Gold Price Forecast: XAU/USD eyes more weakness below $1,860 as yields soar, Fed Powell’s speech eyed

- Gold price has faced barricades around the 23.6% Fibo retracement at $1,880.00 as yields soar.

- The commentary from Fed Powell about interest rate guidance will be keenly watched.

- The USD Index has refreshed its four-week high at 103.28 amid a risk-off mood.

Gold price (XAU/USD) is displaying a sideways auction after building a cushion around $1,860.00 in the early Asian session. The precious metal is expected to display more weakness after surrendering immediate support as US Treasury yields are gaining dramatically ahead of the speech by Federal Reserve (Fed) chair Jerome Powell. The return generated by 10-year US Treasury bonds has scaled to nearly 3.65% with sheer pace.

Markets remained jittery on Monday led by US-China tensions and tight United States labor market data, which has infused fresh blood into Fed’s policy tightening spell. The risk aversion theme kept S&P500 in a negative trajectory consecutive for the second trading session. The US Dollar Index (DXY) extended its upside journey after surpassing the 102.80 resistance and refreshed its four-week high at 103.28.

For further guidance, the commentary from Fed’s Powell about the roadmap of taming stubborn inflation and fresh concerns about inflation projections due to a rebound in labor market conditions will be keenly watched. Meanwhile, U.S. Treasury Secretary Janet Yellen said on Monday the United States may avoid a recession as inflation is coming down while the labor market remains strong, as reported by Reuters.

Gold technical analysis

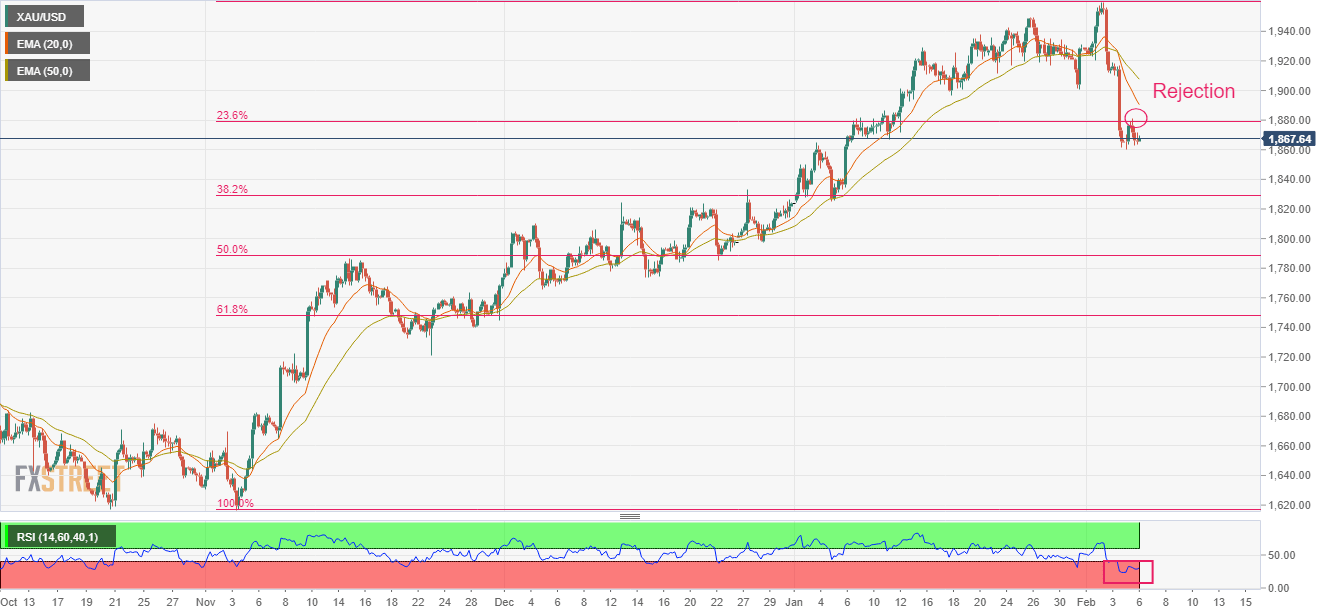

Gold price has sensed rejection after attempting to scale above the 203.6% Fibonacci retracement (placed from November 3 low at $1,616.69 to February 2 high of around $1,960.00) at around $1,880.00 on a four-hour scale. A rejection around 23.6% Fibo retracement indicates that the asset has been exposed to the next cushion at 38.2% Fibo retracement placed around $1,829.45.

A bear cross, represented by the 20-and 50-period Exponential Moving Averages (EMAs) at $1,921.60, adds to the downside filters.

Adding to that, the Relative Strength Index (RSI) (14) has shifted into the bearish range of 20.00-40.00, which indicates more weakness ahead.

Gold four-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.