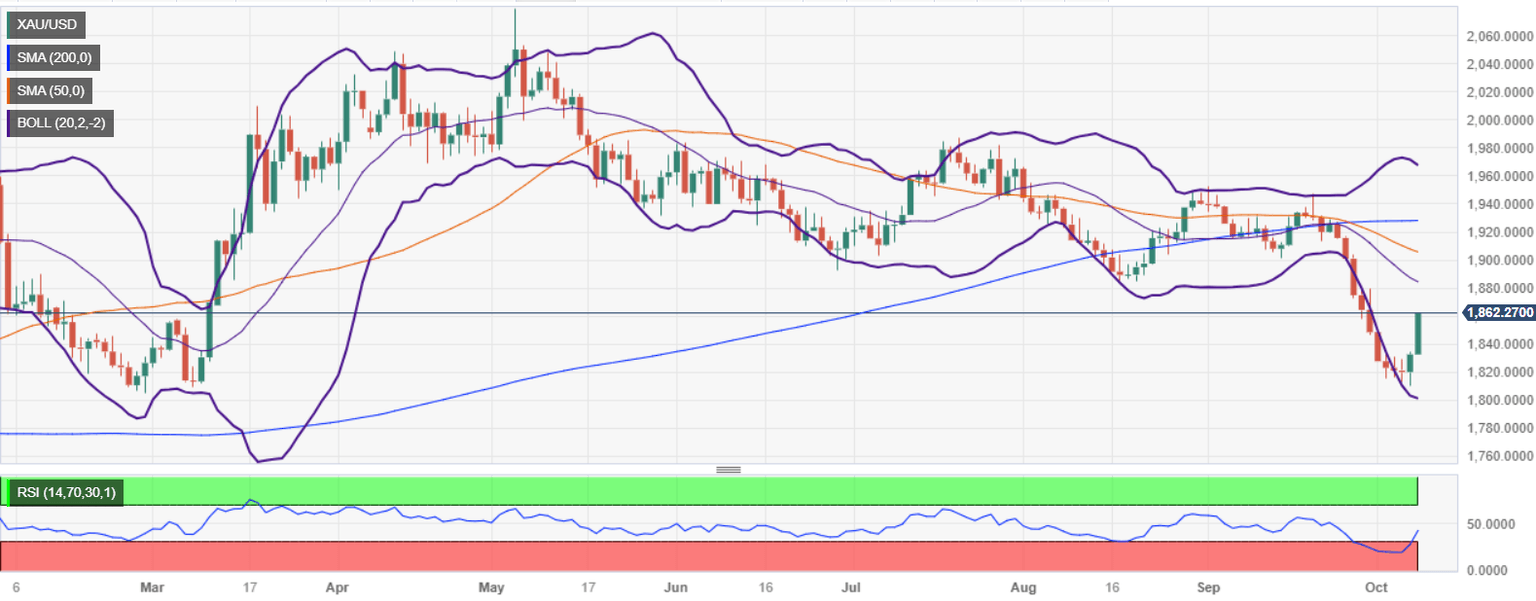

After bottoming at around $1810.00, the XAU/USD has resumed its uptrend due to risk aversion, with buyers eyeing the next resistance level, the 20-day moving average (DMA) at $1884.00. A breach of the latter will expose the 50-DMA at $1905.52, followed by the 100-DMA at $1925.73 and the 200-DMA at $1928.75. Conversely, failure to crack the 20-DMA would open the door for a pullback. First support would be the last week’s low of $1810, followed by the $1800.00 figure.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.