Gold Price Forecast: XAU/USD attempts a bounce towards $1818 ahead of Powell

- XAU/USD tested $1,800 support in the early American session.

- US Treasury bond yields struggle to gain traction on Tuesday despite strong CPI data.

- Gold eyes the 200-day SMA as the next target on the upside.

Update: After a whipsaw witnessed on US inflation blowout, gold price has returned to the familiar range seen before the data release around $1810, as traders refrain from placing any fresh bets on gold price ahead of Fed Chair Jerome Powell’s two-day testimony, starting Tuesday. Markets look forward to Powell’s take on the inflation shoot-up, although it was mainly bumped up by clunker prices. At the time of writing, gold price is trading at $1810, recovering from a dip to $1804, as the US dollar eases across the board in tandem with the Treasury yields. Mounting concerns over the Delta covid variant contagion fuel risk-aversion, which helps gold price remain underpinned. Despite the rebound, gold price remains well below the previous week’s high of $1818.

Read: Powell Preview: Three reasons to expect the Fed Chair to down the dollar

After closing virtually unchanged on Monday, the XAU/USD pair moved sideways around $1,810 in the first half of the day on Tuesday. The renewed USD strength after the US inflation data caused gold to drop to $1,800 support in the early American session but buyers didn't have a difficult time defending that level. As of writing, XAU/USD was up 0.3% on a daily basis at $1,812.

The monthly data published by the US Bureau of Labor Statistics revealed on Tuesday that the Consumer Price Index (CPI) jumped to 5.4% on a yearly basis in June from 5% in May. This print beat the market expectation of 4.9% by a wide margin and provided a boost to the USD.

With the initial reaction, the US Dollar Index (DXY) jumped to a five-day high of 92.73. However, the underlying details of the publication showed that a sharp increase in the prices of used cars was the primary driver behind the rising inflation and the USD lost its momentum. Nevertheless, the DXY remains on track to close in the positive territory and was last seen rising 0.4% at 92.58.

US Inflation Quick Analysis: Dollar selling opportunity? Fed could shrug off clunker-driven CPI.

Meanwhile, the inflation report failed to trigger a rally in the US Treasury bond yields, confirming the view that investors see the increase in price pressure as being temporary. The benchmark 10-year US Treasury bond yield, which gained more than 5% in the previous two trading days, is currently flat on the day at 1.36%.

Commenting on the CPI figures, San Francisco Federal Reserve Bank President Mary Daly argued that long-run inflation expectations remain steady. "Let's get through the volatile period so we can see where the economy really is," Daly added.

With the CPI data out of the way, the market's focus shifts to FOMC Chairman Jerome Powell's semiannual report to Congress on the state of the US economy that will start on Wednesday.

