Gold Price Forecast: XAU/USD eyes more gains above $1,830.00 as risk-off mood eases, US PMI eyed

- Gold price is aiming to shift its business above $1,830.00 as investors shrug off hawkish Fed-inspired volatility.

- An upbeat Caixin Manufacturing PMI has infused fresh blood into the risk-sensitive assets.

- A surprise decline in the US PMI figures could impact the strong labor market.

Gold price (XAU/USD) has rebounded firmly above $1,830.00 in the Asian session and is aiming to shift its auction above the same. The precious metal has picked strength as investors’ risk appetite has improved after the release of the upbeat Caixin Manufacturing PMI data. Investors have cheered the strong performance of the Chinese manufacturing sector as it indicates that the economy is effectively on the path of economic recovery after dismantling pandemic controls.

S&P500 futures have recovered the majority of the losses reported in the Asian session. The US Dollar Index (DXY) has refreshed its day low at 104.57 as investors are turning a deaf ear to the fears associated with higher rates expectations from the Federal Reserve (Fed). The demand for US government bonds still looks gloomy as the return on 10-year US Treasuries is solid at 3.94%.

Wednesday’s session is going to be full of action as the United States Institute of Supply Management (ISM) will report February’s Manufacturing PMI. The economic data is seen at 48.0 lower than the former release of 47.4. The Manufacturing PMI has been contracting consecutively for the past three months as a figure below 50.0 is itself considered a contraction. A surprise decline in the PMI figures could impact the strong US labor market and lay-off could be witnessed ahead.

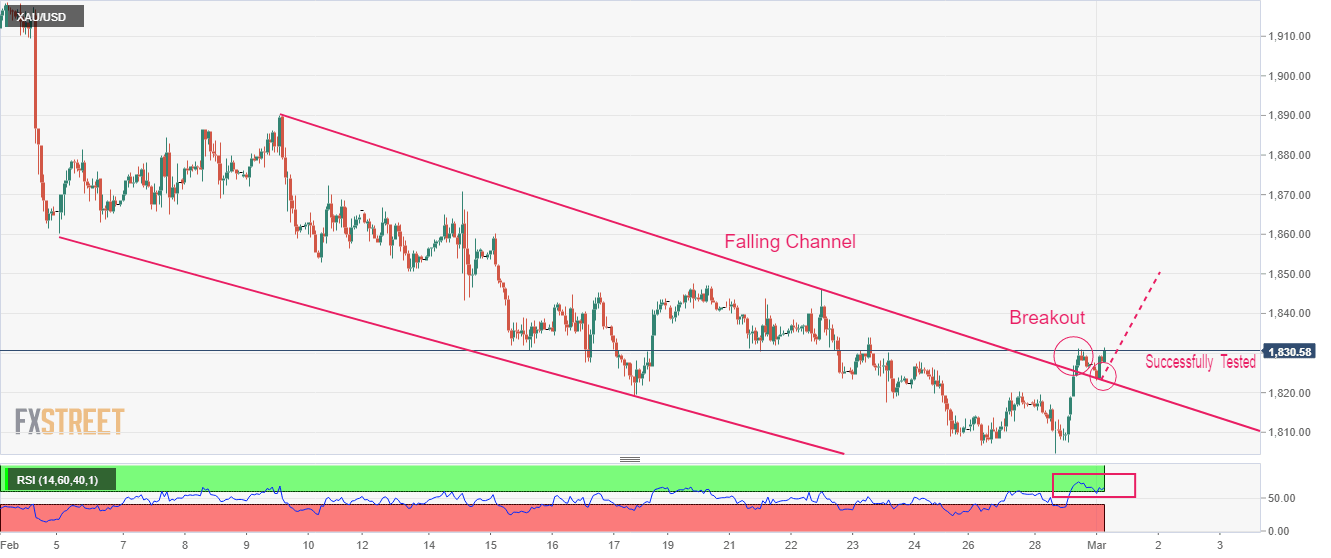

Gold technical analysis

Gold price has rebounded after testing the breakout of the Falling Channel chart pattern formed on an hourly scale. The precious metal is expected to display a sheer upside move as a bullish reversal has been confirmed after exploding the aforementioned chart pattern on the upside.

The Relative Strength Index (RSI) (14) has delivered a range shift move from the 40.00-60.00 dimension to the bullish vault of 60.00-80.00, which advocates more upside ahead.

Gold hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.