Gold technical outlook

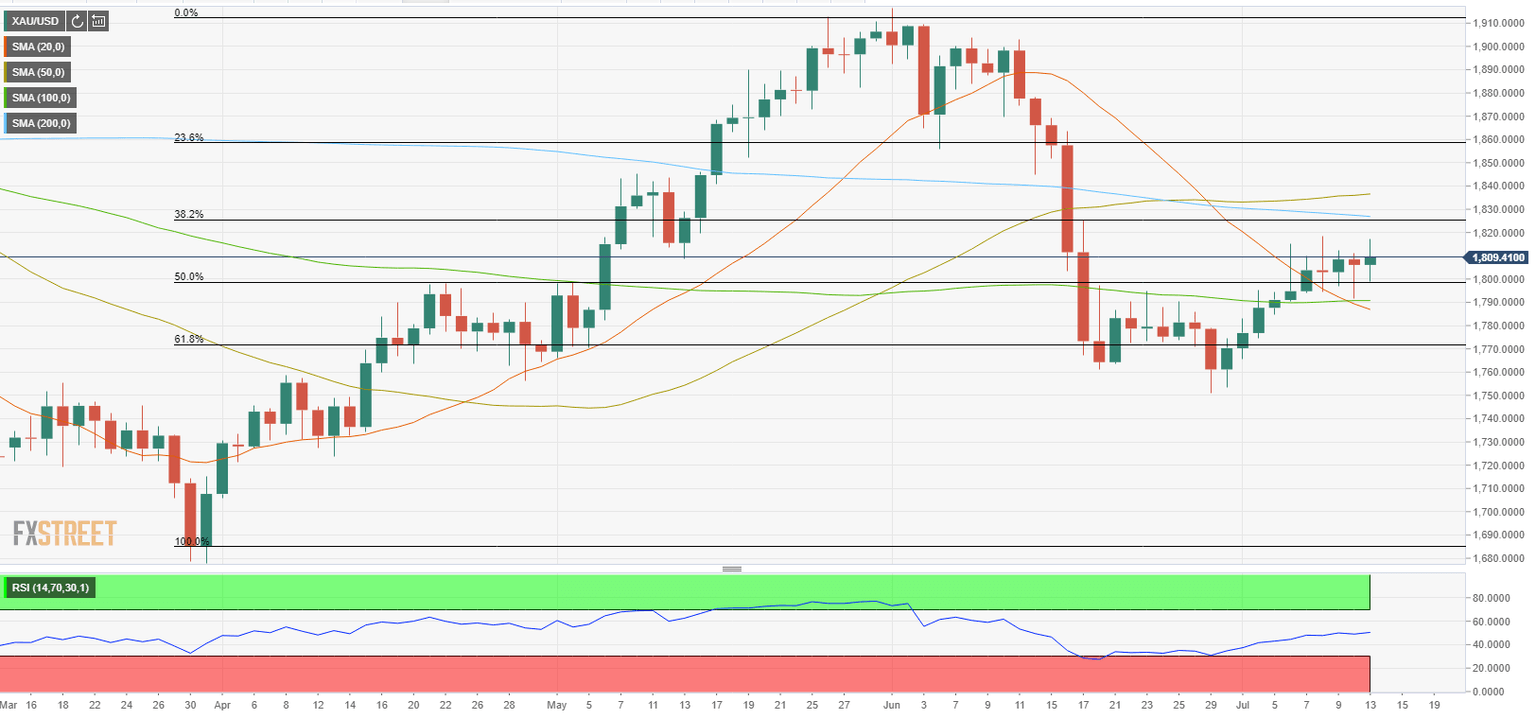

For the second straight day on Tuesday, buyers defended the $1,800 psychological level, which is also reinforced by the Fibonacci 50% retracement of the April-June uptrend. Additionally, the Relative Strength Index (RSI) indicator on the daily chart continues to edge higher above 50, showing that the near-term bullish outlook remains intact.

On the upside, the next significant resistance is located at $1,827 (200-day SMA, Fibonacci 38.2% retracement). In case the price rises above that level and flips it into a support, the next target could be seen at $1,838 (50-day SMA).

As mentioned above, $1,800 aligns as key support. Only a daily close below that level could attract more sellers and open the door for additional losses toward $1,790 (100-day SMA) and $1,770 (Fibonacci 61.8% retracement).

Previous update

Update: Gold (XAU/USD) stays defensive above $1,800, around $1,807 during the early Asian session on Wednesday. The yellow metal portrayed a whipsaw between $1,817 and $1,798 as markets reacted to the strong US inflation data, as well as the firmer US Treasury yields, by putting a bid under the US dollar. However, the following moves have been subdued near $1,805–10 as traders await Fed Chairman Jerome Powell’s testimony on the Semi-Annual Monetary Policy Report before the House Financial Services Committee.

Other than the reflation woes and cautious sentiment ahead of Fed’s Powell, the coronavirus (COVID-19) Delta variant concerns also probe gold buyers below 200-DMA level surrounding $1,827.

Hence, gold traders may witness a lackluster session in Asia but US dollar strength could keep probing the precious metal bulls.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.